Exam 4: Employee Net Pay and Pay Methods

Exam 1: Payroll Practices and System Fundamentals70 Questions

Exam 2: Payroll System Procedures70 Questions

Exam 3: Gross Pay Computation76 Questions

Exam 4: Employee Net Pay and Pay Methods70 Questions

Exam 5: Employer Payroll Taxes and Labor Planning71 Questions

Exam 6: Payroll Register, employees Earning Records, and Accounting System Entries70 Questions

Select questions type

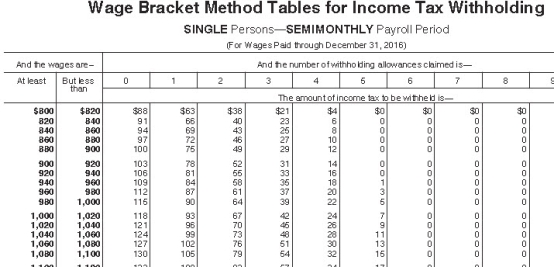

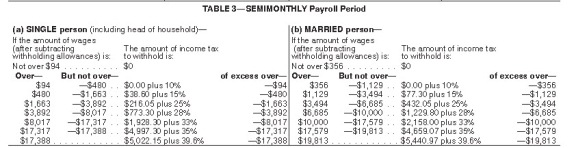

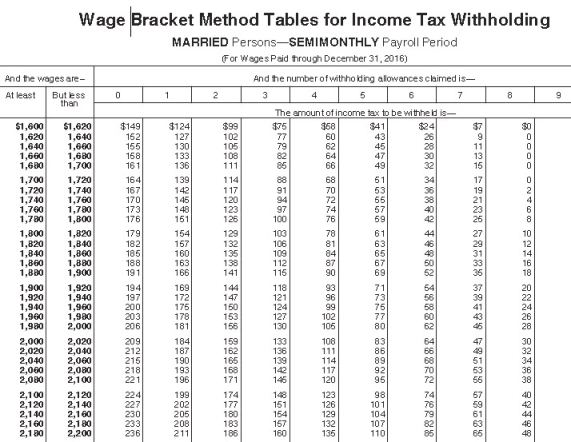

Max earned $1,019.55 during the most recent semimonthly pay period.He is single with 1 withholding allowance and has no pre-tax deductions.Using the following table,how much should be withheld for federal income tax?

Free

(Multiple Choice)

4.7/5  (40)

(40)

Correct Answer:

D

The use of paycards as a means of transmitting employee pay began in the 1990s with over-the-road drivers out of a need to transmit funds reliably on payday.

Free

(True/False)

4.7/5  (28)

(28)

Correct Answer:

True

The purpose of paycards as a pay method is to ______________________________.

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

B

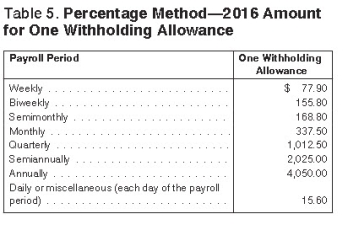

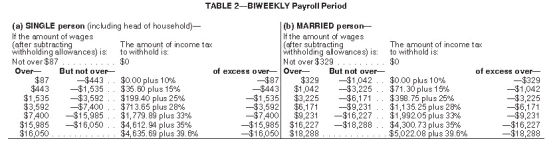

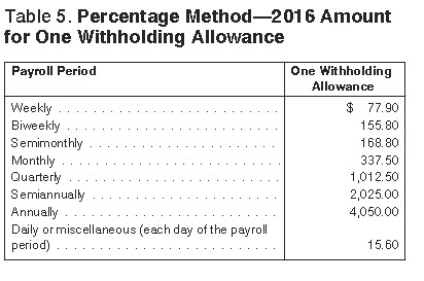

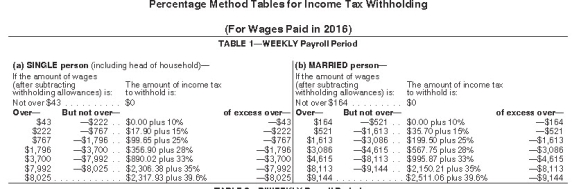

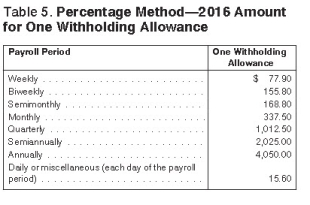

Warren is a married employee with six withholding allowances.During the most recent biweekly pay period,he earned $9,450.00.Using the percentage method,compute Warren's federal income tax.(Do not round interim calculations,only round final answer to two decimal points. )

(Multiple Choice)

4.9/5  (37)

(37)

Which body issued Regulation E to protect consumers from loss of deposited funds?

