Exam 8: Flexible Budgets, Variances, and Management Control: II

Exam 1: The Accountants Vital Role in Decision Making141 Questions

Exam 2: An Introduction to Cost Terms and Purposes165 Questions

Exam 3: Cost-Volume-Profit Analysis139 Questions

Exam 4: Job Costing138 Questions

Exam 5: Activity-Based Costing and Management133 Questions

Exam 6: Master Budget and Responsibility Accounting150 Questions

Exam 7: Flexible Budgets, Variances, and Management Control: I146 Questions

Exam 8: Flexible Budgets, Variances, and Management Control: II137 Questions

Exam 9: Income Effects of Denominator Level on Inventory Valuation154 Questions

Exam 10: Quantitative Analyses of Cost Functions114 Questions

Exam 11: Decision Making and Relevant Information146 Questions

Exam 12: Pricing Decisions, Product Profitability Decisions, and Cost Management135 Questions

Exam 13: Strategy, Balanced Scorecard, and Profitability Analysis140 Questions

Exam 14: Period Cost Allocation153 Questions

Exam 15: Cost Allocation: Joint Products and Byproducts149 Questions

Exam 16: Revenue and Customer Profitability Analysis137 Questions

Exam 17: Process Costing128 Questions

Exam 18: Spoilage, Rework, and Scrap121 Questions

Exam 19: Cost Management: Quality, Time, and the Theory of Constraints158 Questions

Exam 20: Inventory Cost Management Strategies136 Questions

Exam 21: Capital Budgeting: Methods of Investment Analysis128 Questions

Exam 22: Capital Budgeting: a Closer Look120 Questions

Exam 23: Transfer Pricing and Multinational Management Control Systems141 Questions

Exam 24: Multinational Performance Measurement and Compensation139 Questions

Select questions type

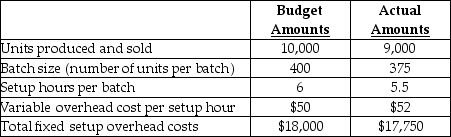

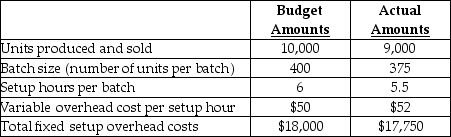

Answer the following question(s) using the information below.

Lukehart Industries Inc. produces air purifiers in batches. To manufacture a batch of the purifiers Lukehart Inc. must setup the machines and assembly line tooling. Setup costs are batch-level costs because they are associated with batches rather than individual units of products. A separate Setup Department is responsible for setting up machines and tooling for different models of the air purifiers.

Setup overhead costs consist of some costs that are variable and some costs that are fixed with respect to the number of setup hours. The following information pertains to June 2012:

-Calculate the flexible-budget variance for variable setup overhead costs.

-Calculate the flexible-budget variance for variable setup overhead costs.

(Multiple Choice)

4.7/5  (32)

(32)

Managers should use unitized fixed manufacturing overhead costs for planning and control.

(True/False)

4.7/5  (48)

(48)

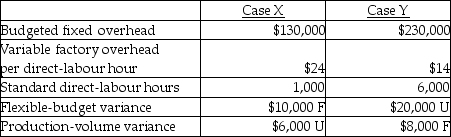

A company had the following information pertaining to two different cases:  The total overhead variance in Case Y was

The total overhead variance in Case Y was

(Multiple Choice)

4.8/5  (43)

(43)

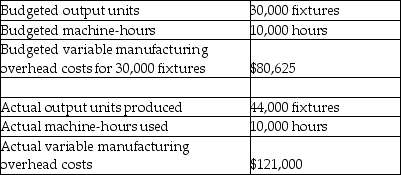

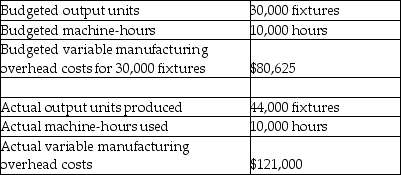

Use the information below to answer the following question(s).

Moeller Electric manufactures light fixtures. The following information pertains to the company's manufacturing overhead data.

-What is the variable manufacturing overhead flexible-budget variance?

-What is the variable manufacturing overhead flexible-budget variance?

(Multiple Choice)

4.7/5  (33)

(33)

All Clean of Alberta manufactures individual shampoos for hotel/motel clientele. The fixed manufacturing overhead costs for 2012 will total $576,000. The company uses good units finished for fixed overhead allocation and anticipates 300,000 units of production. Good units finished average 92 percent of total units produced. During January, 20,000 units were produced. Actual fixed overhead cost per good unit averaged $2.82 in January.

