Exam 5: Inventories and Cost of Sales

Exam 1: Introducing Accounting in Business257 Questions

Exam 2: Analyzing and Recording Transactions216 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements236 Questions

Exam 4: Accounting for Merchandising Operations200 Questions

Exam 5: Inventories and Cost of Sales197 Questions

Exam 6: Cash and Internal Controls198 Questions

Exam 7: Accounts and Notes Receivable170 Questions

Exam 8: Long-Term Assets205 Questions

Exam 9: Current Liabilities191 Questions

Exam 10: Long-Term Liabilities189 Questions

Exam 11: Corporate Reporting and Analysis200 Questions

Exam 12: Reporting Cash Flows175 Questions

Exam 13: Analysis of Financial Statements185 Questions

Exam 14: Managerial Accounting Concepts and Principles198 Questions

Exam 15: Job Order Costing and Analysis155 Questions

Exam 16: Process Costing191 Questions

Exam 17: Activity-Based Costing and Analysis183 Questions

Exam 18: Cost-Volume-Profit Analysis181 Questions

Exam 19: Variable Costing and Performance Reporting178 Questions

Exam 20: Master Budgets and Performance Planning164 Questions

Exam 21: Flexible Budgets and Standard Costs179 Questions

Exam 22: Decentralization and Performance Measurement154 Questions

Exam 23: Relevant Costing for Managerial Decisions140 Questions

Exam 24: Capital Budgeting and Investment Analysis144 Questions

Exam 25: Accounting With Special Journals160 Questions

Exam 26: Time Value of Money58 Questions

Exam 27: Investments and International Operations181 Questions

Exam 28: Accounting for Partnerships126 Questions

Select questions type

A company made the following purchases during the year:

Jan. 10 15 units at \ 360 each Mar. 15 25 units at \ 390 each Apr. 25 10 units at \ 420 each July 30 20 units at \ 450 each Oct. 10 15 units at \ 480 each

On December 31,there were 28 units in ending inventory.These 28 units consisted of 1 from the January 10 purchase,2 from the March 15 purchase,5 from the April 25 purchase,15 from the July 30 purchase,and 5 from the October 10 purchase.Using specific identification,calculate the cost of the ending inventory.

(Essay)

4.8/5  (45)

(45)

The reasoning behind the retail inventory method is that if an accurate estimate of the cost-to-retail ratio is made,it can be multiplied by the ending inventory at retail to estimate ending inventory at cost.

(True/False)

4.9/5  (32)

(32)

An advantage of the weighted-average inventory method is that it tends to smooth out the effects of price changes.

(True/False)

4.8/5  (34)

(34)

Given the following information,determine the cost of ending inventory at November 30 using the FIFO perpetual inventory method.

November 3: 15 units were purchased at $8 per unit.

November 11: 18 units were purchased at $9.50 per unit.

November 15: 15 units were sold at $45 per unit.

November 18: 30 units were purchased at $10.75 per unit.

November 30: 20 units were sold at $55 per unit.

(Essay)

4.9/5  (40)

(40)

Whether prices are rising or falling,FIFO always will yield the highest gross profit and net income.

(True/False)

4.9/5  (47)

(47)

Evaluate each inventory error separately and determine whether it overstates or understates cost of goods sold and net income.

Inventory Error Cost of Goods Sold Net Income Understatement of beginning inventory Understatement of ending inventory Overstatement of beginning inventory Overstatement of ending inventory

(Essay)

4.8/5  (31)

(31)

When purchase costs regularly rise,the ___________________ method of inventory valuation yields the lowest gross profit and net income,providing a tax advantage.

(Short Answer)

4.9/5  (35)

(35)

A company had inventory of 5 units at a cost of $20 each on November 1.On November 2,they purchased 10 units at $22 each.On November 6,they purchased 6 units at $25 each.On November 8,they sold 18 units for $54 each.Using the LIFO perpetual inventory method,what was the cost of the 18 units sold?

(Multiple Choice)

4.9/5  (39)

(39)

Given the following information,determine the cost of ending inventory at November 30 using the weighted-average perpetual inventory method.

November 3: 15 units were purchased at $8 per unit.

November 11: 18 units were purchased at $9.50 per unit.

November 15: 15 units were sold at $45 per unit.

November 18: 30 units were purchased at $10.75 per unit.

November 30: 20 units were sold at $55 per unit.

(Essay)

4.9/5  (49)

(49)

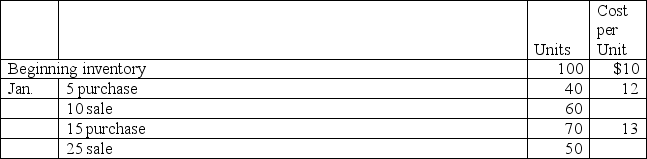

During January,a company that uses a perpetual inventory system had beginning inventory,purchases,and sales as follows.What was the weighted-average cost of the company's January 31 inventory?

(Essay)

4.8/5  (37)

(37)

During a period of steadily rising costs,the inventory valuation method that yields the lowest reported net income is:

(Multiple Choice)

4.8/5  (24)

(24)

Explain why the lower of cost or market rule is used to value inventory.

(Essay)

4.8/5  (34)

(34)

Explain how the inventory turnover ratio and the days' sales in inventory ratio are used to evaluate inventory management.

(Essay)

4.9/5  (29)

(29)

A company's cost of inventory was $317,500.Due to phenomenal demand for this product,the market value of its inventory increased to $323,000.According to the consistency principle,this company should write up the value of its inventory.

(True/False)

4.8/5  (36)

(36)

A company has inventory of 10 units at a cost of $10 each on June 1.On June 3,they purchased 20 units at $12 each.12 units are sold on June 5.Using the FIFO periodic inventory method,what is the cost of the 12 units that were sold?

(Multiple Choice)

4.9/5  (32)

(32)

A company had inventory on November 1 of 5 units at a cost of $20 each.On November 2,they purchased 10 units at $22 each.On November 6,they purchased 6 units at $25 each.On November 8,8 units were sold for $55 each.Using the FIFO perpetual inventory method,what was the value of the inventory on November 8 after the sale?

(Multiple Choice)

4.9/5  (34)

(34)

GAAP and IFRS differ on the rules regarding LIFO as GAAP allows LIFO to assign costs to inventory and IFRS does not.

(True/False)

4.8/5  (35)

(35)

If damaged and obsolete goods cannot be sold,they are not included in inventory.

(True/False)

4.9/5  (33)

(33)

A company has the following per unit original costs and replacement costs for its inventory:

Part A: 10 units with a cost of $3 and replacement cost of $2.50.

Part B: 40 units with a cost of $9 and replacement cost of $9.50.

Part C: 75 units with a cost of $8 and replacement cost of $7.50.

Under the lower of cost or market method,the total value of this company's ending inventory must be reported as:

(Multiple Choice)

4.8/5  (40)

(40)

Showing 141 - 160 of 197

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)