Exam 22: Exchange Rates and Financial Links Between Countries

Exam 1: The Wealth of Nations: Ownership and Economic Freedom87 Questions

Exam 2: Scarcity and Opportunity Costs87 Questions

Exam 3: Markets and the Price System96 Questions

Exam 4: The Aggregate Economy61 Questions

Exam 5: Using Economics to Understand the World Around You68 Questions

Exam 6: Elasticity: Demand and Supply133 Questions

Exam 7: Demand: Consumer Choice142 Questions

Exam 8: Supply: the Costs of Doing Business105 Questions

Exam 9: Profit Maximization121 Questions

Exam 10: Perfect Competition135 Questions

Exam 11: Monopoly118 Questions

Exam 12: Monopolistic Competition and Oligopoly114 Questions

Exam 13: Markets and Government113 Questions

Exam 14: Antitrust and Regulation88 Questions

Exam 15: Resource Markets110 Questions

Exam 16: The Labor Market116 Questions

Exam 17: The Capital Market110 Questions

Exam 18: The Land Market and Natural Resources55 Questions

Exam 19: Current Issues: Income, Income Distribution, Poverty, and Government Policy85 Questions

Exam 20: World Trade Equilibrium112 Questions

Exam 21: International Trade Restrictions109 Questions

Exam 22: Exchange Rates and Financial Links Between Countries130 Questions

Select questions type

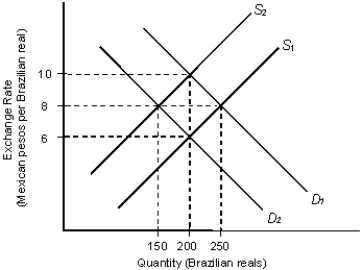

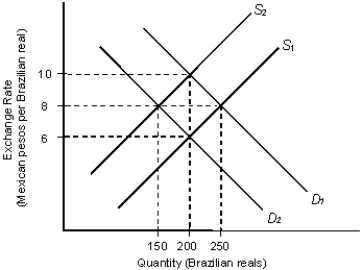

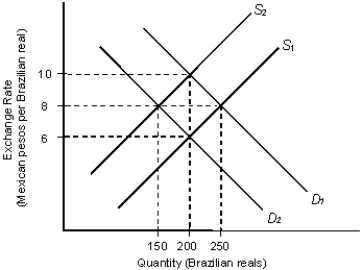

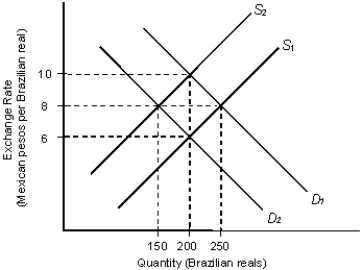

The figure given below depicts the demand and supply of Brazilian reals in the foreign exchange market. Assume that the market operates under a flexible exchange rate regime.Figure 22.1

In the figure:

D1 and D2: Demand for Brazilian reals

S1 and S2: Supply of Brazilian reals

-Refer to Figure 22.1. Assume that the initial equilibrium exchange rate is 8 Mexican pesos per Brazilian real and 150 brazilian reals are traded in the market. Suppose, there is an increase in the Brazilian demand for Mexican exports. Other things remaining equal, which of the following can be concluded?

-Refer to Figure 22.1. Assume that the initial equilibrium exchange rate is 8 Mexican pesos per Brazilian real and 150 brazilian reals are traded in the market. Suppose, there is an increase in the Brazilian demand for Mexican exports. Other things remaining equal, which of the following can be concluded?

(Multiple Choice)

4.9/5  (36)

(36)

