Exam 27: Activity-Based Costing C

Exam 1: Accounting in Business241 Questions

Exam 2: Analyzing and Recording Transactions188 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements213 Questions

Exam 4: Completing the Accounting Cycle168 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 7: Accounting Information Systems164 Questions

Exam 8: Cash and Internal Controls193 Questions

Exam 9: Accounting for Receivables170 Questions

Exam 10: Plant Assets, natural Resources, and Intangibles216 Questions

Exam 11: Current Liabilities and Payroll Accounting194 Questions

Exam 12: Accounting for Partnerships133 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities199 Questions

Exam 15: Investments and International Operations175 Questions

Exam 16: Reporting the Statement of Cash Flows178 Questions

Exam 17: Analysis of Financial Statements178 Questions

Exam 18: Managerial Accounting Concepts and Principles203 Questions

Exam 19: Job Order Costing160 Questions

Exam 20: Process Costing156 Questions

Exam 21: Cost-Volume-Profit Analysis180 Questions

Exam 22: Master Budgets and Planning153 Questions

Exam 23: Flexible Budgets and Standard Costs168 Questions

Exam 24: Performance Measurement and Responsibility Accounting163 Questions

Exam 25: Capital Budgeting and Managerial Decisions131 Questions

Exam 26: Time Value of Money B60 Questions

Exam 27: Activity-Based Costing C37 Questions

Select questions type

Under traditional cost allocation methods,low-volume complex products are often ________________ and high-volume simpler products are likely to be ________________.

Free

(Short Answer)

4.9/5  (40)

(40)

Correct Answer:

undercosted; overcosted

If a firm uses activity-based costing to allocate costs,it must:

Free

(Multiple Choice)

4.7/5  (37)

(37)

Correct Answer:

E

Activity-based costing attempts to better allocate costs to the proper users of overhead by focusing on activities.

Free

(True/False)

4.7/5  (30)

(30)

Correct Answer:

True

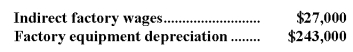

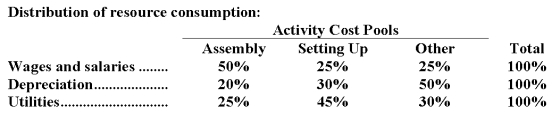

Tresselt Corporation has provided the following data from its activity-based costing accounting system:

Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

Required:

a.Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool.Show your work!

b.Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products.Show your work!

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

Required:

a.Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool.Show your work!

b.Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products.Show your work!

(Essay)

4.9/5  (31)

(31)

A basis for allocating the cost of a resource to an activity cost pool or allocating the cost of an activity cost pool to a cost object is a(n):

(Multiple Choice)

4.8/5  (31)

(31)

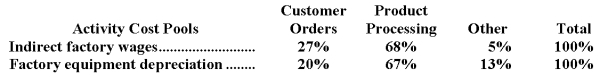

Precision Brackets,Co.is considering switching from traditional allocation of overhead based on direct labor hours to an activity-based costing system.The manager has accumulated the following information on engineering changes for two of the company's major products:

Compute the cost per unit using:

(1)The traditional two-stage allocation of the costs of engineering changes based on direct labor hours.

(2)The activity-based cost allocation of the costs of engineering changes.

Compute the cost per unit using:

(1)The traditional two-stage allocation of the costs of engineering changes based on direct labor hours.

(2)The activity-based cost allocation of the costs of engineering changes.

(Essay)

4.9/5  (25)

(25)

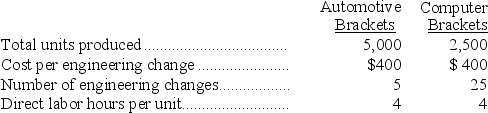

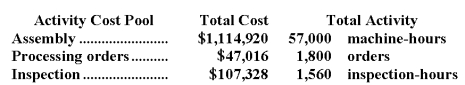

Drewniak Corporation has provided the following data from its activity-based costing system:  The company makes 430 units of product O37W a year,requiring a total of 690 machine-hours,40 orders,and 10 inspection-hours per year.The product's direct materials cost is $35.72 per unit and its direct labor cost is $29.46 per unit.According to the activity-based costing system,the average cost of product O37W is closest to:

The company makes 430 units of product O37W a year,requiring a total of 690 machine-hours,40 orders,and 10 inspection-hours per year.The product's direct materials cost is $35.72 per unit and its direct labor cost is $29.46 per unit.According to the activity-based costing system,the average cost of product O37W is closest to:

