Exam 4: Employee Net Pay and Pay Methods

Exam 1: Payroll Practices and System Fundamentals70 Questions

Exam 2: Payroll System Procedures70 Questions

Exam 3: Gross Pay Computation76 Questions

Exam 4: Employee Net Pay and Pay Methods70 Questions

Exam 5: Employer Payroll Taxes and Labor Planning71 Questions

Exam 6: Payroll Register, employees Earning Records, and Accounting System Entries70 Questions

Select questions type

Garnishments are court-ordered amounts that an employer must withhold from an employee's pre-tax pay and remit to the appropriate authority.

(True/False)

4.9/5  (37)

(37)

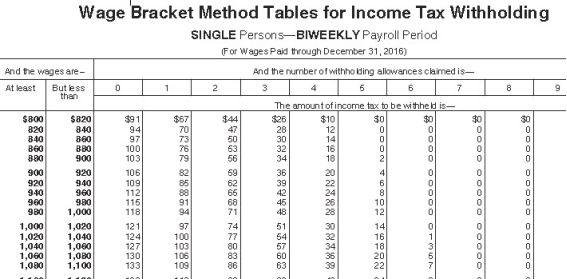

Tierney is a full-time nonexempt salaried employee who earns $990 per biweekly pay period.She is single with 1 withholding allowance and both lives and works in Maryland.Assuming that she had no overtime,what is the total of her federal and state taxes for a pay period? (Use the wage-bracket tables.Maryland state income rate is 2.0%.Round final answers to 2 decimal places. )

(Multiple Choice)

4.8/5  (42)

(42)

The percentage of the Medicare tax withholding _________________________.

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following is true about cash as a method of paying employees?

(Multiple Choice)

5.0/5  (45)

(45)

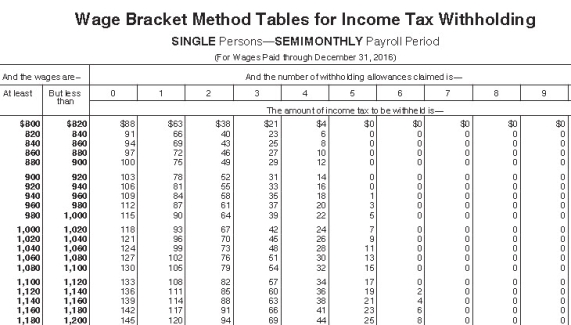

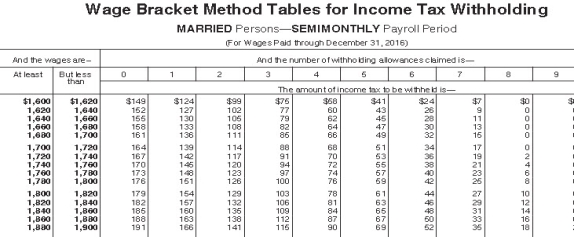

Julio is single with 1 withholding allowance.He earned $1,025.00 during the most recent semimonthly pay period.He needs to decide between contributing 3% and $30 to his 401(k)plan.If he chooses the method that results in the lowest taxable income,how much will be withheld for federal income tax (based on the following table)?

(Multiple Choice)

5.0/5  (36)

(36)

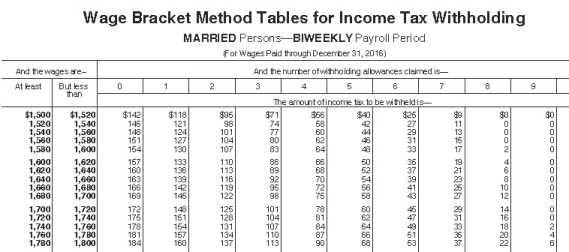

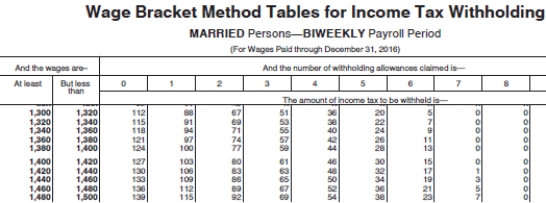

Ramani earned $1,698.50 during the most recent biweekly pay period.He contributes $100 to his 401(k)plan.He is married and claims 3 withholding allowances.Based on the following table,how much federal income tax should be withheld from his pay?

(Multiple Choice)

4.9/5  (38)

(38)

The regular Medicare tax deduction is 1.45% for employee and employer and must be paid by all employees.

(True/False)

4.9/5  (43)

(43)

Which of the following deductions may be taken on a pre-tax basis (Select all that apply)?

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following payment methods is growing in popularity among employees?

(Multiple Choice)

4.7/5  (35)

(35)

Which of the following is the correct sequence for computing net pay?

(Multiple Choice)

4.9/5  (42)

(42)

Melody is a full-time employee in Sioux City,South Dakota,who earns $3,600 per month and is paid semimonthly.She is married with 1 withholding allowance (use the wage-bracket tables).She has a qualified health insurance deduction of $50 per pay period and contributes 3% to her 401(k),both of which are pre-tax deductions.What is her net pay? (Do not round interim calculations,only round final answer to two decimal points. )

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following guidelines does the IRS use to evaluate the tax treatment of supplemental health insurance?

(Multiple Choice)

4.9/5  (35)

(35)

What role does the employer play regarding an employee's federal withholding tax?

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following is used in the determination of the amount of federal income tax to be withheld from an employee per pay period?

(Multiple Choice)

4.7/5  (36)

(36)

Steve is a full-time exempt employee at a local electricity co-operative.He earns an annual salary of $43,325 and is paid biweekly.What is his Social Security tax deduction for each pay period? (Do not round interim calculations,only round final answer to two decimal points. )

(Multiple Choice)

4.8/5  (44)

(44)

The amount of federal income tax decreases as the number of allowances increases.

(True/False)

4.8/5  (41)

(41)

Vivienne is a full-time exempt employee in DeKalb County,Indiana,and is paid biweekly.She earns $39,000 annually,and is married with 2 withholding allowances.Her state income tax deduction is $44.46,and the DeKalb County income tax deduction is $19.62.What is the total amount of her FICA,federal,state,and local taxes per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine the federal tax deduction.Do not round intermediate calculations,only round final answer to two decimal points. )

(Multiple Choice)

4.8/5  (45)

(45)

A retirement plan that allows employees to gain shares of ownership in their firm is called a(n)_____________.

(Multiple Choice)

4.8/5  (34)

(34)

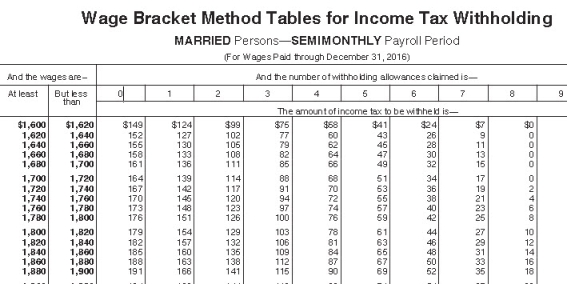

Trish earned $1,734.90 during the most recent semimonthly pay period.She is married and has 3 withholding allowances and has no pre-tax deductions.Based on the following table,how much should be withheld from her gross pay for federal income tax?

(Multiple Choice)

4.8/5  (29)

(29)

Post-Tax Deductions are amounts ____________________________________.

(Multiple Choice)

4.8/5  (40)

(40)

Showing 41 - 60 of 70

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)