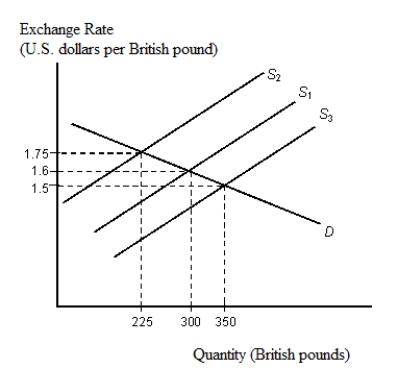

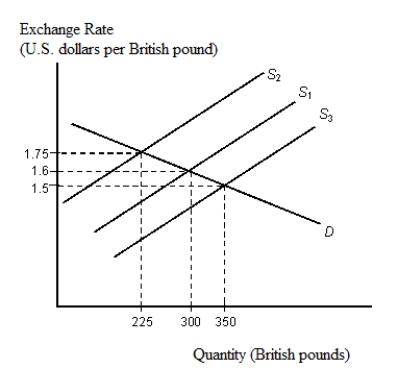

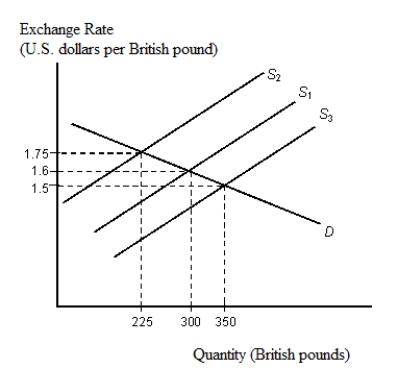

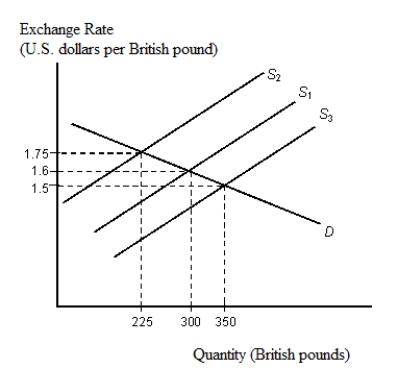

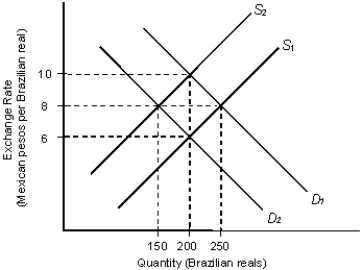

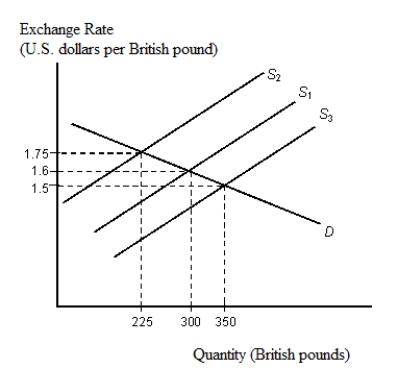

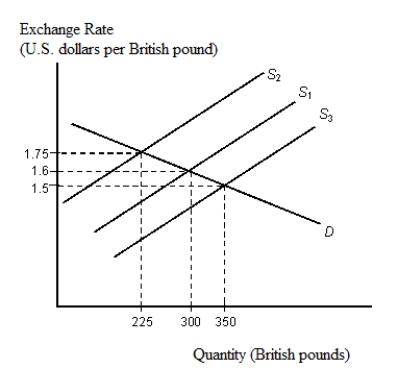

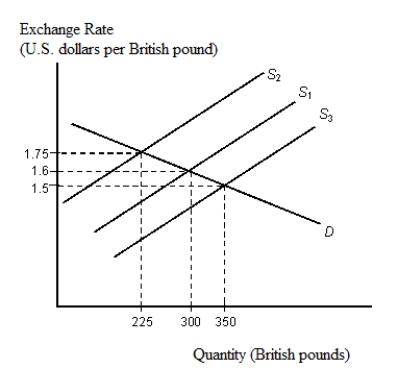

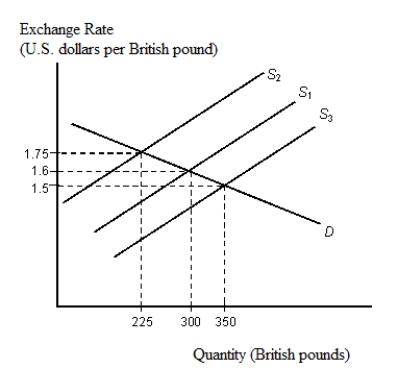

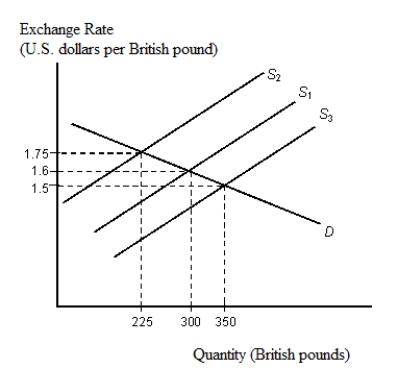

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.Figure 22.2

-An Australian investor buys a U.S. Treasury bond that has a price of $10,000, pays 5 percent interest, and matures in a year. Between the purchase date and the maturity date, the exchange rate changes from $1 = AUD 5.0 to $1= AUD 5.2. What will be the Australian investor's rate of return from the U.S. bond?

-An Australian investor buys a U.S. Treasury bond that has a price of $10,000, pays 5 percent interest, and matures in a year. Between the purchase date and the