Exam 3: Computing the Tax

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Computing the Tax187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: in General146 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses95 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses181 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions105 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Tax Credits and Payments118 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, basis Considerations, and Nontaxable Exchanges280 Questions

Exam 14: Property Transactions, capital Gains and Losses, sec1231, and Recapture Provisions145 Questions

Exam 15: Alternative Minimum Tax132 Questions

Exam 16: Accounting Periods and Methods91 Questions

Exam 17: Corporations: Introduction and Operating Rules112 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation192 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganization72 Questions

Exam 21: Partnerships163 Questions

Exam 22: S Corporations145 Questions

Exam 23: Exempt Entities141 Questions

Exam 24: Multistate Corporate Taxation196 Questions

Exam 25: Taxation of International Transactions164 Questions

Exam 26: Tax Practice and Ethics183 Questions

Exam 27: The Federal Gift and Estate Taxes167 Questions

Exam 28: Income Taxation of Trusts and Estates167 Questions

Select questions type

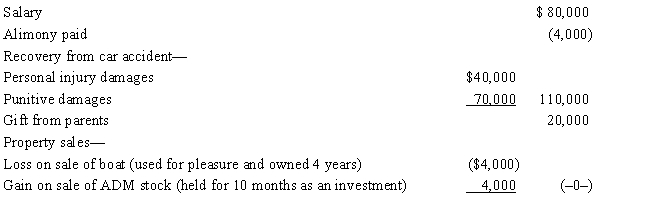

Edgar had the following transactions for 2017:

What is Edgar's AGI for 2017?

(Essay)

5.0/5  (39)

(39)

In determining the filing requirement based on gross income received,both additional standard deductions (i.e.,age and blindness) are taken into account.

(True/False)

4.8/5  (34)

(34)

Derek,age 46,is a surviving spouse.If he has itemized deductions of $12,900 for 2017,Derek should not claim the standard deduction.

(True/False)

4.8/5  (36)

(36)

For dependents who have income,special filing requirements apply.

(True/False)

4.8/5  (37)

(37)

Dan and Donna are husband and wife and file separate returns for the year.If Dan itemizes his deductions from AGI,Donna cannot claim the standard deduction.

(True/False)

4.8/5  (34)

(34)

Match the statements that relate to each other. Note: Some choices may be used more than once.

a.Not available to 65-year old taxpayer who itemizes.

b.Exception for U.S. citizenship or residency test (for dependency exemption purposes).

c.Largest basic standard deduction available to a dependent who has no earned income.

d.Considered for dependency exemption purposes.

e.Qualifies for head of household filing status.

f.A child (age 15) who is a dependent and has only earned income.

g.Considered in applying gross income test (for dependency exemption purposes).

h.Not considered in applying the gross income test (for dependency exemption purposes).

i.Unmarried taxpayer who can use the same tax rates as married persons filing jointly.

j.Exception to the support test (for dependency exemption purposes).

k.A child (age 16) who is a dependent and has only unearned income of $4,500.

l.No correct match provided.

-Additional standard deduction

(Short Answer)

4.9/5  (44)

(44)

Howard,age 82,dies on January 2,2017.On Howard's final income tax return,the full amount of the basic and additional standard deductions will be allowed even though Howard lived for only 2 days during the year.

(True/False)

4.8/5  (36)

(36)

Jayden and Chloe Harper are husband and wife and use the calendar year for tax purposes.

a.If the Harpers file a joint return for 2017, can they later switch to separate returns for 2017?

b.If the Harpers file separate returns for 2017, can they later switch to a joint return for 2017?

(Essay)

4.8/5  (36)

(36)

For tax purposes,married persons filing separate returns are treated the same as single taxpayers.

(True/False)

5.0/5  (44)

(44)

The kiddie tax does not apply to a child whose earned income is more than one-half of his or her support.

(True/False)

4.9/5  (39)

(39)

Homer (age 68) and his wife Jean (age 70) file a joint return.They furnish all of the support of Luther (Homer's 90-year old father),who lives with them.In 2017,they received $6,000 of interest income on city of Chicago bonds and interest income on corporate bonds of $48,000.Compute Homer and Jean's taxable income for 2017.

(Essay)

5.0/5  (42)

(42)

Match the statements that relate to each other.

a.Available to a 70-year-old father claimed as a dependent by his son.

b.Equal to tax liability divided by taxable income.

c.The highest income tax rate applicable to a taxpayer.

d.Not eligible for the standard deduction.

e.No one qualified taxpayer meets the support test.

f.Taxpayer's ex-husband does not qualify.

g.A dependent child (age 18) who has only unearned income.

h.Highest applicable rate is 39.6%.

i.Applicable rate could be as low as 0%.

j.Maximum rate is 28%.

k.Income from foreign sources is not subject to tax.

l.No correct match provided.

-Nonresident alien

(Short Answer)

4.8/5  (42)

(42)

In which,if any,of the following situations will the kiddie tax not apply?

(Multiple Choice)

4.7/5  (35)

(35)

Kim,a resident of Oregon,supports his parents who are residents of Canada but citizens of Korea.Kim can claim his parents as dependents.

(True/False)

4.8/5  (33)

(33)

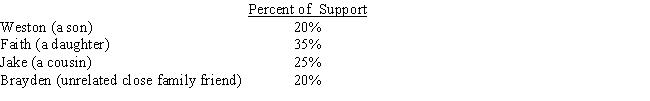

Millie,age 80,is supported during the current year as follows:

During the year,Millie lives in an assisted living facility.Under a multiple support agreement,indicate which parties can qualify to claim Millie as a dependent.

(Multiple Choice)

4.9/5  (32)

(32)

Which,if any,of the statements regarding the standard deduction is correct?

(Multiple Choice)

4.8/5  (30)

(30)

List at least three exceptions to the application of the kiddie tax.

(Essay)

4.7/5  (43)

(43)

Regarding the rules applicable to filing of income tax returns,which,if any,of the following is an incorrect statement:

(Multiple Choice)

4.9/5  (43)

(43)

A child who has unearned income of $2,100 or less cannot be subject to the kiddie tax.

(True/False)

4.8/5  (27)

(27)

Match the statements that relate to each other.

a.Available to a 70-year-old father claimed as a dependent by his son.

b.Equal to tax liability divided by taxable income.

c.The highest income tax rate applicable to a taxpayer.

d.Not eligible for the standard deduction.

e.No one qualified taxpayer meets the support test.

f.Taxpayer's ex-husband does not qualify.

g.A dependent child (age 18) who has only unearned income.

h.Highest applicable rate is 39.6%.

i.Applicable rate could be as low as 0%.

j.Maximum rate is 28%.

k.Income from foreign sources is not subject to tax.

l.No correct match provided.

-Additional standard deduction

(Short Answer)

4.8/5  (44)

(44)

Showing 141 - 160 of 187

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)