(Multiple Choice)

4.9/5  (33)

(33)

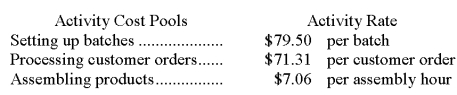

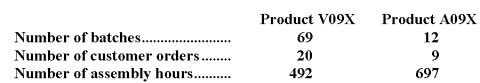

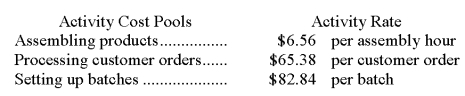

Wecker Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data concerning two products appear below:

Data concerning two products appear below:

How much overhead cost would be assigned to Product V09X using the activity-based costing system?

How much overhead cost would be assigned to Product V09X using the activity-based costing system?

(Multiple Choice)

4.8/5  (36)

(36)

Why would a firm use activity-based costing (ABC)rather than traditional two-stage methods of cost allocation for overhead?

(Essay)

4.8/5  (30)

(30)

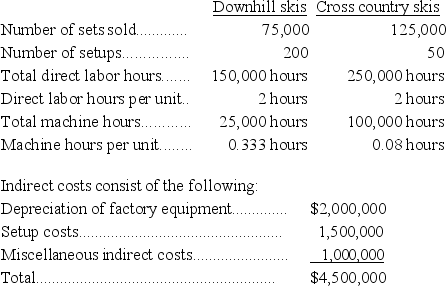

Outdoor Sports,Inc.,produces two types of skis,downhill skis and cross country skis.Product and production information about the two items is shown below:

Required:

1.If Outdoor Sports uses the traditional two-stage method of allocating overhead costs based on direct labor hours,what is the amount of indirect costs per set of skis for each of the two types of skis?

2.If Outdoor Sports uses activity based costing,what is the total amount of indirect costs per set of skis for each of the two types of skis?

Assume that depreciation is allocated based on machine hours,setup costs based on the number of setups,and miscellaneous costs based on the number of direct labor hours.

Required:

1.If Outdoor Sports uses the traditional two-stage method of allocating overhead costs based on direct labor hours,what is the amount of indirect costs per set of skis for each of the two types of skis?

2.If Outdoor Sports uses activity based costing,what is the total amount of indirect costs per set of skis for each of the two types of skis?

Assume that depreciation is allocated based on machine hours,setup costs based on the number of setups,and miscellaneous costs based on the number of direct labor hours.

(Essay)

4.9/5  (29)

(29)

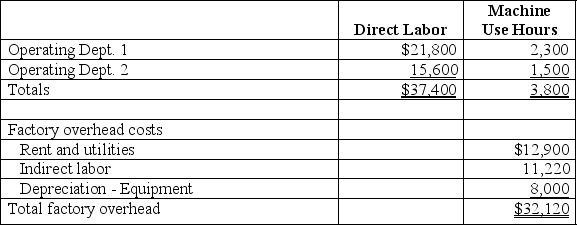

The following is taken from Ames Company's internal records of its factory with two operating departments.The cost driver for indirect labor is direct labor costs,and the cost driver for the remaining items is number of hours of machine use.Compute the total amount of overhead allocated to Dept.2 using activity-based costing.

(Multiple Choice)

4.9/5  (35)

(35)

A factor that causes the cost of an activity to go up or down is a(n):

(Multiple Choice)

4.8/5  (30)

(30)

Billabong Resources provides the following data to enable you to calculate overhead rates:

Machining Department Overhead is $16,000,which is to be allocated on estimated machine hours of 25,000.The rate per Machine Hour would be ___________________.If Machining cost is to be allocated to three jobs which consumed A = 3,000 hours,B = 6,000 hours,and C = 1,000 hours respectively; then Job A should be charged $ _______________; Job B should be charged $_______________; and Job C $_______________.

(Short Answer)

5.0/5  (37)

(37)

Unit costs can be significantly different when using activity-based costing compared to traditional cost allocation methods.

(True/False)

4.8/5  (44)

(44)

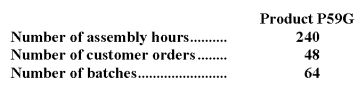

Ekmark Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data for one of the company's products follow:

Data for one of the company's products follow:

How much overhead cost would be assigned to Product P59G using the activity-based costing system?

