Exam 24: Performance Measurement and Responsibility Accounting

Exam 1: Accounting in Business241 Questions

Exam 2: Analyzing and Recording Transactions188 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements213 Questions

Exam 4: Completing the Accounting Cycle168 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 7: Accounting Information Systems164 Questions

Exam 8: Cash and Internal Controls193 Questions

Exam 9: Accounting for Receivables170 Questions

Exam 10: Plant Assets, natural Resources, and Intangibles216 Questions

Exam 11: Current Liabilities and Payroll Accounting194 Questions

Exam 12: Accounting for Partnerships133 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities199 Questions

Exam 15: Investments and International Operations175 Questions

Exam 16: Reporting the Statement of Cash Flows178 Questions

Exam 17: Analysis of Financial Statements178 Questions

Exam 18: Managerial Accounting Concepts and Principles203 Questions

Exam 19: Job Order Costing160 Questions

Exam 20: Process Costing156 Questions

Exam 21: Cost-Volume-Profit Analysis180 Questions

Exam 22: Master Budgets and Planning153 Questions

Exam 23: Flexible Budgets and Standard Costs168 Questions

Exam 24: Performance Measurement and Responsibility Accounting163 Questions

Exam 25: Capital Budgeting and Managerial Decisions131 Questions

Exam 26: Time Value of Money B60 Questions

Exam 27: Activity-Based Costing C37 Questions

Select questions type

An expense that does not require allocation between departments is a(n):

Free

(Multiple Choice)

4.8/5  (45)

(45)

Correct Answer:

C

What is the main difference between a cost center and a profit center?

Free

(Essay)

4.9/5  (41)

(41)

Correct Answer:

A cost center incurs costs but does not directly generate revenues.A profit center incurs costs and also directly generates revenues.This difference implies that managers of two types of these centers must be evaluated differently.

Expenses that are not easily associated with a specific department,and which are incurred for the benefit of more than one department,are:

Free

(Multiple Choice)

4.7/5  (30)

(30)

Correct Answer:

B

Departmental contribution to overhead is calculated as revenues of the department less:

(Multiple Choice)

4.7/5  (25)

(25)

A measure used to evaluate the manager of an investment center is return on total costs for the investment center.

(True/False)

4.7/5  (37)

(37)

Jamesway Corporation has two separate divisions that operate as profit centers.The following information is available for the most recent year:

White Division Grey Division sales (net) \ 200,000 \ 400,000 salary expense 28,000 48,000 Cost of goods sold ...... 100,000 159,000 The White Division occupies 20,000 square feet in the plant.The Grey Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.Compute departmental income for the White and Grey Divisions,respectively.

(Multiple Choice)

4.8/5  (31)

(31)

Calculating return on total assets for an investment center is defined by the following formula for an investment center:

(Multiple Choice)

4.8/5  (25)

(25)

The most useful evaluation of a manager's cost performance is based on:

(Multiple Choice)

4.8/5  (36)

(36)

Match the appropriate definition a through h with the following terms:

Correct Answer:

Premises:

Responses:

(Matching)

4.7/5  (43)

(43)

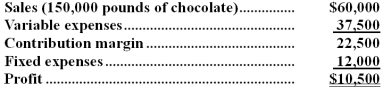

The Milk Chocolate Division of Mmmm Foods,Inc.had the following operating results last year:  Milk Chocolate expects identical operating results this year.The Milk Chocolate Division has the ability to produce and sell 200,000 pounds of chocolate annually.Assume that the Peanut Butter Division of Mmmm Foods wants to purchase an additional 20,000 pounds of chocolate from the Milk Chocolate Division.Milk Chocolate will be able to increase its profit by accepting any transfer price above:

Milk Chocolate expects identical operating results this year.The Milk Chocolate Division has the ability to produce and sell 200,000 pounds of chocolate annually.Assume that the Peanut Butter Division of Mmmm Foods wants to purchase an additional 20,000 pounds of chocolate from the Milk Chocolate Division.Milk Chocolate will be able to increase its profit by accepting any transfer price above:

(Multiple Choice)

4.7/5  (31)

(31)

A company pays $15,000 per period to rent a small building that has 10,000 square feet of space.This cost is allocated to the company's three departments on the basis of the amount and value of the space occupied by each.Department One occupies 2,000 square feet of ground-floor space,Department Two occupies 3,000 square feet of ground-floor space,and Department Three occupies 5,000 square feet of second-floor space.If rents for comparable floor space in the neighborhood average $2.20 per square foot for ground-floor space and $1.10 per square foot for second-floor space and the rent is allocated based on the total value of the space,Department One should be charged rent expense for the period of:

(Multiple Choice)

4.7/5  (32)

(32)

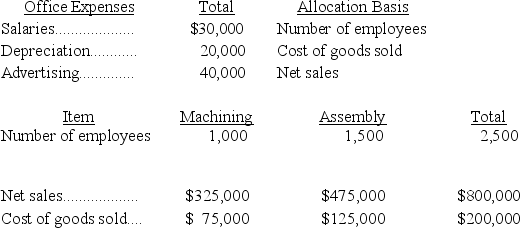

Baker Corporation has two operating departments,Machining and Assembly,and an office.The three categories of office expenses are allocated to the two departments using different allocation bases.The following information is available for the current period:

The amount of the total office expenses that should be allocated to Assembly for the current period is:

The amount of the total office expenses that should be allocated to Assembly for the current period is:

(Multiple Choice)

4.8/5  (37)

(37)

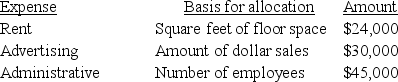

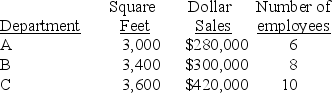

Mace Department store allocates its service department expenses to its various operating (sales)departments.The following data is available:

The following information is available for its three operating (sales)departments:

The following information is available for its three operating (sales)departments:

What is the total expense allocated to Department B?

What is the total expense allocated to Department B?

(Multiple Choice)

4.8/5  (33)

(33)

Yoho Company reported the following financial numbers for one of its divisions for the year; average total assets of $5,800,000; sales of $5,375,000; cost of goods sold of $3,225,000; and operating expenses of $1,147,000.Assume a target income of 15% of average invested assets.Compute residual income for the division:

(Multiple Choice)

4.8/5  (39)

(39)

Scottie is the manager of an investment center within Hamilton Company.Using the information below,calculate (a)return on total assets and (b)investment center residual income.

Net Income…………………… $315,900

Average Invested Assets……..$2,100,000

Target Net Income…………… 6% of division assets

(Essay)

4.9/5  (31)

(31)

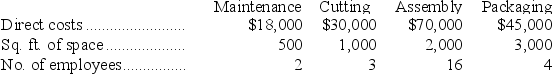

Dresden,Inc.has four departments.Information about these departments is listed below.If allocated maintenance cost is based on floor space occupied by each,compute the amount of maintenance cost allocated to the Cutting Department.

(Multiple Choice)

4.8/5  (36)

(36)

A ______________________ incurs costs without directly generating revenues.

(Short Answer)

4.8/5  (35)

(35)

Showing 1 - 20 of 163

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)