maturity date, the exchange rate changes from $1 = AUD 5.0 to $1= AUD 5.2. What will be the Australian investor's rate of return from the U.S. bond?

(Multiple Choice)

4.8/5  (35)

(35)

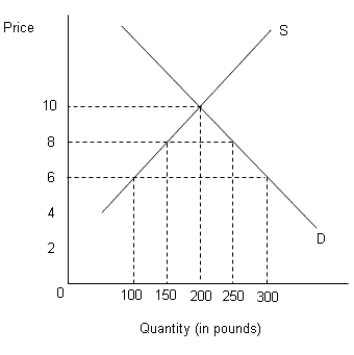

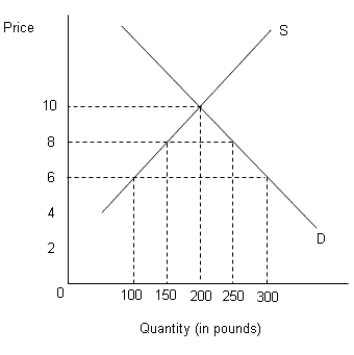

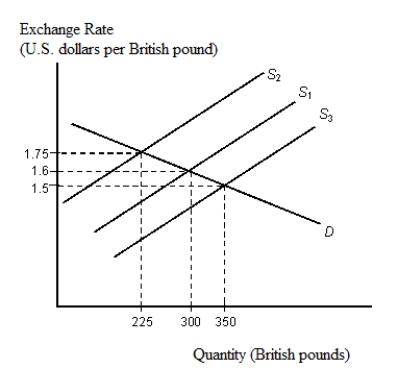

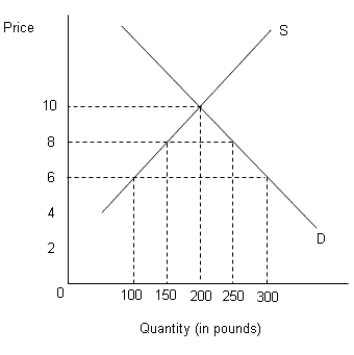

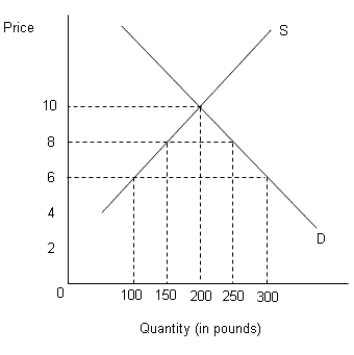

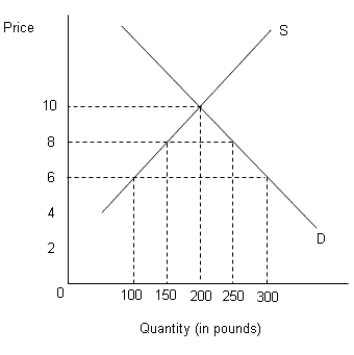

The figure below shows the demand (D) and supply (S) curves of cocoa in the U.S.Figure 21.4

-A country on a gold standard was able to maintain people's confidence in the value of its currency by:

-A country on a gold standard was able to maintain people's confidence in the value of its currency by:

(Multiple Choice)

4.8/5  (36)

(36)

The figure given below depicts the demand and supply of Brazilian reals in the foreign exchange market. Assume that the market operates under a flexible exchange rate regime.Figure 22.1

