Exam 3: Appendix A: AIncome Tax Allocation

Exam 1: Setting the Stage40 Questions

Exam 2: Intercorporate Equity Investments: an Introduction43 Questions

Exam 3: Business Combinations43 Questions

Exam 3: Appendix A: AIncome Tax Allocation6 Questions

Exam 4: Wholly Owned Subsidiaries: Reporting Subsequent Acquisitions40 Questions

Exam 4: Appendix A: Wholly Owned Subsidiaries: Reporting Subsequent Acquisitions4 Questions

Exam 4: Appendix B: Wholly Owned Subsidiaries: Reporting Subsequent Acquisitions6 Questions

Exam 5: Consolidation of Non-Wholly Owned Subsidiaries41 Questions

Exam 5: Appendix A: Step Purchases6 Questions

Exam 5: Appendix B: Decreases in Ownership Interest4 Questions

Exam 6: Subsequent-Year Consolidations: General Approach40 Questions

Exam 6: Appendix B: Intercompany Bond Holdings6 Questions

Exam 7: Segment and Interim Reporting41 Questions

Exam 8: Foreign Currency Transactions and Hedges49 Questions

Exam 9: Reporting Foreign Operations44 Questions

Exam 10: Financial Reporting for Not-For-Profit Organizations46 Questions

Exam 10: Appendix A: Fund Accounting5 Questions

Exam 11: Public Sector Financial Reporting44 Questions

Select questions type

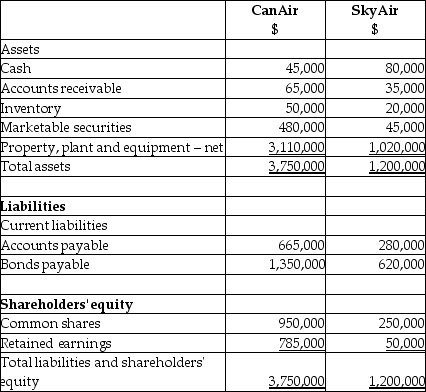

On September 1, 20X7, CanAir Limited decided to buy 100% of the shares outstanding of SkyAir Inc. for $1,215,000. CanAir will pay for this acquisition by cashing in all of its marketable securities and issuing share capital for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X7, are as follows:

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

Property, plant, and equipment: Fair value is $1,350,000

Internet domain name: Fair value is $55,000

Customer lists: Fair value is $35,000

In addition, SkyAir has tax losses available for carryforward that have a fair value of $225,000 and it is probable that they will be realized in the future.

Required:

Determine the amount of goodwill that will be recorded on the business combination.

Prepare the consolidated statement of financial position as at September 1, 20X7.

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

Property, plant, and equipment: Fair value is $1,350,000

Internet domain name: Fair value is $55,000

Customer lists: Fair value is $35,000

In addition, SkyAir has tax losses available for carryforward that have a fair value of $225,000 and it is probable that they will be realized in the future.

Required:

Determine the amount of goodwill that will be recorded on the business combination.

Prepare the consolidated statement of financial position as at September 1, 20X7.

Free

(Essay)

4.9/5  (36)

(36)

Correct Answer:

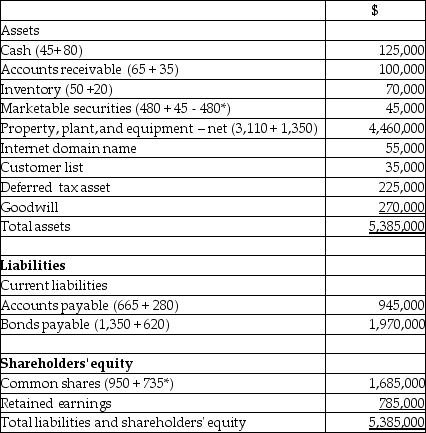

Calculation of goodwill:

Consideration received:

Fair value of net assets acquired:

Can Air Limited

Consolidated Statement of Financial Position

September 1, 20X 7

*Note: The purchase price of $1,215,000 is paid with cash from the marketable securities of $480,000 and an issue of shares totalling $735,000.

*Note: The purchase price of $1,215,000 is paid with cash from the marketable securities of $480,000 and an issue of shares totalling $735,000.

Foster Ltd. acquired 100% of Benson Ltd. The carrying values of Benson's capital assets differed from their fair values and their fair values differed from their tax bases. Which of the following statements is true?

Free

(Multiple Choice)

4.7/5  (34)

(34)

Correct Answer:

B

Castle Ltd. acquired 100% of Bello Ltd. At the time of acquisition, Bello had assets with a tax value of $700,000, carrying value of $800,000, and fair value of $950,000. Both Castle and Bello are subject to a tax rate of 40%. What is the amount of the deferred tax liability on Castle's consolidated SFP?

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

C

Castle Ltd. acquired 100% of Bello Ltd. At the time of acquisition, Bello had assets with a tax value of $700,000, carrying value of $800,000, and fair value of $950,000. Both Castle and Bello are subject to a tax rate of 40%. What is the effect of recognizing the deferred tax in accounting for the acquisition?

(Multiple Choice)

5.0/5  (38)

(38)

O'Ball Ltd. wants to acquire Kiro Ltd. to take advantage of its tax losses and credit carryforwards. In what way can O'Ball accomplish this?

(Multiple Choice)

4.7/5  (36)

(36)

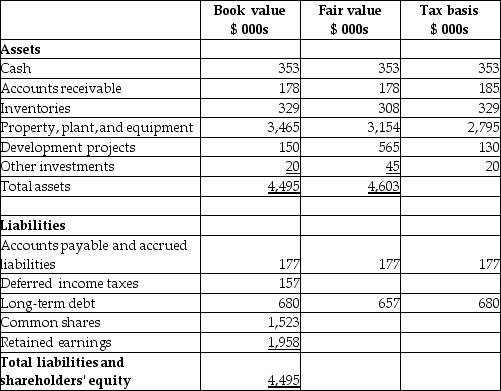

On January 1, 20X7, Falcon acquired 100% of the outstanding shares of Intra for $3,600,000. Both are mining companies involved in nickel and copper production. The balance sheet for Intra at the date of acquisition is shown below, together with estimates of the fair values and tax values of Intra's recorded assets and liabilities.

Intra Corp

Statement of Financial Position

December 31, 20X 6  The tax rate for Intra and for Falcon is 30%.

Required:

What is the amount of goodwill to be recorded for this business combination?

The tax rate for Intra and for Falcon is 30%.

Required:

What is the amount of goodwill to be recorded for this business combination?

(Essay)

4.9/5  (34)

(34)

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)