Exam 6: Deductions and Losses: in General

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Tax Formula and Tax Determination;an Overview of Property Transactions188 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions114 Questions

Exam 6: Deductions and Losses: in General142 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses120 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion115 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses177 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions104 Questions

Exam 11: Investor Losses110 Questions

Exam 12: Alternative Minimum Tax119 Questions

Exam 13: Tax Credits and Payment Procedures124 Questions

Exam 14: Property Transactions: Determination of Gain or Loss and Basis Considerations142 Questions

Exam 15: Property Transactions: Nontaxable Exchanges120 Questions

Exam 16: Property Transactions: Capital Gains and Losses72 Questions

Exam 17: Property Transactions: 1231 and Recapture Provisions70 Questions

Exam 18: Accounting Periods and Methods108 Questions

Exam 19: Deferred Compensation102 Questions

Exam 20: Corporations and Partnerships207 Questions

Select questions type

If a vacation home is classified as primarily personal use (i.e. ,rented for fewer than 15 days),none of the related expenses can be deducted.

(True/False)

4.8/5  (34)

(34)

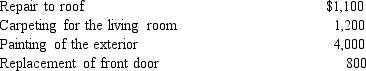

Marvin spends the following amounts on a house he owns:

a.How much of these expenses can Marvin deduct if the house is his principal residence?

b.How much of these expenses can Marvin deduct if he rents the house to a tenant?

c.Classify any deductible expenses as deductions for AGI or as deductions from AGI.

a.How much of these expenses can Marvin deduct if the house is his principal residence?

b.How much of these expenses can Marvin deduct if he rents the house to a tenant?

c.Classify any deductible expenses as deductions for AGI or as deductions from AGI.

(Essay)

4.9/5  (43)

(43)

A vacation home at the beach which is rented for 200 days and used personally for 16 days is classified in the personal/rental use category.

(True/False)

4.9/5  (41)

(41)

Iris,a calendar year cash basis taxpayer,owns and operates several TV rental outlets in Florida,and wants to expand to other states.During 2014,she spends $14,000 to investigate TV rental stores in South Carolina and $9,000 to investigate TV rental stores in Georgia.She acquires the South Carolina operations,but not the outlets in Georgia.As to these expenses,Iris should:

(Multiple Choice)

4.8/5  (38)

(38)

None of the prepaid rent paid on September 1 by a calendar year cash basis taxpayer for the next 18 months is deductible in the current period.

(True/False)

4.8/5  (37)

(37)

Andrew,who operates a laundry business,incurred the following expenses during the year. -Parking ticket of $250 for one of his delivery vans that parked illegally.

-Parking ticket of $75 when he parked illegally while attending a rock concert in Tulsa.

-DUI ticket of $500 while returning from the rock concert.

-Attorney's fee of $600 associated with the DUI ticket.

What amount can Andrew deduct for these expenses?

(Multiple Choice)

4.9/5  (28)

(28)

Alfred's Enterprises,an unincorporated entity,pays employee salaries of $100,000 during the year.At the end of the year,$12,000 of additional salaries have been earned but not paid until the beginning of the next year.

a.Determine the amount of the deduction for salaries if Alfred is a cash method taxpayer.

b.Determine the amount of the deduction for salaries if Alfred is an accrual method taxpayer.

(Essay)

4.8/5  (32)

(32)

Isabella owns two business entities.She may be able to use the cash method for one and the accrual method for the other.

(True/False)

4.8/5  (35)

(35)

The portion of a shareholderemployee's salary that is classified as unreasonable has no effect on the amount of a shareholderemployee's gross income,but results in an increase in the taxable income of the corporation.

(True/False)

4.8/5  (41)

(41)

If a vacation home is classified as primarily rental use,a deduction for all of the rental expenses is allowed.

(True/False)

4.8/5  (32)

(32)

Hobby activity expenses are deductible from AGI to the extent of hobby income.Such expenses not in excess of hobby income are not subject to the 2% of AGI floor.

(True/False)

4.8/5  (41)

(41)

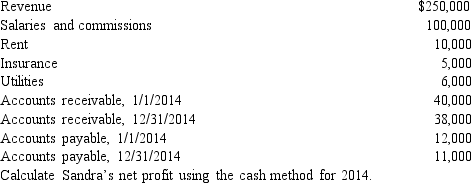

Sandra owns an insurance agency.The following selected data are taken from the agency balance sheet and income statement prepared using the accrual method.

(Essay)

4.7/5  (39)

(39)

Legal expenses incurred in connection with rental property are deductions from AGI.

(True/False)

4.9/5  (38)

(38)

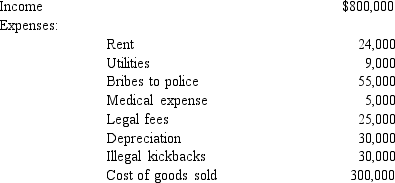

Bobby operates a drug trafficking business.Because he has an accounting background,he keeps detailed financial records.What expenses can Bobby deduct on his Federal income tax return?

(Essay)

4.9/5  (29)

(29)

If a taxpayer operates an illegal business,no deductions are permitted.

(True/False)

4.8/5  (32)

(32)

In determining whether an activity should be classified as a business or as a hobby,the satisfaction of the presumption (i.e. ,profit in at least 3 out of 5 years)ensures treatment as a business.

(True/False)

4.9/5  (35)

(35)

Agnes operates a Christmas Shop in Atlantic City,NJ.She makes a weekend trip to Vero Beach,FL,for the purpose of determining the feasibility of opening another shop.Her travel expenses are $2,000 (includes $500 for meals).In addition,she pays $5,000 to a market research firm in Vero Beach to prepare a feasibility study.Determine the amount of the expenses that Agnes can deduct if:

a.She opens a new shop in Vero Beach.

b.She decides not to open a new shop in Vero Beach.

(Essay)

4.9/5  (43)

(43)

Albie operates an illegal drugrunning business and has the following items of income and expense.What is Albie's adjusted gross income from this operation?

(Essay)

4.9/5  (40)

(40)

The period in which an accrual basis taxpayer can deduct an expense is determined by applying the economic performance and all events tests.

(True/False)

5.0/5  (41)

(41)

Showing 61 - 80 of 142

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)