Exam 11: Current Liabilities and Payroll Accounting

Exam 1: Accounting in Business241 Questions

Exam 2: Analyzing and Recording Transactions188 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements213 Questions

Exam 4: Completing the Accounting Cycle168 Questions

Exam 5: Accounting for Merchandising Operations189 Questions

Exam 7: Accounting Information Systems164 Questions

Exam 8: Cash and Internal Controls193 Questions

Exam 9: Accounting for Receivables170 Questions

Exam 10: Plant Assets, natural Resources, and Intangibles216 Questions

Exam 11: Current Liabilities and Payroll Accounting194 Questions

Exam 12: Accounting for Partnerships133 Questions

Exam 13: Accounting for Corporations210 Questions

Exam 14: Long-Term Liabilities199 Questions

Exam 15: Investments and International Operations175 Questions

Exam 16: Reporting the Statement of Cash Flows178 Questions

Exam 17: Analysis of Financial Statements178 Questions

Exam 18: Managerial Accounting Concepts and Principles203 Questions

Exam 19: Job Order Costing160 Questions

Exam 20: Process Costing156 Questions

Exam 21: Cost-Volume-Profit Analysis180 Questions

Exam 22: Master Budgets and Planning153 Questions

Exam 23: Flexible Budgets and Standard Costs168 Questions

Exam 24: Performance Measurement and Responsibility Accounting163 Questions

Exam 25: Capital Budgeting and Managerial Decisions131 Questions

Exam 26: Time Value of Money B60 Questions

Exam 27: Activity-Based Costing C37 Questions

Select questions type

Define liabilities and explain the difference between current and long-term liabilities.

Free

(Essay)

4.8/5  (33)

(33)

Correct Answer:

Liabilities are probable future payments of assets or services a company is presently obligated to make as a result of past transactions or events. Current liabilities are obligations due within one year or the company's operating cycle,whichever is longer. Long-term liabilities are obligations due beyond one year or the company's operating cycle,whichever is longer.

On December 1,Martin Company signed a 90-day,6% note payable,with a face value of $5,000.What amount of interest expense is accrued at December 31 on the note?

(Multiple Choice)

4.8/5  (37)

(37)

Obligations not due within one year or the company's operating cycle,whichever is longer,are reported as current liabilities.

(True/False)

4.8/5  (32)

(32)

On November 1,Carter Company signed a 120-day,10% note payable,with a face value of $9,000.What is the adjusting entry for the accrued interest at December 31 on the note?

(Multiple Choice)

4.8/5  (32)

(32)

During August,Arena Company sells $356,000 in product that has a one year warranty.Experience shows that warranty expenses average about 5% of the selling price.The warranty liability account has a balance of $12,800 before adjustment.Customers returned product for warranty repairs during the month that used $9,400 in parts for repairs.The entry to record the customer warranty repairs is:

(Multiple Choice)

4.8/5  (30)

(30)

A liability is a probable future payment of assets or services that a company is presently obligated to make as a result of past transactions or events.

(True/False)

4.9/5  (31)

(31)

The Federal Insurance Contributions Act (FICA)requires that each employer file a:

(Multiple Choice)

4.8/5  (27)

(27)

Required payroll deductions result from laws and include income taxes,Social Security taxes,pension and health contributions,union dues,and charitable giving.

(True/False)

4.8/5  (39)

(39)

A high value for the times interest earned ratio means that a company is a higher risk borrower.

(True/False)

5.0/5  (35)

(35)

__________ are obligations due within one year or the company's operating cycle,whichever is longer.

(Short Answer)

4.8/5  (29)

(29)

A company's income before interest expense and taxes is $250,000 and its interest expense is $100,000.Its times interest earned ratio is .4.

(True/False)

4.8/5  (39)

(39)

On November 1,Bob's Skateboards signed a $12,000,90-day,5% note payable to cover a past due account payable.

a.What amount of interest expense on this note should Bob's Skateboards report on year-end December 31?

b.Prepare Bob's journal entry to record the issuance of the note payable.

c.Prepare Bob's journal entry to record the payment of the note on February 1 of the following year.

(Essay)

4.9/5  (32)

(32)

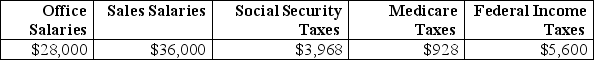

Frado Company provides you with following information related to payroll transactions for the month of May.Prepare journal entries to record the transactions for May.

a.Recorded the March payroll using the payroll register information given above.

b.Recorded the employer's payroll taxes resulting from the March payroll.The company had a merit rating that reduces its state unemployment tax rate to 3.5% of the first $7,000 paid each employee.Only $42,000 of the current months salaries are subject to unemployment taxes.The federal rate is .8%.

c.Issued a check to Swift Bank in payment of the May FICA and employee taxes.

d.Issued a check to the state for the payment of the SUTA taxes for the month of May.

e.Issued a check to Swift Bank in payment of the employer's quarterly FUTA taxes for the first quarter in the amount of $1,360.

a.Recorded the March payroll using the payroll register information given above.

b.Recorded the employer's payroll taxes resulting from the March payroll.The company had a merit rating that reduces its state unemployment tax rate to 3.5% of the first $7,000 paid each employee.Only $42,000 of the current months salaries are subject to unemployment taxes.The federal rate is .8%.

c.Issued a check to Swift Bank in payment of the May FICA and employee taxes.

d.Issued a check to the state for the payment of the SUTA taxes for the month of May.

e.Issued a check to Swift Bank in payment of the employer's quarterly FUTA taxes for the first quarter in the amount of $1,360.

(Essay)

4.9/5  (38)

(38)

A bank that is authorized to accept deposits of amounts payable to the federal government is a:

(Multiple Choice)

4.8/5  (27)

(27)

Showing 1 - 20 of 194

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)