How much overhead cost would be assigned to Product P59G using the activity-based costing system?

(Multiple Choice)

4.8/5  (36)

(36)

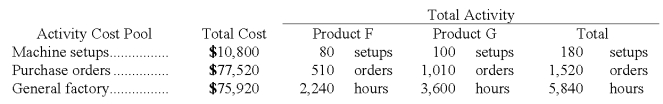

Daba Company manufactures two products,Product F and Product G.The company expects to produce and sell 1,400 units of Product F and 1,800 units of Product G during the current year.The company uses activity-based costing to compute unit product costs for external reports.Data relating to the company's three activity cost pools are given below for the current year:

Required:

Using the activity-based costing approach,determine the overhead cost per unit for each product.

Required:

Using the activity-based costing approach,determine the overhead cost per unit for each product.

(Essay)

4.9/5  (42)

(42)

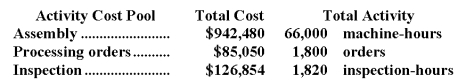

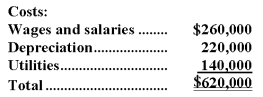

Bossie Corporation uses an activity-based costing system with three activity cost pools.The company has provided the following data concerning its costs and its activity based costing system:

How much cost,in total,would be allocated in the first-stage allocation to the Assembly activity cost pool?

How much cost,in total,would be allocated in the first-stage allocation to the Assembly activity cost pool?

(Multiple Choice)

4.7/5  (47)

(47)

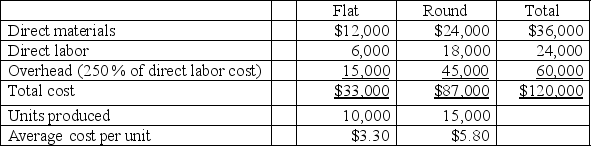

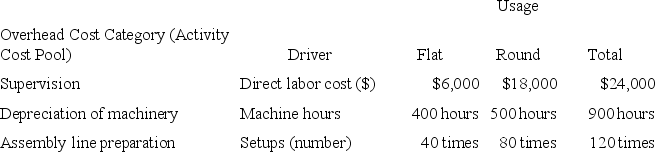

Larabee Company produces two types of product,flat and round,on the same production line.For the current period,the company reports the following data.

Larabee's controller wishes to apply activity-based costing (ABC)to allocate the $60,000 of overhead costs incurred by the two product lines to see whether cost per unit would change markedly from that reported above.She has collected the following information.

Larabee's controller wishes to apply activity-based costing (ABC)to allocate the $60,000 of overhead costs incurred by the two product lines to see whether cost per unit would change markedly from that reported above.She has collected the following information.

She has also collected the following information about the cost drivers for each category (cost pool)and the amount of each driver used by the two product lines.

She has also collected the following information about the cost drivers for each category (cost pool)and the amount of each driver used by the two product lines.

Assign these three overhead cost pools to each of the two products using ABC.Show each overhead cost allocation by product and the total overhead allocated to each product.Determine average cost per unit for each of the two products using ABC.(Round your answer to 2 decimal places.)Which overhead cost allocation method would you recommend to the controller?

Assign these three overhead cost pools to each of the two products using ABC.Show each overhead cost allocation by product and the total overhead allocated to each product.Determine average cost per unit for each of the two products using ABC.(Round your answer to 2 decimal places.)Which overhead cost allocation method would you recommend to the controller?

(Essay)

5.0/5  (31)

(31)

Activity-based costing assigns costs first to activity pools,and then costs from activity cost pools are assigned to the cost objects benefiting from the activities.

(True/False)

4.8/5  (29)

(29)

Spendlove Corporation has provided the following data from its activity-based costing system:  The company makes 430 units of product S78N a year,requiring a total of 1,120 machine-hours,40 orders,and 30 inspection-hours per year.The product's direct materials cost is $49.81 per unit and its direct labor cost is $12.34 per unit.The product sells for $129.90 per unit.According to the activity-based costing system,the product margin for product S78N is:

The company makes 430 units of product S78N a year,requiring a total of 1,120 machine-hours,40 orders,and 30 inspection-hours per year.The product's direct materials cost is $49.81 per unit and its direct labor cost is $12.34 per unit.The product sells for $129.90 per unit.According to the activity-based costing system,the product margin for product S78N is:

(Multiple Choice)

4.9/5  (32)

(32)

Showing 1 - 20 of 37

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)