Exam 24: Multinational Performance Measurement and Compensation

Exam 1: The Accountants Vital Role in Decision Making141 Questions

Exam 2: An Introduction to Cost Terms and Purposes165 Questions

Exam 3: Cost-Volume-Profit Analysis139 Questions

Exam 4: Job Costing138 Questions

Exam 5: Activity-Based Costing and Management133 Questions

Exam 6: Master Budget and Responsibility Accounting150 Questions

Exam 7: Flexible Budgets, Variances, and Management Control: I146 Questions

Exam 8: Flexible Budgets, Variances, and Management Control: II137 Questions

Exam 9: Income Effects of Denominator Level on Inventory Valuation154 Questions

Exam 10: Quantitative Analyses of Cost Functions114 Questions

Exam 11: Decision Making and Relevant Information146 Questions

Exam 12: Pricing Decisions, Product Profitability Decisions, and Cost Management135 Questions

Exam 13: Strategy, Balanced Scorecard, and Profitability Analysis140 Questions

Exam 14: Period Cost Allocation153 Questions

Exam 15: Cost Allocation: Joint Products and Byproducts149 Questions

Exam 16: Revenue and Customer Profitability Analysis137 Questions

Exam 17: Process Costing128 Questions

Exam 18: Spoilage, Rework, and Scrap121 Questions

Exam 19: Cost Management: Quality, Time, and the Theory of Constraints158 Questions

Exam 20: Inventory Cost Management Strategies136 Questions

Exam 21: Capital Budgeting: Methods of Investment Analysis128 Questions

Exam 22: Capital Budgeting: a Closer Look120 Questions

Exam 23: Transfer Pricing and Multinational Management Control Systems141 Questions

Exam 24: Multinational Performance Measurement and Compensation139 Questions

Select questions type

Investment turnover is calculated by dividing investments by revenues.

(True/False)

4.8/5  (39)

(39)

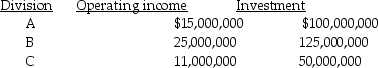

Capital Investments has three divisions. Each division's required rate of return is 15 percent. Planned operating results for 2011 are:

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a. Compute the current ROI for each division.

b. Compute the current residual income for each division.

c. Rank the divisions according to their current ROIs and residual incomes.

d. Determine the effects after adding the new project to each division's ROI and residual income.

e. Which Divisions are pleased with the addition and which ones are unhappy assuming the managers are evaluated on a combination of ROI and residual income? Is a combination of ROI and residual income appropriate for the divisions?

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a. Compute the current ROI for each division.

b. Compute the current residual income for each division.

c. Rank the divisions according to their current ROIs and residual incomes.

d. Determine the effects after adding the new project to each division's ROI and residual income.

e. Which Divisions are pleased with the addition and which ones are unhappy assuming the managers are evaluated on a combination of ROI and residual income? Is a combination of ROI and residual income appropriate for the divisions?

(Essay)

4.7/5  (32)

(32)

The imputed cost of an investment is the required rate of return times the investment.

(True/False)

4.8/5  (37)

(37)

Which type of compensation is most prevalent when a satisfactory performance measure cannot be designed?

(Multiple Choice)

4.9/5  (44)

(44)

Economic value-added is after-tax operating income minus (required rate of return times total assets).

(True/False)

4.9/5  (39)

(39)

The Auto Division of Fran Corporation has $2.5 million in total assets and $200,000 in liabilities, while the Transportation Division has $5 million in total assets and $3 million in liabilities. What are the imputed costs of the Auto division and of the Transportation division, respectively, if the corporation has a required rate of return of 11%?

(Multiple Choice)

4.9/5  (36)

(36)

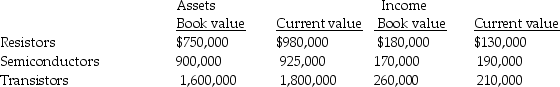

Holmes Electronics Ltd. has three divisions: Resistors, Semiconductors and Transistors, each located in a different geographic region. Data for its most recent year are presented below:  The company is currently using a required rate of return of 16 percent.

Required:

A) Compute the ROI using both book value and current value for all divisions. Round to four decimal places.

B) Compute residual income using book value and current value for all divisions.

C) Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

The company is currently using a required rate of return of 16 percent.

Required:

A) Compute the ROI using both book value and current value for all divisions. Round to four decimal places.

B) Compute residual income using book value and current value for all divisions.

C) Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

(Essay)

4.8/5  (39)

(39)

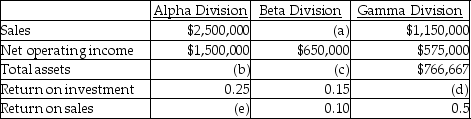

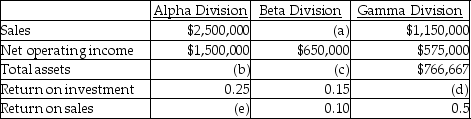

Use the information below to answer the following question(s).