Required:

a. Determine the fixed overhead rate for 2012.

b. Determine the fixed overhead static-budget variance for January.

c. Determine the fixed overhead production-volume variance for January.

d. Determine the fixed overhead rate variance for January.

(Essay)

4.8/5  (40)

(40)

When machine-hours are used as an overhead cost-allocation base, the LEAST likely cause of a unfavourable variable overhead rate variance is

(Multiple Choice)

4.9/5  (37)

(37)

The difference between budgeted fixed manufacturing overhead and the fixed manufacturing overhead allocated to actual output units achieved is called

(Multiple Choice)

4.7/5  (38)

(38)

For planning and control purposes, actual energy usage per machine hour compared with budgeted energy usage per machine hour, is a valid financial performance measure.

(True/False)

4.9/5  (38)

(38)

If a manager views the proration approach as not being cost-effective, then the adjusted allocation rate approach would be used.

(True/False)

4.7/5  (39)

(39)

When machine-hours are used as a cost allocation base, the item MOST likely to contribute to an unfavourable production-volume variance is

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following would possibly be adjusted as an end-of-period adjustment, using the adjusted allocation rate approach?

(Multiple Choice)

4.7/5  (37)

(37)

Randy's Production Company uses a single cost pool for fixed manufacturing overhead. The amount for May 2012 was budgeted at $250,000; however, the actual amount was $350,000. Actual production for May was 12,500 units, and actual machine hours were 10,000. Budgeted production included 17,750 units and 12,375 machine hours. What is the budgeted fixed overhead rate per input unit?

(Multiple Choice)

4.9/5  (41)

(41)

Can the variable overhead efficiency variance

a. be computed the same way as the efficiency variance for direct-cost items?

b. be interpreted the same way as the efficiency variance for direct-cost items? Explain.

(Essay)

4.8/5  (40)

(40)

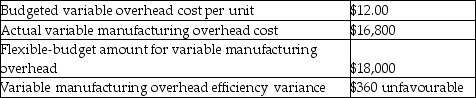

Answer the following question(s) using the information below.

Kellar Corporation manufactured 1,500 chairs during June. The following variable overhead data pertain to June:

-What is the variable overhead flexible-budget variance?

-What is the variable overhead flexible-budget variance?

(Multiple Choice)

5.0/5  (40)

(40)

An unfavourable variable overhead rate variance can be the result of paying lower prices than budgeted for variable overhead items such as energy.

(True/False)

4.9/5  (42)

(42)

Answer the following question(s) using the information below.

Lukehart Industries Inc. produces air purifiers in batches. To manufacture a batch of the purifiers Lukehart Inc. must setup the machines and assembly line tooling. Setup costs are batch-level costs because they are associated with batches rather than individual units of products. A separate Setup Department is responsible for setting up machines and tooling for different models of the air purifiers.

Setup overhead costs consist of some costs that are variable and some costs that are fixed with respect to the number of setup hours. The following information pertains to June 2012:

-Calculate the production-volume variance for fixed setup overhead costs.

-Calculate the production-volume variance for fixed setup overhead costs.

(Multiple Choice)

4.8/5  (41)

(41)

Fixed overhead costs are a lump sum that does not change in total despite changes in the cost driver.

(True/False)

4.9/5  (33)

(33)

Use the information below to answer the following question(s).

Moeller Electric manufactures light fixtures. The following information pertains to the company's manufacturing overhead data.

-What is Moeller Electric's variable manufacturing overhead sales-volume variance?

-What is Moeller Electric's variable manufacturing overhead sales-volume variance?

(Multiple Choice)

4.7/5  (33)

(33)

Ever-Sharp Lawnmowers Ltd. controls variable manufacturing overhead costs with assembly-line hours as the denominator. Fixed manufacturing overhead costs are applied on a unit-of-output basis. Each lawnmower is allowed 10 assembly-line hours and standard variable manufacturing overhead totals $650 per unit. Budgeted fixed manufacturing overhead totals $29,400 for 420 lawnmowers. During July 4,200 assembly-line hours were incurred and 400 lawnmowers were produced. Actual manufacturing overhead costs for July were $260,400 for variable expenses and $32,300 for fixed expenses.

Required:

a. Compute a 4-variance analysis for the month of July.

b. Compute a 3-variance analysis for the month of July.

c. Compute a 2-variance analysis for the month of July.

(Essay)

4.9/5  (35)

(35)

The fixed manufacturing overhead efficiency variance is used to analyze overhead costs.

(True/False)

4.9/5  (34)

(34)

Showing 41 - 60 of 137

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)