Exam 9: Deductions: Employee and Self-Employed-Related Expenses

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Computing the Tax187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: in General146 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses95 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses181 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions105 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Tax Credits and Payments118 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, basis Considerations, and Nontaxable Exchanges280 Questions

Exam 14: Property Transactions, capital Gains and Losses, sec1231, and Recapture Provisions145 Questions

Exam 15: Alternative Minimum Tax132 Questions

Exam 16: Accounting Periods and Methods91 Questions

Exam 17: Corporations: Introduction and Operating Rules112 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation192 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganization72 Questions

Exam 21: Partnerships163 Questions

Exam 22: S Corporations145 Questions

Exam 23: Exempt Entities141 Questions

Exam 24: Multistate Corporate Taxation196 Questions

Exam 25: Taxation of International Transactions164 Questions

Exam 26: Tax Practice and Ethics183 Questions

Exam 27: The Federal Gift and Estate Taxes167 Questions

Exam 28: Income Taxation of Trusts and Estates167 Questions

Select questions type

Match the statements that relate to each other. (Note: Choice L may be used more than once.)

a.Cover charge paid to entertain client at a night club.

b.Deductible even if taxpayer does not take the new job

c.Company picnic sponsored by employer

d.Use of Federal per diem allowance to substantiate meals while in travel status

e.Does not have to be job related

f.Can include cost of car insurance and automobile club dues

g.Distribution from plan is taxable

h.Distribution from plan is not taxable

i.Expatriate (U.S. person who is employed overseas) returns home to retire

j.Taxpayer moves to a new residence 55 miles closer to his present job

k.Country club membership fee

l.Correct match not provided

-Roth IRAs

(Short Answer)

4.9/5  (38)

(38)

Qualifying job search expenses are deductible even if the taxpayer does not change jobs.

(True/False)

4.9/5  (34)

(34)

Ashley and Matthew are husband and wife and both are practicing CPAs.On a joint return,Ashley gets to deduct her professional dues but Matthew does not.Explain.

(Essay)

4.7/5  (40)

(40)

Match the statements that relate to each other. (Note: Choice L may be used more than once.)

a.Cover charge paid to entertain client at a night club.

b.Deductible even if taxpayer does not take the new job

c.Company picnic sponsored by employer

d.Use of Federal per diem allowance to substantiate meals while in travel status

e.Does not have to be job related

f.Can include cost of car insurance and automobile club dues

g.Distribution from plan is taxable

h.Distribution from plan is not taxable

i.Expatriate (U.S. person who is employed overseas) returns home to retire

j.Taxpayer moves to a new residence 55 miles closer to his present job

k.Country club membership fee

l.Correct match not provided

-Deemed substantiation

(Short Answer)

4.8/5  (36)

(36)

As to meeting the time test for purposes of deducting moving expenses,which of the following statements is correct?

(Multiple Choice)

4.7/5  (34)

(34)

Under the actual cost method,which,if any,of the following expenses will not be allowed?

(Multiple Choice)

4.7/5  (42)

(42)

For tax purposes,"travel" is a broader classification than "transportation."

(True/False)

4.8/5  (30)

(30)

Which,if any,of the following expenses is subject to the 2%-of-AGI floor?

(Multiple Choice)

5.0/5  (34)

(34)

Faith just graduated from college and she needs advice on the tax treatment of the costs she incurs in connection with her first job (a sales person for a pharmaceutical company).Specifically,she wants to know about the following items:

a.Job search costs.

b.Business wardrobe cost.

c.Moving expenses.

d.Deduction for office in the home.

(Essay)

4.8/5  (36)

(36)

Sue performs services for Lynn. Regarding this arrangement, use the legend provided to classify each statement.

a.Indicates employee status.

b.Indicates independent contractor status.

-Sue files a Schedule SE with her Form 1040.

(Short Answer)

4.9/5  (36)

(36)

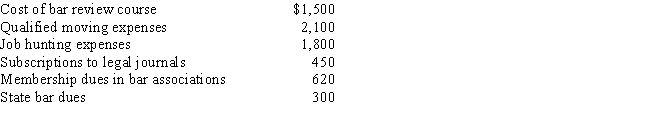

In the current year,Bo accepted employment with a Kansas City law firm after graduating from law school.Her expenses for the year are listed below:

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

(Essay)

4.9/5  (42)

(42)

How are combined business/pleasure trips treated for travel within the United States as opposed to foreign travel?

(Essay)

4.9/5  (32)

(32)

Nick Lee is a linebacker for the Baltimore Ravens (a professional football club).During the football season he rents an apartment in a Baltimore suburb.The rest of the time he lives with his family in Ann Arbor (MI) and works at a local bank as a vice president in charge of public relations.Can Nick deduct his expenses while away from Ann Arbor? Explain.

(Essay)

4.9/5  (32)

(32)

Which,if any,of the following factors is not a characteristic of independent contractor status?

(Multiple Choice)

4.9/5  (34)

(34)

Mallard Corporation pays for a trip to Aruba for its two top salespersons.This expense is subject to the cutback adjustment.

(True/False)

4.9/5  (40)

(40)

A taxpayer who uses the automatic mileage method for the business use of an automobile can change to the actual cost method in a later year.

(True/False)

4.8/5  (46)

(46)

A taxpayer who uses the automatic mileage method to compute auto expenses can also deduct the business portion of tolls and parking.

(True/False)

4.8/5  (30)

(30)

Match the statements that relate to each other. (Note: Choice L may be used more than once.)

a.Cover charge paid to entertain client at a night club.

b.Deductible even if taxpayer does not take the new job

c.Company picnic sponsored by employer

d.Use of Federal per diem allowance to substantiate meals while in travel status

e.Does not have to be job related

f.Can include cost of car insurance and automobile club dues

g.Distribution from plan is taxable

h.Distribution from plan is not taxable

i.Expatriate (U.S. person who is employed overseas) returns home to retire

j.Taxpayer moves to a new residence 55 miles closer to his present job

k.Country club membership fee

l.Correct match not provided

-Job hunting expenses

(Short Answer)

4.8/5  (42)

(42)

In the case of an office in the home deduction,the exclusive business use test does not apply when the home is used as a daycare center.

(True/False)

4.9/5  (32)

(32)

The tax law specifically provides that a taxpayer cannot be temporarily away from home for any period of employment that exceeds one year.

(True/False)

4.9/5  (35)

(35)

Showing 141 - 160 of 181

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)