Exam 18: Accounting for Share-Based Payments

Exam 1: An Overview of the Australian External Reporting Environment50 Questions

Exam 2: The Conceptual Framework of Accounting and Its Relevance to Financ62 Questions

Exam 3: Theories of Financial Accounting61 Questions

Exam 4: An Overview of Accounting for Assets62 Questions

Exam 5: Depreciation of Property, plant and Equipment62 Questions

Exam 6: Revaluation and Impairment Testing of Non-Current Assets59 Questions

Exam 7: Inventory61 Questions

Exam 8: Accounting for Intangibles61 Questions

Exam 9: Accounting for Heritage Assets and Biological Assets61 Questions

Exam 10: An Overview of Accounting for Liabilities58 Questions

Exam 11: Accounting for Lease78 Questions

Exam 12: Set-Off and Extinguishment of Debt47 Questions

Exam 13: Accounting for Employee Benefits67 Questions

Exam 15: Accounting for Financial Instruments72 Questions

Exam 16: Revenue Recognition Issues64 Questions

Exam 17: The Statement of Comprehensive Income and Statement of Changes in E62 Questions

Exam 19: Accounting for Income Taxes56 Questions

Exam 20: Cash-Flow Statements60 Questions

Exam 21: Accounting for the Extractive Industries60 Questions

Exam 22: Accounting for General Insurance Contracts58 Questions

Exam 23: Accounting for Superannuation Plans62 Questions

Exam 24: Events Occurring After Balance Sheet Date62 Questions

Exam 25: Segment Reporting61 Questions

Exam 26: Related-Party Disclosures59 Questions

Exam 28: Accounting for Group Structures69 Questions

Exam 29: Further Consolidation Issues I: Accounting for Intragroup Transact46 Questions

Exam 30: Further Consolidation Issues II: Accounting for Minority Interests34 Questions

Exam 31: Further Consolidation Issues III: Accounting for Indirect Ownershi38 Questions

Exam 32: Further Consolidation Issues Iv: Accounting for Changes in the Deg39 Questions

Exam 33: Accounting for Equity Investments67 Questions

Exam 33: Accounting for Equity Investments59 Questions

Exam 35: Accounting for Foreign Currency Transactions58 Questions

Exam 36: Translation of the Accounts of Foreign Operations41 Questions

Exam 37: Accounting for Corporate Social Responsibility59 Questions

Select questions type

In a share-based payment transaction like an option,vesting date is:

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

C

Where equity instruments are issued with a vesting period,the transactions must be recognised over the vesting period.

Free

(True/False)

4.8/5  (32)

(32)

Correct Answer:

False

Issue of shares in exchange for shares of another entity in a purchase transaction of the net assets of an entity in a business combination is within the scope of AASB 2.

Free

(True/False)

4.9/5  (33)

(33)

Correct Answer:

False

Which of the following statements is incorrect of equity-settled share-based payment transactions?

(Multiple Choice)

4.8/5  (44)

(44)

AASB 2 also applies to transactions where an entity issues equity instruments to purchase the net assets of another entity in a business combination.

(True/False)

4.9/5  (32)

(32)

In accordance with AASB 2,how much remuneration expense related to the share option issue should Blackburn Ltd recognise for the year ended 30 June 2010,30 June 2011 and 30 June 2012,respectively?

(Multiple Choice)

4.7/5  (42)

(42)

If a grant of equity instruments is conditional upon satisfying specified vesting conditions,the vesting conditions shall be taken into account in estimating the fair value of the instruments at measurement date.

(True/False)

4.9/5  (36)

(36)

In accordance with AASB 2,how much Employee benefits expense related to the share option issue should Wigan Ltd recognise for the year ended 30 June 2012?

(Multiple Choice)

4.9/5  (35)

(35)

What is the Employee benefits expense of Liverpool Ltd related to this share option for the year ended 30 June 2012?

(Multiple Choice)

4.8/5  (42)

(42)

On 1 July 2009 Lancashire Ltd grants 100 share options to each of its 50 employees conditional upon the employee working for the entity for the next three years.On the same date,the entity estimates the fair value of each share option at $15.Based on probability estimates,15 employees are expected to leave the entity in one year and another 5 employees in two years.Actual resignation for the year ending 2010 was 12 employees and the fair value of the option is $12 on 30 June 2011. In accordance with AASB 2,what is the cumulative remuneration expense (related to the share option issue)as at 30 June 2011?

(Multiple Choice)

4.7/5  (38)

(38)

Which of the following share-based payment transactions are considered equity-settled transactions within the scope of AASB 2?

(Multiple Choice)

4.8/5  (41)

(41)

What would be the appropriate journal entry to account for the share-based payment transaction for the year ending 30 June 2010?

(Multiple Choice)

4.8/5  (35)

(35)

AASB 2 requires all share-based payment transactions to be recognised at:

(Multiple Choice)

4.8/5  (31)

(31)

If share appreciation rights vest immediately,the entity shall presume that the services rendered by the employees in exchange for the share appreciation rights have been received.

(True/False)

4.9/5  (46)

(46)

If the arrangement in a share-based transaction provides either the entity or the counter party with the choice of cash settlement or issuance of the equity instruments,what is the accounting treatment required in AASB 2?

(Multiple Choice)

5.0/5  (39)

(39)

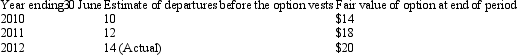

Longreach Ltd grants 100 options to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for 3 years.The fair value of each option at grant date is $15. The following information is available:

What is the employee benefits expense of Longreach Ltd related to this share option for the year ended 30 June 2010?

What is the employee benefits expense of Longreach Ltd related to this share option for the year ended 30 June 2010?

(Multiple Choice)

4.8/5  (36)

(36)

On 1 July 2009 Chester Ltd granted an executive director a choice between receiving a cash payment equivalent to 5,000 shares or receiving 6,000 shares.The grant is conditional upon the director being under the employ of the entity for three years.What is the accounting treatment for this share-based payment arrangement that is consistent with AASB 2?

(Multiple Choice)

4.9/5  (34)

(34)

On 30 June 2011,based on probability estimates how many employees are expected to be employed by Windermere Ltd when the share vests?

(Multiple Choice)

4.8/5  (33)

(33)

In accordance with AASB 2,how much Employee benefits expense related to the share option issue should Southport Ltd recognise for the year ended 30 June 2010?

(Multiple Choice)

4.9/5  (39)

(39)

AASB 2 requires all share-based payment transactions to be expensed on grant date and the credit is equity.

(True/False)

5.0/5  (42)

(42)

Showing 1 - 20 of 62

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)