Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

For a new car that is used predominantly in business, the "luxury auto" limit depends on whether the taxpayer takes MACRS or straight-line depreciation.

(True/False)

4.7/5  (39)

(39)

If more than 40% of the value of property, other than real property, is placed in service during the last quarter, all of the property placed in service in the second quarter will be allowed 7.5 months of cost recovery.

(True/False)

4.8/5  (31)

(31)

Antiques may be eligible for cost recovery if they are used in a trade or business.

(True/False)

4.8/5  (36)

(36)

The § 179 deduction can exceed $510,000 in 2017 if the taxpayer had a § 179 amount which exceeded the taxable income limitation in the prior year.

(True/False)

4.9/5  (31)

(31)

Bonnie purchased a new business asset (five-year property) on March 10, 2017, at a cost of $30,000. She also purchased a new business asset (seven-year property) on November 20, 2017, at a cost of $13,000. Bonnie did not elect to expense either of the assets under § 179, nor did she elect straight-line cost recovery. Bonnie takes additional first-year depreciation. Determine the cost recovery deduction for 2017 for these assets.

(Multiple Choice)

4.8/5  (36)

(36)

All personal property placed in service in 2017 and used in a trade or business qualifies for additional first-year depreciation.

(True/False)

4.9/5  (39)

(39)

The only asset Bill purchased during 2017 was a new seven-year class asset. The asset, which was listed property, was acquired on June 17 at a cost of $50,000. The asset was used 40% for business, 30% for the production of income, and the rest of the time for personal use. Bill always elects to expense the maximum amount under § 179 whenever it is applicable. The net income from the business before the § 179 deduction is $100,000. Determine Bill's maximum deduction with respect to the property for 2017.

(Multiple Choice)

4.9/5  (34)

(34)

The cost of a covenant not to complete for 10 years incurred in connection with the acquisition of a business is amortized over 10 years.

(True/False)

4.9/5  (40)

(40)

Diane purchased a factory building on April 15, 1993, for $5,000,000. She sells the factory building on February 2, 2017. Determine the cost recovery deduction for the year of the sale.

(Multiple Choice)

4.9/5  (34)

(34)

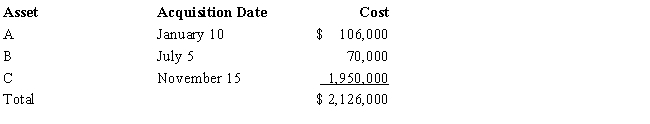

Audra acquires the following new five-year class property in 2017:

Audra elects § 179 treatment for Asset C. Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra claims the full available additional first-year depreciation deduction. Determine her total cost recovery deduction (including the § 179 deduction) for the year.

(Essay)

4.9/5  (36)

(36)

Martin is a sole proprietor of a sandwich business. On March 4, 2017, Martin purchased and placed in service new seven-year class assets costing $570,000. Martin's business reports taxable income for the year, before any deductions associated with the purchased assets, of $160,000. Martin also received $30,000 of interest income for the year, which is not related to the business. Martin wants his adjusted gross income for the year to be as low as possible. With this objective in mind, determine how Martin should recover the cost of the acquired assets.

(Essay)

4.9/5  (37)

(37)

On June 1, 2017, James places in service a new automobile that cost $40,000. The car is used 60% for business and 40% for personal use. (Assume this percentage is maintained for the life of the car.) James does not take additional first-year depreciation. Determine the cost recovery deduction for 2017.

(Multiple Choice)

4.7/5  (48)

(48)

On June 1, 2017, Red Corporation purchased an existing business. With respect to the acquired assets of the business, Red allocated $300,000 of the purchase price to a patent. The patent will expire in 20 years. Determine the total amount that Red may amortize for 2017 for the patent.

(Multiple Choice)

4.9/5  (41)

(41)

Tom purchased and placed in service used office furniture on January 3, 2017, for $40,000. Tom's accountant depreciated the furniture using straight-line depreciation over 10 years for financial reporting purposes. The accountant also used the same depreciation amounts when filing Tom's income tax returns. On January 10, 2022, Tom sold the furniture. Determine the tax basis of the furniture at the time of the sale.

(Essay)

4.7/5  (32)

(32)

The maximum cost recovery method for all personal property under MACRS is 150% declining balance.

(True/False)

4.9/5  (39)

(39)

Hazel purchased a new business asset (five-year asset) on September 30, 2017, at a cost of $100,000. On October 4, 2017, Hazel placed the asset in service. This was the only asset Hazel placed in service in 2017. Hazel did not elect § 179 or additional first-year depreciation. On August 20, 2018, Hazel sold the asset. Determine the cost recovery for 2018 for the asset.

(Multiple Choice)

4.9/5  (36)

(36)

On August 20, 2017, May placed in service a building for her business. On November 28, 2017, May paid $80,000 for improvements to the building. What is May's cost recovery deduction for the building improvements in 2017?

(Essay)

4.8/5  (39)

(39)

Intangible drilling costs must be capitalized and recovered through depletion.

(True/False)

4.8/5  (42)

(42)

Showing 41 - 60 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)