Exam 3: Computing the Tax

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law195 Questions

Exam 2: Working With the Tax Law86 Questions

Exam 3: Computing the Tax187 Questions

Exam 4: Gross Income: Concepts and Inclusions124 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: in General146 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses95 Questions

Exam 8: Depreciation, cost Recovery, amortization, and Depletion103 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses181 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions105 Questions

Exam 11: Investor Losses111 Questions

Exam 12: Tax Credits and Payments118 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, basis Considerations, and Nontaxable Exchanges280 Questions

Exam 14: Property Transactions, capital Gains and Losses, sec1231, and Recapture Provisions145 Questions

Exam 15: Alternative Minimum Tax132 Questions

Exam 16: Accounting Periods and Methods91 Questions

Exam 17: Corporations: Introduction and Operating Rules112 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation192 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganization72 Questions

Exam 21: Partnerships163 Questions

Exam 22: S Corporations145 Questions

Exam 23: Exempt Entities141 Questions

Exam 24: Multistate Corporate Taxation196 Questions

Exam 25: Taxation of International Transactions164 Questions

Exam 26: Tax Practice and Ethics183 Questions

Exam 27: The Federal Gift and Estate Taxes167 Questions

Exam 28: Income Taxation of Trusts and Estates167 Questions

Select questions type

Under the Federal income tax formula for individuals,a choice must be made between claiming deductions for AGI and itemized deductions.

(True/False)

4.8/5  (40)

(40)

During the current year,Doris received a large gift from her parents and a sizeable inheritance from an uncle.She also paid premiums on an insurance policy on her life.Doris is confused because she cannot find any place on Form 1040 to report these items.Explain.

(Essay)

4.9/5  (41)

(41)

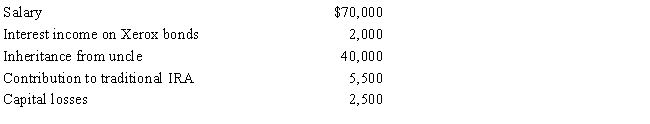

During 2017,Esther had the following transactions:

Esther's AGI is:

(Multiple Choice)

4.8/5  (36)

(36)

When separate income tax returns are filed by married taxpayers,one spouse cannot claim the other spouse as an exemption.

(True/False)

4.8/5  (28)

(28)

The Deweys are expecting to save on their taxes for 2017.Not only have both incurred large medical expenses,but both reached age 65.During the year,they also recognized a $30,000 loss on some land they sold which was purchased as an investment several years ago.Are the Deweys under a mistaken understanding regarding their tax position? Explain.

(Essay)

4.9/5  (39)

(39)

Stuart has a short-term capital loss,a collectible long-term capital gain,and a long-term capital gain from land held as investment.The short-term loss is first applied to the collectible capital gain.

(True/False)

4.8/5  (38)

(38)

In terms of the tax formula applicable to individual taxpayers,which,if any,of the following statements is correct?

(Multiple Choice)

5.0/5  (35)

(35)

In meeting the criteria of a qualifying child for dependency exemption purposes,when if ever,might the child's income become relevant?

(Essay)

4.9/5  (35)

(35)

In terms of the tax formula applicable to individual taxpayers,which,if any,of the following statements is correct?

(Multiple Choice)

4.9/5  (47)

(47)

As opposed to itemizing deductions from AGI,the majority of individual taxpayers choose the standard deduction.

(True/False)

4.8/5  (43)

(43)

Match the statements that relate to each other. Note: Some choices may be used more than once.

a.Not available to 65-year old taxpayer who itemizes.

b.Exception for U.S. citizenship or residency test (for dependency exemption purposes).

c.Largest basic standard deduction available to a dependent who has no earned income.

d.Considered for dependency exemption purposes.

e.Qualifies for head of household filing status.

f.A child (age 15) who is a dependent and has only earned income.

g.Considered in applying gross income test (for dependency exemption purposes).

h.Not considered in applying the gross income test (for dependency exemption purposes).

i.Unmarried taxpayer who can use the same tax rates as married persons filing jointly.

j.Exception to the support test (for dependency exemption purposes).

k.A child (age 16) who is a dependent and has only unearned income of $4,500.

l.No correct match provided.

-Kiddie tax applies

(Short Answer)

4.7/5  (39)

(39)

In 2017,Hal furnishes more than half of the support of his ex-wife and her father,both of whom live with him.The divorce occurred in 2016.Hal may claim the father-in-law and the ex-wife as dependents.

(True/False)

4.8/5  (39)

(39)

Mel is not quite sure whether an expenditure he made is a deduction for AGI or a deduction from AGI.Since he plans to choose the standard deduction option for the year,does the distinction matter? Explain.

(Essay)

4.8/5  (36)

(36)

Tony,age 15,is claimed as a dependent by his grandmother.During 2017,Tony had interest income from Boeing Corporation bonds of $1,000 and earnings from a part-time job of $800.Tony's taxable income is:

(Multiple Choice)

5.0/5  (42)

(42)

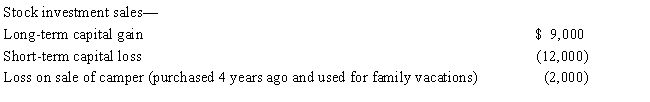

For the current year,David has wages of $80,000 and the following property transactions:

What is David's AGI for the current year?

(Multiple Choice)

4.7/5  (41)

(41)

During the year,Kim sold the following assets: business auto for a $1,000 loss,stock investment for a $1,000 loss,and pleasure yacht for a $1,000 loss.Presuming adequate income,how much of these losses may Kim claim?

(Multiple Choice)

4.8/5  (44)

(44)

Under the Federal income tax formula for individuals,the determination of adjusted gross income (AGI) precedes that of taxable income (TI).

(True/False)

5.0/5  (45)

(45)

Match the statements that relate to each other. Note: Some choices may be used more than once.

a.Not available to 65-year old taxpayer who itemizes.

b.Exception for U.S. citizenship or residency test (for dependency exemption purposes).

c.Largest basic standard deduction available to a dependent who has no earned income.

d.Considered for dependency exemption purposes.

e.Qualifies for head of household filing status.

f.A child (age 15) who is a dependent and has only earned income.

g.Considered in applying gross income test (for dependency exemption purposes).

h.Not considered in applying the gross income test (for dependency exemption purposes).

i.Unmarried taxpayer who can use the same tax rates as married persons filing jointly.

j.Exception to the support test (for dependency exemption purposes).

k.A child (age 16) who is a dependent and has only unearned income of $4,500.

l.No correct match provided.

-Resident of Canada or Mexico

(Short Answer)

4.8/5  (36)

(36)

Katrina,age 16,is claimed as a dependent by her parents.During 2017,she earned $5,600 as a checker at a grocery store.Her standard deduction is $5,950 ($5,600 earned income + $350).

(True/False)

4.9/5  (41)

(41)

Showing 41 - 60 of 187

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)