In the figure:

D1 and D2: Demand for Brazilian reals

S1 and S2: Supply of Brazilian reals

-Refer to Figure 22.1. If the initial equilibrium exchange rate is 6 pesos per real, then other things equal, a decrease in the number of Brazilian tourists to Mexico would:

-Refer to Figure 22.1. If the initial equilibrium exchange rate is 6 pesos per real, then other things equal, a decrease in the number of Brazilian tourists to Mexico would:

(Multiple Choice)

4.8/5  (36)

(36)

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.Figure 22.2

-Assume that a one-year Malaysian bond yields 10 percent interest and that the dollar return on maturity is 5 percent. If the exchange rate at maturity is $1 = MYR 4.00 (Malaysian ringgit), what was the exchange rate at the time the bond was purchased?

-Assume that a one-year Malaysian bond yields 10 percent interest and that the dollar return on maturity is 5 percent. If the exchange rate at maturity is $1 = MYR 4.00 (Malaysian ringgit), what was the exchange rate at the time the bond was purchased?

(Multiple Choice)

4.9/5  (37)

(37)

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.Figure 22.2

-Appreciation of the dollar means that now it takes more dollars to buy one unit of foreign currency.

-Appreciation of the dollar means that now it takes more dollars to buy one unit of foreign currency.

(True/False)

4.9/5  (50)

(50)

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.Figure 22.2

-Suppose you are a U.S. exporter expecting to receive a payment of NZD1,000 (New Zealand dollars) in 12 months. The annual interest rate on NZD deposits is 5 percent, and the annual interest rate on dollar deposits is 9 percent. If the present exchange rate is $0.50 per NZD and interest rate parity holds, how many dollars do you expect to receive at the maturity date of the export contract?

-Suppose you are a U.S. exporter expecting to receive a payment of NZD1,000 (New Zealand dollars) in 12 months. The annual interest rate on NZD deposits is 5 percent, and the annual interest rate on dollar deposits is 9 percent. If the present exchange rate is $0.50 per NZD and interest rate parity holds, how many dollars do you expect to receive at the maturity date of the export contract?

(Multiple Choice)

4.8/5  (33)

(33)

The figure below shows the demand (D) and supply (S) curves of cocoa in the U.S.Figure 21.4

-The World Bank obtains the funds it lends by:

-The World Bank obtains the funds it lends by:

(Multiple Choice)

5.0/5  (44)

(44)

The figure given below depicts the demand and supply of Brazilian reals in the foreign exchange market. Assume that the market operates under a flexible exchange rate regime.Figure 22.1

In the figure:

D1 and D2: Demand for Brazilian reals

S1 and S2: Supply of Brazilian reals

-Carlos Silva, a Colombian singer, goes on tour to the United States for one month, following high American demand for his live shows. Assuming that all the show's expenses are paid by the U.S. promoters, other things equal, the U.S. tour will bring about:

-Carlos Silva, a Colombian singer, goes on tour to the United States for one month, following high American demand for his live shows. Assuming that all the show's expenses are paid by the U.S. promoters, other things equal, the U.S. tour will bring about:

(Multiple Choice)

4.9/5  (34)

(34)

The figure given below depicts the demand and supply of Brazilian reals in the foreign exchange market. Assume that the market operates under a flexible exchange rate regime.Figure 22.1

In the figure:

D1 and D2: Demand for Brazilian reals

S1 and S2: Supply of Brazilian reals

-Refer to Figure 22.1. Assume that the initial equilibrium exchange rate is 6 pesos per real. Other things remaining equal, an increase in the number of Brazilian tourists to Mexico is most likely to:

-Refer to Figure 22.1. Assume that the initial equilibrium exchange rate is 6 pesos per real. Other things remaining equal, an increase in the number of Brazilian tourists to Mexico is most likely to:

(Multiple Choice)

4.8/5  (38)

(38)

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.Figure 22.2

-Suppose a Canadian investor buys a one-year U.S. government bond that pays 7 percent interest. If the U.S. dollar appreciates 4 percent against the Canadian dollar during the year, what must be the yield on a comparable Canadian government bond for interest rate parity to hold?

