Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions

Exam 1: An Introduction to Taxation and Understanding Federal Tax Law194 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination; an Overview of Property Transactions187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General155 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses124 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses178 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions106 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Alternative Minimum Tax134 Questions

Exam 13: Tax Credits and Payment Procedures120 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations148 Questions

Exam 15: Property Transactions: Nontaxable Exchanges138 Questions

Exam 16: Property Transactions: Capital Gains and Losses78 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions74 Questions

Exam 18: Accounting Periods and Methods110 Questions

Exam 19: Deferred Compensation101 Questions

Exam 20: Corporations and Partnerships198 Questions

Select questions type

The Hutters filed a joint return for 2017. They provide more than 50% of the support of Carla, Melvin, and Aaron. Carla (age 18) is a cousin and earns $2,800 from a part-time job. Melvin (age 25) is their son and is a full-time law student. He received from the university a $3,800 scholarship for tuition. Aaron is a brother who is a citizen of Israel but resides in France. Carla and Melvin live with the Hutters. How many personal and dependency exemptions can the Hutters claim on their Federal income tax return?

(Multiple Choice)

4.9/5  (40)

(40)

An increase in a taxpayer's AGI could decrease the amount of charitable contribution that can be claimed.

(True/False)

4.7/5  (37)

(37)

The basic and additional standard deductions both are subject to an annual adjustment for inflation.

(True/False)

4.9/5  (26)

(26)

As opposed to itemizing deductions from AGI, the majority of individual taxpayers choose the standard deduction.

(True/False)

4.7/5  (34)

(34)

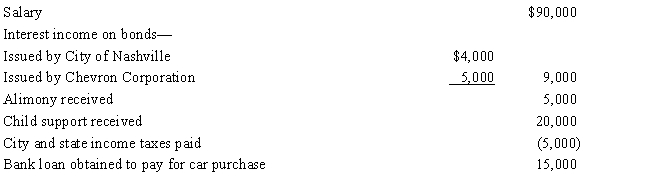

Emily had the following transactions during 2016:

What is Emily's AGI for 2017?

(Essay)

4.9/5  (38)

(38)

A decrease in a taxpayer's AGI could increase the amount of medical expenses that can be deducted.

(True/False)

4.9/5  (37)

(37)

Match the statements that relate to each other. Note: Some choices may be used more than once.

a.Not available to 65-year old taxpayer who itemizes.

b.Exception for U.S. citizenship or residency test (for dependency exemption purposes).

c.Largest basic standard deduction available to a dependent who has no earned income.

d.Considered for dependency exemption purposes.

e.Qualifies for head of household filing status.

f.A child (age 15) who is a dependent and has only earned income.

g.Considered in applying gross income test (for dependency exemption purposes).

h.Not considered in applying the gross income test (for dependency exemption purposes).

i.Unmarried taxpayer who can use the same tax rates as married persons filing jointly.j.Exception to the support test (for dependency exemption purposes).k.A child (age 16) who is a dependent and has only unearned income of $4,500.l.No correct match provided.

-Age of a qualifying child

(Short Answer)

4.7/5  (37)

(37)

Gain on the sale of collectibles held for more than 12 months always is subject to a tax rate of 28%.

(True/False)

4.8/5  (24)

(24)

Derek, age 46, is a surviving spouse. If he has itemized deductions of $12,900 for 2017, Derek should not claim the standard deduction.

(True/False)

4.9/5  (37)

(37)

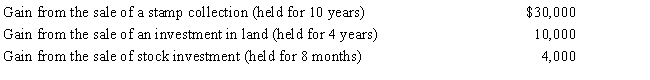

During 2017, Madison had salary income of $80,000 and the following capital transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

(Essay)

4.8/5  (32)

(32)

Ellen, age 39 and single, furnishes more than 50% of the support of her parents, who do not live with her; their only source of income are Social Security benefits. Ellen practices as a self-employed interior decorator and has gross income in 2017 of $120,000. Her deductions are as follows: $30,000 business and $8,100 itemized.

a.Can Ellen qualify for head of household filing status? Explain.

b.What is Ellen's taxable income for 2017?

(Essay)

4.7/5  (33)

(33)

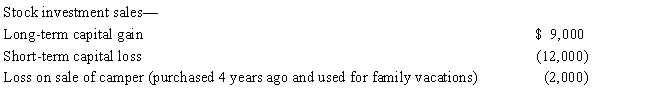

Perry is in the 33% tax bracket. During 2017, he had the following capital asset transactions: Perry's tax consequences from these gains are as follows:

(Multiple Choice)

4.7/5  (42)

(42)

In which, if any, of the following situations will the kiddie tax not apply?

(Multiple Choice)

4.8/5  (41)

(41)

Warren, age 17, is claimed as a dependent by his father. In 2017, Warren has dividend income of $1,500 and earns $400 from a part-time job.

a.What is Warren's taxable income for 2017?

b.Suppose Warren earned $1,200 (not $400) from the part-time job. What is Warren's taxable income for 2017?

(Essay)

4.7/5  (36)

(36)

During the year, Kim sold the following assets: business auto for a $1,000 loss, stock investment for a $1,000 loss, and pleasure yacht for a $1,000 loss. Presuming adequate income, how much of these losses may Kim claim?

(Multiple Choice)

4.8/5  (43)

(43)

For the current year, David has wages of $80,000 and the following property transactions: What is David's AGI for the current year?

(Multiple Choice)

4.9/5  (33)

(33)

Match the statements that relate to each other. Note: Some choices may be used more than once.

a.Not available to 65-year old taxpayer who itemizes.

b.Exception for U.S. citizenship or residency test (for dependency exemption purposes).

c.Largest basic standard deduction available to a dependent who has no earned income.

d.Considered for dependency exemption purposes.

e.Qualifies for head of household filing status.

f.A child (age 15) who is a dependent and has only earned income.

g.Considered in applying gross income test (for dependency exemption purposes).

h.Not considered in applying the gross income test (for dependency exemption purposes).

i.Unmarried taxpayer who can use the same tax rates as married persons filing jointly.j.Exception to the support test (for dependency exemption purposes).k.A child (age 16) who is a dependent and has only unearned income of $4,500.l.No correct match provided.

-Abandoned spouse

(Short Answer)

4.7/5  (42)

(42)

Nelda is married to Chad, who abandoned her in early June of 2017. She has not seen or communicated with him since then. She maintains a household in which she and her two dependent children live. Which of the following statements about Nelda's filing status in 2017 is correct?

(Multiple Choice)

4.9/5  (45)

(45)

In meeting the criteria of a qualifying child for dependency exemption purposes, when if ever, might the child's income become relevant?

(Essay)

4.7/5  (36)

(36)

An individual taxpayer uses a fiscal year of March 1 to February 28. The due date of this taxpayer's Federal income tax return is May 15 of each tax year.

(True/False)

4.9/5  (34)

(34)

Showing 61 - 80 of 187

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)