Exam 12: Set-Off and Extinguishment of Debt

Exam 1: An Overview of the Australian External Reporting Environment50 Questions

Exam 2: The Conceptual Framework of Accounting and Its Relevance to Financ62 Questions

Exam 3: Theories of Financial Accounting61 Questions

Exam 4: An Overview of Accounting for Assets62 Questions

Exam 5: Depreciation of Property, plant and Equipment62 Questions

Exam 6: Revaluation and Impairment Testing of Non-Current Assets59 Questions

Exam 7: Inventory61 Questions

Exam 8: Accounting for Intangibles61 Questions

Exam 9: Accounting for Heritage Assets and Biological Assets61 Questions

Exam 10: An Overview of Accounting for Liabilities58 Questions

Exam 11: Accounting for Lease78 Questions

Exam 12: Set-Off and Extinguishment of Debt47 Questions

Exam 13: Accounting for Employee Benefits67 Questions

Exam 15: Accounting for Financial Instruments72 Questions

Exam 16: Revenue Recognition Issues64 Questions

Exam 17: The Statement of Comprehensive Income and Statement of Changes in E62 Questions

Exam 19: Accounting for Income Taxes56 Questions

Exam 20: Cash-Flow Statements60 Questions

Exam 21: Accounting for the Extractive Industries60 Questions

Exam 22: Accounting for General Insurance Contracts58 Questions

Exam 23: Accounting for Superannuation Plans62 Questions

Exam 24: Events Occurring After Balance Sheet Date62 Questions

Exam 25: Segment Reporting61 Questions

Exam 26: Related-Party Disclosures59 Questions

Exam 28: Accounting for Group Structures69 Questions

Exam 29: Further Consolidation Issues I: Accounting for Intragroup Transact46 Questions

Exam 30: Further Consolidation Issues II: Accounting for Minority Interests34 Questions

Exam 31: Further Consolidation Issues III: Accounting for Indirect Ownershi38 Questions

Exam 32: Further Consolidation Issues Iv: Accounting for Changes in the Deg39 Questions

Exam 33: Accounting for Equity Investments67 Questions

Exam 33: Accounting for Equity Investments59 Questions

Exam 35: Accounting for Foreign Currency Transactions58 Questions

Exam 36: Translation of the Accounts of Foreign Operations41 Questions

Exam 37: Accounting for Corporate Social Responsibility59 Questions

Select questions type

There were two methods of achieving an insubstance debt defeasance in accordance with the former AASB 1014's requirements:

(Multiple Choice)

4.8/5  (34)

(34)

Legal defeasance is not addressed in AASB 132 and will no longer be used in Australia.

(True/False)

4.8/5  (35)

(35)

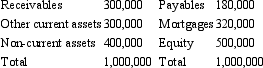

Pete Ltd's statement of financial position is shown below.  The above balances include a receivable from Patricia Ltd for an amount of $100,000 and a payable to Patricia Ltd for $50,000.A debt contract with ABC Bank signed by Pete Ltd requires a debt equity ratio of no more than 50%.

Based on the above information,which course of action will be consistent with positive accounting theory?

The above balances include a receivable from Patricia Ltd for an amount of $100,000 and a payable to Patricia Ltd for $50,000.A debt contract with ABC Bank signed by Pete Ltd requires a debt equity ratio of no more than 50%.

Based on the above information,which course of action will be consistent with positive accounting theory?

(Multiple Choice)

4.9/5  (38)

(38)

A futures contract is an example of a financial instrument where the net amount of a financial asset and a financial liability may be presented in the statement of financial position.

(True/False)

4.7/5  (35)

(35)

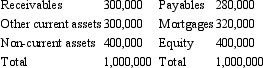

Lynne and Tom Ltd's statement of financial position is shown below.  The above balances include a receivable from Melinda Ltd for an amount of $100,000 and a payable to Melinda Ltd for $50,000.

Assuming a right to set-off exists with Melinda Ltd the balances on the statement of financial position of Lynne and Tom Ltd after set-off will be:

The above balances include a receivable from Melinda Ltd for an amount of $100,000 and a payable to Melinda Ltd for $50,000.

Assuming a right to set-off exists with Melinda Ltd the balances on the statement of financial position of Lynne and Tom Ltd after set-off will be:

(Multiple Choice)

4.8/5  (40)

(40)

The former AASB 1014 required that if a trust was established to assume the responsibility for a debt in an insubstance debt defeasance,that trust must:

(Multiple Choice)

4.7/5  (32)

(32)

Showing 41 - 47 of 47

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)