Exam 18: Public Choice, taxes, and the Distribution of Income

Exam 1: Economics: Foundations and Models142 Questions

Exam 2: Trade-Offs, comparative Advantage, and the Market System152 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply149 Questions

Exam 4: Economic Efficiency, government Price Setting, and Taxes137 Questions

Exam 5: Externalities, environmental Policy, and Public Goods139 Questions

Exam 6: Elasticity: The Responsiveness of Demand and Supply149 Questions

Exam 7: The Economics of Health Care117 Questions

Exam 8: Firms, the Stock Market, and Corporate Governance140 Questions

Exam 9: Comparative Advantage and the Gains From International Trade124 Questions

Exam 10: Consumer Choice and Behavioral Economics154 Questions

Exam 11: Technology, production, and Costs174 Questions

Exam 12: Firms in Perfectly Competitive Markets153 Questions

Exam 13: Monopolistic Competition: The Competitive Model in a More Realistic Setting137 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets129 Questions

Exam 15: Monopoly and Antitrust Policy148 Questions

Exam 16: Pricing Strategy134 Questions

Exam 17: The Markets for Labor and Other Factors of Production149 Questions

Exam 18: Public Choice, taxes, and the Distribution of Income134 Questions

Exam 19: GDP: Measuring Total Production and Income135 Questions

Exam 20: Unemployment and Inflation148 Questions

Exam 21: Economic Growth, the Financial System, and Business Cycles130 Questions

Exam 22: Long-Run Economic Growth: Sources and Policies134 Questions

Exam 23: Aggregate Expenditure and Output in the Short Run157 Questions

Exam 24: Aggregate Demand and Aggregate Supply Analysis145 Questions

Exam 25: Money, banks, and the Federal Reserve System144 Questions

Exam 26: Monetary Policy145 Questions

Exam 27: Fiscal Policy155 Questions

Exam 28: Inflation, unemployment, and Federal Reserve Policy135 Questions

Exam 29: Macroeconomics in an Open Economy145 Questions

Exam 30: The International Financial System139 Questions

Select questions type

Which of the following statements about a consumption tax is false?

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

C

Unlike the market process,in the political market it is possible for some individuals to receive very large benefits from the political process without any significant impact on their tax bills.

Free

(True/False)

4.8/5  (35)

(35)

Correct Answer:

True

The idea that individuals should be taxed in proportion to the marginal benefits that they receive from public goods is called

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

D

If the government wants to minimize the welfare loss of a tax,it should tax goods with more inelastic demands or supplies.

(True/False)

4.8/5  (49)

(49)

The largest source of revenue for the federal government of the United States is from

(Multiple Choice)

4.9/5  (41)

(41)

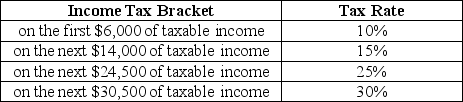

Table 18-5

Table 18-5 shows the income tax brackets and tax rates for single taxpayers in Bauxhall.

-Refer to Table 18-5.A tax exemption is granted for the first $10,000 earned per year.Suppose you earn $75,000.

a.What is the amount of taxes you will pay?

b.What is your average tax rate?

c.What is your marginal tax rate?

Table 18-5 shows the income tax brackets and tax rates for single taxpayers in Bauxhall.

-Refer to Table 18-5.A tax exemption is granted for the first $10,000 earned per year.Suppose you earn $75,000.

a.What is the amount of taxes you will pay?

b.What is your average tax rate?

c.What is your marginal tax rate?

(Essay)

4.9/5  (33)

(33)

Suppose the equilibrium price and quantity of a 12-pack of Dr.Pepper are $5.00 and 10,000 12-packs,respectively,and the government decides to impose a $1.00 tax on every 12-pack of carbonated soft drinks.Draw two supply and demand graphs,one showing the excess burden of the tax when supply is less elastic and the other showing the excess burden of the tax when supply is more elastic.Identify the excess burden of the tax on each graph.On which graph is the excess burden the greatest?

(Essay)

4.8/5  (25)

(25)

Figure 18-3  -Refer to Figure 18-3.Rank the above panels in terms of most unequal income distribution to least unequal income distribution.

-Refer to Figure 18-3.Rank the above panels in terms of most unequal income distribution to least unequal income distribution.

(Multiple Choice)

4.9/5  (33)

(33)

The median voter theorem will be an accurate predicator of the outcomes of elections

(Multiple Choice)

4.9/5  (38)

(38)

The idea that two taxpayers in the same economic circumstances should pay the same level of taxes is known as the

(Multiple Choice)

4.9/5  (38)

(38)

A study published by the Federal Reserve Bank of Chicago indicates that a tax on soda would affect demographic groups in different ways,and the groups that would feel the greatest impact of a soda tax are

(Multiple Choice)

4.8/5  (35)

(35)

If you pay $2,000 in taxes on an income of $20,000,and a tax of $3,500 on an income of $30,000,then over this range of income the tax is

(Multiple Choice)

4.7/5  (34)

(34)

If you pay $2,000 in taxes on an income of $20,000,and a tax of $2,700 on an income of $30,000,then over this range of income the tax is

(Multiple Choice)

4.8/5  (39)

(39)

If you pay $3,000 in taxes on an income of $28,000,and $4,450 in taxes on an income of $38,000,what is your marginal tax rate? Show your work.

(Essay)

4.8/5  (29)

(29)

Figure 18-1  -Refer to Figure 18-1.The excess burden of the tax is represented by the area

-Refer to Figure 18-1.The excess burden of the tax is represented by the area

(Multiple Choice)

4.9/5  (36)

(36)

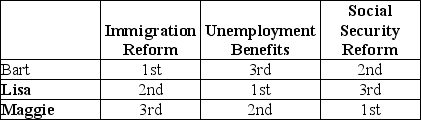

Table 18-2

-Refer to Table 18-2.The table above outlines the rankings of three members of the U.S.Senate on three spending alternatives.Assume that Congress can spend additional revenue on only one of the three spending alternatives and that Bart,Lisa,and Maggie,all members of the Senate,participate in a series of votes in which they are to determine which of the spending alternatives should receive funding.Three votes will be taken: (1)Immigration Reform and Unemployment Benefits (2)Immigration Reform and Social Security Reform and (3)Unemployment Benefits and Social Security Reform.

Show the results of each vote and determine whether the voting paradox will occur as a result of these votes.

-Refer to Table 18-2.The table above outlines the rankings of three members of the U.S.Senate on three spending alternatives.Assume that Congress can spend additional revenue on only one of the three spending alternatives and that Bart,Lisa,and Maggie,all members of the Senate,participate in a series of votes in which they are to determine which of the spending alternatives should receive funding.Three votes will be taken: (1)Immigration Reform and Unemployment Benefits (2)Immigration Reform and Social Security Reform and (3)Unemployment Benefits and Social Security Reform.

Show the results of each vote and determine whether the voting paradox will occur as a result of these votes.

(Essay)

4.9/5  (35)

(35)

Showing 1 - 20 of 134

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)