Exam 10: Deductions and Losses: Certain Itemized Deductions

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

Employee business expenses for travel qualify as itemized deductions subject to the 2%-of-AGI floor if they are not reimbursed.

(True/False)

4.7/5  (45)

(45)

Linda is planning to buy Vicki's home. They want to keep the transaction simple, so the sales agreement will not apportion the property taxes that Vicki has already paid on the home. Comment on the tax implications for Linda and Vicki.

(Essay)

4.9/5  (38)

(38)

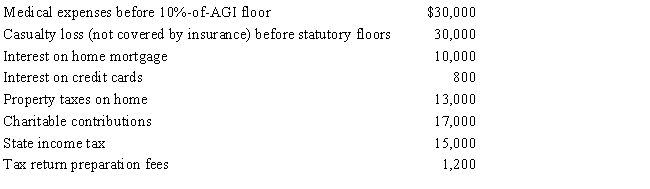

For calendar year 2017, Jon and Betty Hansen (ages 59 and 60) file a joint return reflecting AGI of $280,000. They incur the following expenditures:

What is the amount of itemized deductions the Hansens may claim?

(Essay)

4.9/5  (44)

(44)

A taxpayer pays points to obtain financing to purchase a second residence. At the election of the taxpayer, the points can be deducted as interest expense for the year paid.

(True/False)

4.7/5  (44)

(44)

In 2018, Rhonda received an insurance reimbursement for medical expenses incurred in 2017. She is not required to include the reimbursement in gross income in 2018 if she claimed the standard deduction in 2017.

(True/False)

4.9/5  (38)

(38)

For purposes of computing the deduction for qualified residence interest, a qualified residence includes the taxpayer's principal residence and two other residences of the taxpayer or spouse.

(True/False)

4.8/5  (34)

(34)

Bill paid $2,500 of medical expenses for his daughter, Marie. Marie is married to John and they file a joint return. Bill can include the $2,500 of expenses when calculating his medical expense deduction.

(True/False)

4.9/5  (39)

(39)

Joe, a cash basis taxpayer, took out a 12-month business loan on December 1, 2017. He prepaid all $3,600 of the interest on the loan on December 1, 2017. Joe can deduct only $300 of the prepaid interest in 2017.

(True/False)

4.8/5  (39)

(39)

Joseph and Sandra, married taxpayers, took out a mortgage on their home for $350,000 15 years ago. In May of this year, when the home had a fair market value of $450,000 and they owed $250,000 on the mortgage, they took out a home equity loan for $220,000. They used the funds to purchase a single engine airplane to be used for recreational travel purposes. What is the maximum amount of debt on which they can deduct home equity interest?

(Multiple Choice)

4.9/5  (39)

(39)

In 2017, Allison drove 800 miles to volunteer in a project sponsored by a qualified charitable organization in Utah. In addition, she spent $250 for meals while away from home. In total, Allison may take a charitable contribution deduction of $112 (800 miles × $.14) relating to her volunteer work.

(True/False)

4.8/5  (39)

(39)

In Lawrence County, the real property tax year is the calendar year. The real property tax becomes a personal liability of the owner of real property on January 1 in the current real property tax year (assume this year is not a leap year). The tax is payable on June 1. On May 1, Reggie sells his house to Dana for $350,000. On June 1, Dana pays the entire real estate tax of $7,950 for the year ending December 31. How much of the property taxes may Reggie deduct?

(Multiple Choice)

4.9/5  (35)

(35)

Chad pays the medical expenses of his son, James. James would qualify as Chad's dependent except that he earns $7,500 during the year. Chad may claim James' medical expenses even if he is not a dependent.

(True/False)

4.8/5  (43)

(43)

Brad, who uses the cash method of accounting, lives in a state that imposes an income tax (including withholding from wages). On April 14, 2017, he files his state return for 2016, paying an additional $600 in state income taxes. During 2017, his withholdings for state income tax purposes amount to $3,550. On April 13, 2018, he files his state return for 2017 claiming a refund of $800. Brad receives the refund on June 3, 2018. If he itemizes deductions, how much may Brad claim as a deduction for state income taxes on his Federal income tax return for calendar year 2017 (filed in April 2018)?

(Multiple Choice)

4.8/5  (40)

(40)

Shirley pays FICA (employer's share) on the wages she pays her housekeeper to clean and maintain Shirley's personal residence. The FICA payment is not deductible as an itemized deduction.

(True/False)

4.8/5  (44)

(44)

Brian, a self-employed individual, pays state income tax payments of:

$900 on January 17, 2017 (4th estimated tax payment for 2016)

$1,000 on April 17, 2017 (1st estimated tax payment in 2017)

$1,000 on June 15, 2017 (2nd estimated tax payment in 2017)

$1,000 on September 15, 2017 (3rd estimated tax payment in 2017)

$800 on January 16, 2018 (4th estimated tax payment of 2017)

Brian had a tax overpayment of $500 on his 2016 state income tax return and applied this to his 2017 state income taxes. What is the amount of Brian's state income tax itemized deduction for his 2017 Federal income tax return?

(Essay)

4.8/5  (32)

(32)

Samuel, a 36 year old individual who has been physically handicapped for a year, paid $15,000 for the installation of wheelchair ramps, support bars, railings, and widening doorways in his personal residence. These improvements increased the value of his personal residence by $4,000. How much of Samuel's expenditures qualify as a medical expense deduction (subject to the 10%-of-AGI floor)? Explain.

(Essay)

4.9/5  (30)

(30)

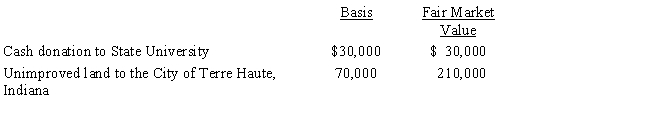

Karen, a calendar year taxpayer, made the following donations to qualified charitable organizations during the year:

The land had been held as an investment and was acquired 4 years ago. Shortly after receipt, the City of Terre Haute sold the land for $210,000. Karen's AGI is $450,000. The allowable charitable contribution deduction this year is:

The land had been held as an investment and was acquired 4 years ago. Shortly after receipt, the City of Terre Haute sold the land for $210,000. Karen's AGI is $450,000. The allowable charitable contribution deduction this year is:

(Multiple Choice)

5.0/5  (38)

(38)

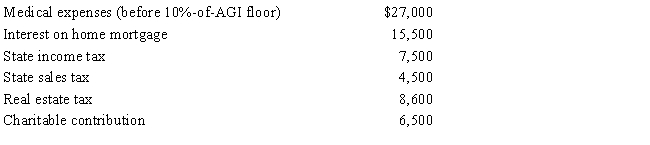

George is single and age 56, has AGI of $265,000, and incurs the following expenditures in 2017.

What is the amount of itemized deductions George may claim?

(Essay)

4.8/5  (35)

(35)

During the year, Victor spent $300 on bingo games sponsored by his church. If all profits went to the church, Victor has a charitable contribution deduction of $300.

(True/False)

4.7/5  (33)

(33)

In Piatt County, the real property tax year is the calendar year. The real property tax becomes a personal liability of

the owner of real property on January 1 and is payable on July 1 in the real property tax year. On June 30 of this year

(assume it is not a leap year), Harry sells his house to Judy for $110,000 and on July 1, Judy pays the entire real estate tax

of $4,380 for the current year ending December 31.

a.How much of the property taxes may Harry deduct?

b.How much of the property taxes may Judy deduct?

(Essay)

4.9/5  (26)

(26)

Showing 61 - 80 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)