Exam 4: An Overview of Accounting for Assets

Exam 1: An Overview of the Australian External Reporting Environment50 Questions

Exam 2: The Conceptual Framework of Accounting and Its Relevance to Financ62 Questions

Exam 3: Theories of Financial Accounting61 Questions

Exam 4: An Overview of Accounting for Assets62 Questions

Exam 5: Depreciation of Property, plant and Equipment62 Questions

Exam 6: Revaluation and Impairment Testing of Non-Current Assets59 Questions

Exam 7: Inventory61 Questions

Exam 8: Accounting for Intangibles61 Questions

Exam 9: Accounting for Heritage Assets and Biological Assets61 Questions

Exam 10: An Overview of Accounting for Liabilities58 Questions

Exam 11: Accounting for Lease78 Questions

Exam 12: Set-Off and Extinguishment of Debt47 Questions

Exam 13: Accounting for Employee Benefits67 Questions

Exam 15: Accounting for Financial Instruments72 Questions

Exam 16: Revenue Recognition Issues64 Questions

Exam 17: The Statement of Comprehensive Income and Statement of Changes in E62 Questions

Exam 19: Accounting for Income Taxes56 Questions

Exam 20: Cash-Flow Statements60 Questions

Exam 21: Accounting for the Extractive Industries60 Questions

Exam 22: Accounting for General Insurance Contracts58 Questions

Exam 23: Accounting for Superannuation Plans62 Questions

Exam 24: Events Occurring After Balance Sheet Date62 Questions

Exam 25: Segment Reporting61 Questions

Exam 26: Related-Party Disclosures59 Questions

Exam 28: Accounting for Group Structures69 Questions

Exam 29: Further Consolidation Issues I: Accounting for Intragroup Transact46 Questions

Exam 30: Further Consolidation Issues II: Accounting for Minority Interests34 Questions

Exam 31: Further Consolidation Issues III: Accounting for Indirect Ownershi38 Questions

Exam 32: Further Consolidation Issues Iv: Accounting for Changes in the Deg39 Questions

Exam 33: Accounting for Equity Investments67 Questions

Exam 33: Accounting for Equity Investments59 Questions

Exam 35: Accounting for Foreign Currency Transactions58 Questions

Exam 36: Translation of the Accounts of Foreign Operations41 Questions

Exam 37: Accounting for Corporate Social Responsibility59 Questions

Select questions type

In a previous period Banshee Ltd wrote-off its 'dynamic mover' equipment,but new information has shown that it is probable that the future economic benefits exceed its cost of $40 000.What is the appropriate accounting entry?

(Multiple Choice)

4.7/5  (39)

(39)

The AASB Framework allows use of different measurement basis for similar assets as long as this is disclosed in the summary of accounting policies adopted in the notes to the accounts.

(True/False)

4.8/5  (34)

(34)

When an asset's recoverable amount is less than the asset's cost,the asset's cost must be written down to recognise an impairment loss:

(True/False)

4.8/5  (35)

(35)

The class of assets that is to be valued at lower than cost or net realisable value is:

(Multiple Choice)

4.9/5  (46)

(46)

An accountant is not sure on how to recognise an asset that is purchased in excess of fair value.Which of the following action will you recommend?

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following items is not considered capitalisable cost of property,plant and equipment?

(Multiple Choice)

4.8/5  (27)

(27)

Bella Enterprises recorded as an asset a piece of equipment it purchased for $13 000 this period.No depreciation has been recorded as yet and it has been revealed that it is not probable that the equipment will generate future economic benefits.What is the appropriate accounting entry?

(Multiple Choice)

4.8/5  (34)

(34)

A reporting entity must have legal ownership of an asset to record it as such within its balance sheet:

(True/False)

4.7/5  (34)

(34)

For an asset to be recognised it is essential that it be acquired by purchase or exchange of another asset:

(True/False)

4.9/5  (31)

(31)

The treatment of repairs and additions to property,plant and equipment can be best described as:

(Multiple Choice)

4.8/5  (34)

(34)

The classification of assets into current or non-current in the balance sheet will provide useful information on the short-term solvency of the entity:

(Multiple Choice)

4.8/5  (37)

(37)

Where the entity presents current assets separately from non-current assets and current liabilities separately from non-current liabilities,AASB 101 requires items to be disclosed on the face of the balance sheet,including:

(Multiple Choice)

4.9/5  (36)

(36)

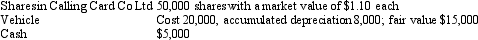

Calling Card Co Ltd has acquired a printing press from Metal Manufacturers Ltd.The deal required Calling Card Co Ltd to exchange the following assets for the printing press:  The cost to install the press was $1,000 (not yet paid).What is the entry to record the purchase of the printing press?

The cost to install the press was $1,000 (not yet paid).What is the entry to record the purchase of the printing press?

(Multiple Choice)

4.8/5  (31)

(31)

Current generally accepted accounting practices require one approach to measurement to be applied to all classes of assets:

(True/False)

4.8/5  (37)

(37)

Under AASB 101 the classification of assets into current and non-current will depend on the entity's:

(Multiple Choice)

4.8/5  (33)

(33)

AASB 101's definition of current assets and further discussion at paragraph 59 will:

(Multiple Choice)

4.8/5  (40)

(40)

The description of 'probable' in the AASB Framework means that:

(Multiple Choice)

4.9/5  (39)

(39)

'Recognised' in relation to asset disclosure may be defined as meaning:

(Multiple Choice)

4.9/5  (31)

(31)

Where the entity presents current assets separately from non-current assets and current liabilities separately from non-current liabilities what disclosure is the entity required to make under AASB 101?

(Multiple Choice)

4.8/5  (37)

(37)

Relevance and reliability are important considerations for determining the format to use for the purposes of balance sheet presentation:

(True/False)

4.8/5  (42)

(42)

Showing 41 - 60 of 62

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)