Exam 5: Time Value of Money

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning185 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows and Risk Refinements195 Questions

Exam 12: Leverage and Capital Structure217 Questions

Exam 13: Payout Policy130 Questions

Exam 14: Working Capital and Current Assets Management340 Questions

Exam 15: Current Liabilities Management171 Questions

Select questions type

Everything else being equal, the higher the discount rate, the higher the present value.

(True/False)

4.7/5  (31)

(31)

Assume you have a choice between two deposit accounts. Account X has an annual percentage rate of 12.25 percent but with interest compounded monthly. Account Y has an annual percentage rate of 12.20 percent with interest compounded continuously. Which account provides the highest effective annual return?

(Essay)

5.0/5  (32)

(32)

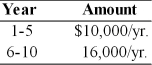

Find the present value of the following stream of cash flows, assuming that the firm's opportunity cost is 9 percent.

(Multiple Choice)

4.8/5  (35)

(35)

$100 is received at the beginning of year 1, $200 is received at the beginning of year 2, and $300 is received at the beginning of year 3. If these cash flows are deposited at 12 percent, their combined future value at the end of year 3 is ________.

(Multiple Choice)

4.8/5  (26)

(26)

An annuity due is an amount that occurs at the beginning of each period.

(True/False)

4.9/5  (46)

(46)

The future value of a $2,000 annuity due deposited at 8 percent compounded annually for each of the next 10 years is

(Multiple Choice)

4.8/5  (35)

(35)

The future value of an annuity due is always greater than the future value of an otherwise identical ordinary annuity for interest rates greater than zero.

(True/False)

4.9/5  (31)

(31)

An ordinary annuity is an annuity in which cash flows occurs at the beginning of each period.

(True/False)

4.8/5  (29)

(29)

A deep-discount bond can be purchased for $312 and in 20 years it will be worth $1,000. What is the rate of interest on the bond?

(Essay)

5.0/5  (35)

(35)

The nominal (stated) annual rate is the rate of interest actually paid or earned.

(True/False)

4.9/5  (33)

(33)

A local bank is offering a zero coupon certificate of deposit for $25,000. At maturity, three years from now, the investor will receive $32,000. What is the rate of return on this investment?

(Multiple Choice)

4.8/5  (41)

(41)

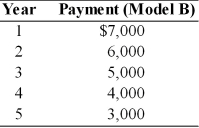

You are considering the purchase of new equipment for your company and you have narrowed down the possibilities to two models which perform equally well. However, the method of paying for the two models is different. Model A requires $5,000 per year payment for the next five years. Model B requires the following payment schedule. Which model should you buy if your opportunity cost is 8 percent?

(Essay)

4.8/5  (31)

(31)

Showing 161 - 173 of 173

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)