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-A corporation has a required rate of return of 13% for all subsidiaries. The Calgary subsidiary earned residual income of $200,000 in year 1, and $300,000 in year 2 on an investment base of $4,500,000. What rate of return did the Calgary subsidiary earn in years 1 and 2 respectively?

-A corporation has a required rate of return of 13% for all subsidiaries. The Calgary subsidiary earned residual income of $200,000 in year 1, and $300,000 in year 2 on an investment base of $4,500,000. What rate of return did the Calgary subsidiary earn in years 1 and 2 respectively?

(Multiple Choice)

4.7/5  (34)

(34)

Answer the following question(s) using the information below:

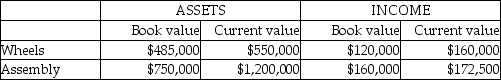

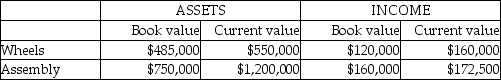

Carriage Ltd. manufactures baby carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a 12% required rate of return.

-The cost today of purchasing an asset identical to the one currently held is called a(n)

The company is currently using a 12% required rate of return.

-The cost today of purchasing an asset identical to the one currently held is called a(n)

(Multiple Choice)

4.8/5  (37)

(37)

Current cost is the cost of purchasing an asset today identical to the one currently held.

(True/False)

4.7/5  (39)

(39)

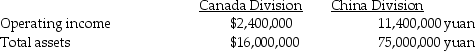

The Irnakk Corporation manufactures iPod covers in Canada and China. The operations are organized as decentralized divisions. The following information is available for the year just ended:

The exchange rate at the time of Irnakk's investment (the end of the previous year) in China was 7.5 Chinese yuan = $1 Canadian. During the year, the yuan declined steadily in value and the exchange rate at the end of the current year was 8.5 yuan = $1 Canadian. The average exchange rate during the year was 8 yuan = $1 Canadian.

Required:

a. Calculate the Canadian Division's ROI for last year based on dollars.

b. Calculate the Chinese Division's ROI for last year based on yuan.

c. Which of Irnakk's two divisions earned the better ROI? Explain your answer, complete with supporting calculations.

The exchange rate at the time of Irnakk's investment (the end of the previous year) in China was 7.5 Chinese yuan = $1 Canadian. During the year, the yuan declined steadily in value and the exchange rate at the end of the current year was 8.5 yuan = $1 Canadian. The average exchange rate during the year was 8 yuan = $1 Canadian.

Required:

a. Calculate the Canadian Division's ROI for last year based on dollars.

b. Calculate the Chinese Division's ROI for last year based on yuan.

c. Which of Irnakk's two divisions earned the better ROI? Explain your answer, complete with supporting calculations.

(Essay)

4.8/5  (44)

(44)

Managers use ________ to create an ongoing dialog around the organization's key strategic issues to personally involve themselves in subordinates' decision-making activities.

(Multiple Choice)

4.7/5  (40)

(40)

Current cost is defined as the cost of purchasing an asset today identical to the one currently held.

Required:

Discuss why this is a useful concept and explain some difficulties in its use.

(Essay)

4.9/5  (39)

(39)

Use the information below to answer the following question(s).

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

-What is the Gamma Division's return on investment?

-What is the Gamma Division's return on investment?

(Multiple Choice)

4.7/5  (38)

(38)

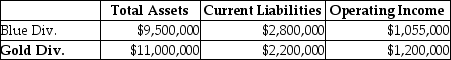

Answer the following question(s) using the information below:

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

-What is Economic Value Added (EVA) for the Gold Division?

-What is Economic Value Added (EVA) for the Gold Division?

(Multiple Choice)

4.9/5  (29)

(29)

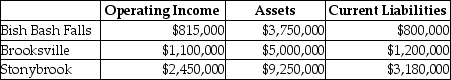

Answer the following question(s) using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

-What is the EVA for Stonybrook?

-What is the EVA for Stonybrook?

(Multiple Choice)

4.9/5  (35)

(35)

The Coffee Division of Canadian Products is planning the 2011 operating budget. Average total assets of $1,500,000 will be used during the year and unit selling prices are expected to average $100 each. Variable costs of the division are budgeted at $400,000 while fixed costs are set at $250,000. The company's required rate of return is 18 percent.

Required:

a. Compute the volume necessary to achieve a 20 percent ROI.

b. The division manager receives a bonus of 50 percent of the residual income. What is his anticipated bonus for 2011 assuming he achieves the targeted operating income in part a. and the required return is based on 18%?

(Essay)

4.9/5  (30)

(30)

Answer the following question(s) using the information below:

Carriage Ltd. manufactures baby carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for the year just ended:

The company is currently using a 12% required rate of return.

-What are Wheels's and Assembly's return on investment based on book values, respectively?

The company is currently using a 12% required rate of return.

-What are Wheels's and Assembly's return on investment based on book values, respectively?

(Multiple Choice)

4.8/5  (29)

(29)

The absence of good performance measures restricts the owner's ability to motivate managers through

(Multiple Choice)

4.7/5  (54)

(54)

Showing 81 - 100 of 139

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)