(Multiple Choice)

4.8/5  (35)

(35)

Charitable contributions are an example of post-tax voluntary deductions.

(True/False)

4.9/5  (34)

(34)

State and Local Income Tax rates __________________________.

(Multiple Choice)

4.9/5  (36)

(36)

The purpose of the wage base used for the Social Security tax is ______________________________.

(Multiple Choice)

4.9/5  (38)

(38)

Olga earned $1,558.00 during the most recent weekly pay period.She is single with 2 withholding allowances and no pre-tax deductions.Using the percentage method,compute Olga's federal income tax for the period.(Do not round intermediate calculations.Round final answer to two decimal places. )

(Multiple Choice)

4.9/5  (35)

(35)

The factors that determine an employee's federal income tax are ____________________.

(Multiple Choice)

4.8/5  (32)

(32)

What is an advantage of direct deposit from the employee's perspective?

(Multiple Choice)

4.8/5  (35)

(35)

Retirement fund contributions are considered Pre-Tax Deductions because ____________________.

(Multiple Choice)

4.9/5  (44)

(44)

Collin is a full-time exempt employee in Juneau,Alaska,who earns $135,000 annually and has not yet reached the Social Security wage base.He is single with 1 withholding allowance and is paid semimonthly.He contributes 3% per pay period to his 401(k)and has pre-tax health insurance and AFLAC deductions of $150 and $25,respectively.Collin has a child support garnishment of $300 per pay period.What is his net pay? (Use the percentage method.Do not round interim calculations,only round final answer to two decimal points. )

(Multiple Choice)

4.9/5  (34)

(34)

Jesse is a part-time nonexempt employee in Austin,Texas,who earns $12.50 per hour.During the last biweekly pay period he worked 35 hours.He is married with zero withholding allowances,which means his federal income tax deduction is $10.00,and has additional federal tax withholding of $30 per pay period.What is his net pay? (Do not round interim calculations,only round final answer to two decimal points. )

(Multiple Choice)

4.8/5  (37)

(37)

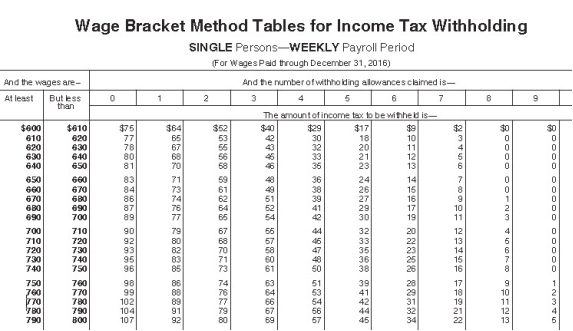

Andie earned $680.20 during the most recent weekly pay period.She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k)plan.If she chooses the method that results in the lowest taxable income,how much will be withheld for federal income tax (based on the following table)?

(Multiple Choice)

4.9/5  (39)

(39)

Brent is a full-time exempt employee in Clark County,Indiana.He earns an annual salary of $48,000 and is paid semimonthly.He is married with 3 withholding allowances.His state income tax per pay period is $57.38,and Clark County income tax is $33.75 per pay period.What is the total of FICA,federal,state,and local deductions per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine federal taxes.Do not round intermediate calculations,only round final answer to two decimal points. )

(Multiple Choice)

4.8/5  (42)

(42)

From the employer's perspective,which of the following is a challenge of paying employees by direct deposit?

(Multiple Choice)

4.8/5  (38)

(38)

The wage-bracket of determining federal tax withholding yields more accurate amounts than the percentage method.

(True/False)

4.8/5  (40)

(40)

A firm has headquarters in Indiana,but has offices in California and Utah.For employee taxation purposes,it may choose which of those three states income tax laws it wishes to use.

(True/False)

4.9/5  (50)

(50)

Showing 1 - 20 of 70

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)