Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

A taxpayer may elect to use the alternative depreciation system (ADS) to compute depreciation for earnings and profits.

(True/False)

4.9/5  (40)

(40)

If an automobile is placed in service in 2017, the limitation for cost recovery in 2019 will be based on the cost recovery limits for the year 2017.

(True/False)

4.7/5  (42)

(42)

On July 17, 2017, Kevin places in service a used automobile that cost $25,000. The car is used 80% for business and 20% for personal use. In 2018, he used the automobile 40% for business and 60% for personal use. Determine the cost recovery recapture for 2018.

(Multiple Choice)

4.9/5  (31)

(31)

Discuss the tax implications of a seller allocating the selling price to goodwill or a covenant not to compete.

(Essay)

4.8/5  (33)

(33)

Pat purchased a used five-year class asset on March 15, 2017, for $60,000. He did not elect § 179 expensing. Determine the cost recovery deduction for 2017 for earnings and profits purposes.

(Multiple Choice)

4.9/5  (38)

(38)

The basis of cost recovery property must be reduced by at least the cost recovery allowable.

(True/False)

4.9/5  (26)

(26)

The "luxury auto" cost recovery limits change if mid-quarter cost recovery is used.

(True/False)

4.9/5  (32)

(32)

On June 1, 2017, Norm leases a taxi and places it in service. The lease payments are $1,000 per month. Assuming the dollar amount from the IRS table for such leases is $241, determine Norm's gross income inclusion amount.

(Multiple Choice)

4.8/5  (34)

(34)

Percentage depletion enables the taxpayer to recover more than the cost of an asset in the form of tax deductions.

(True/False)

4.8/5  (40)

(40)

On June 1, 2017, Irene places in service a new automobile that cost $21,000. The car is used 70% for business and 30% for personal use. (Assume this percentage is maintained for the life of the car.) She does not take additional first-year depreciation. Determine the cost recovery deduction for 2018.

(Multiple Choice)

4.7/5  (35)

(35)

The basis of an asset on which $20,000 has been expensed under § 179 will be reduced by $20,000, even if $20,000 cannot be expensed in the current year because of the taxable income limitation.

(True/False)

4.9/5  (34)

(34)

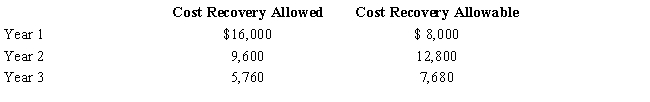

Tara purchased a machine for $40,000 to be used in her business. The cost recovery allowed and allowable for the three years the machine was used are computed as follows. If Tara sells the machine after three years for $15,000, how much gain should she recognize?

(Multiple Choice)

4.9/5  (49)

(49)

Discuss the criteria used to determine whether a building is residential or nonresidential realty. Also explain the tax consequences resulting from this determination if the property is placed in service in 2017.

(Essay)

4.7/5  (29)

(29)

James purchased a new business asset (three-year personalty) on July 23, 2017, at a cost of $40,000. James takes additional first-year depreciation but does not elect Section 179 expense on the asset. Determine the cost recovery deduction for 2017.

(Multiple Choice)

4.8/5  (38)

(38)

Bhaskar purchased a new factory building and land on September 10, 2017, for $3,700,000. ($500,000 of the purchase price was allocated to the land.) He elected the alternative depreciation system (ADS). Determine the cost recovery deduction for 2018.

(Multiple Choice)

4.8/5  (36)

(36)

Discuss the requirements in order for startup expenditures to be amortized under § 195.

(Essay)

4.8/5  (31)

(31)

The key date for calculating cost recovery is the date the asset is placed in service.

(True/False)

4.9/5  (34)

(34)

On January 15, 2017, Vern purchased the rights to a mineral interest for $3,500,000. At that time it was estimated that the recoverable units would be 500,000. During the year, 40,000 units were mined and 25,000 units were sold for $800,000. Vern incurred expenses during 2017 of $500,000. The percentage depletion rate is 22%. Determine Vern's depletion deduction for 2017.

(Multiple Choice)

4.8/5  (43)

(43)

Once the more-than-50% business usage test is passed for listed property, it still matters if the business usage for the property drops to 50% or less during the recovery period.

(True/False)

4.8/5  (38)

(38)

Rod paid $1,950,000 for a new warehouse on April 14, 2017. He sold the warehouse on September 29, 2022. Determine the cost recovery deduction for 2017 and 2022.

(Essay)

4.9/5  (46)

(46)

Showing 81 - 100 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)