-Suppose a Canadian investor buys a one-year U.S. government bond that pays 7 percent interest. If the U.S. dollar appreciates 4 percent against the Canadian dollar during the year, what must be the yield on a comparable Canadian government bond for interest rate parity to hold?

(Multiple Choice)

4.7/5  (34)

(34)

The figure below shows the demand (D) and supply (S) curves of cocoa in the U.S.Figure 21.4

-The Bretton Woods System of exchange rates was established:

-The Bretton Woods System of exchange rates was established:

(Multiple Choice)

4.7/5  (35)

(35)

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.Figure 22.2

-If the euro per dollar exchange rate changes from $1 = 0.8 euros to $1 = 0.7 euros, it implies that the euro has depreciated against the dollar.

-If the euro per dollar exchange rate changes from $1 = 0.8 euros to $1 = 0.7 euros, it implies that the euro has depreciated against the dollar.

(True/False)

4.9/5  (40)

(40)

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.Figure 22.2

-An appreciation of the Norwegian kroner in relation to the U.S. dollar is most likely to cause:

-An appreciation of the Norwegian kroner in relation to the U.S. dollar is most likely to cause:

(Multiple Choice)

4.8/5  (41)

(41)

The figure below shows the demand (D) and supply (S) curves of cocoa in the U.S.Figure 21.4

-Foreign exchange market intervention is most effective when:

-Foreign exchange market intervention is most effective when:

(Multiple Choice)

4.9/5  (34)

(34)

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.Figure 22.2

-A downward-sloping demand curve for Korean won in terms of Canadian dollars indicates that the higher the dollar price of Korean won, the more won will be demanded.

-A downward-sloping demand curve for Korean won in terms of Canadian dollars indicates that the higher the dollar price of Korean won, the more won will be demanded.

(True/False)

4.7/5  (35)

(35)

The figure given below depicts the demand and supply of Brazilian reals in the foreign exchange market. Assume that the market operates under a flexible exchange rate regime.Figure 22.1

In the figure:

D1 and D2: Demand for Brazilian reals

S1 and S2: Supply of Brazilian reals

-In 1991, the French mineral water Perrier was temporarily taken off the market in the United States because of suspected impurities. Other things equal, this action brought about:

-In 1991, the French mineral water Perrier was temporarily taken off the market in the United States because of suspected impurities. Other things equal, this action brought about:

(Multiple Choice)

5.0/5  (39)

(39)

The figure below shows the demand (D) and supply (S) curves of cocoa in the U.S.Figure 21.4

-If $1 was equivalent to 120 Japanese yen in 2008 and 125 Japanese yen in 2010, it implies in 2010, there was:

-If $1 was equivalent to 120 Japanese yen in 2008 and 125 Japanese yen in 2010, it implies in 2010, there was:

(Multiple Choice)

4.8/5  (41)

(41)

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.Figure 22.2

-Assume an Australian importer expects to pay 16,000 Australian dollars (AUD) for $8,000 worth of U.S. goods, but on the shipment date 30 days later, the same volume of U.S. goods costs the Australian importer only 10,000 Australian dollars. This means that between the contract date and the payment date, the exchange rate has changed:

-Assume an Australian importer expects to pay 16,000 Australian dollars (AUD) for $8,000 worth of U.S. goods, but on the shipment date 30 days later, the same volume of U.S. goods costs the Australian importer only 10,000 Australian dollars. This means that between the contract date and the payment date, the exchange rate has changed:

(Multiple Choice)

4.8/5  (35)

(35)

The figure given below depicts the foreign exchange market for British pounds traded for U.S. dollars.Figure 22.2

-Suppose a U.S. citizen purchases a one-year Norwegian bond that yields 10 percent interest. Between the purchase date and the maturity date, the exchange rate changes from to How much was initially invested in the bond if the dollar value of the proceeds at maturity is $3,500? (roundoff up to the nearest whole number)

-Suppose a U.S. citizen purchases a one-year Norwegian bond that yields 10 percent interest. Between the purchase date and the maturity date, the exchange rate changes from to How much was initially invested in the bond if the dollar value of the proceeds at maturity is $3,500? (roundoff up to the nearest whole number)

(Multiple Choice)

4.9/5  (36)

(36)

Showing 81 - 100 of 130

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)