Exam 27: Accounting for Unincorporated Businesses

Exam 1: Uses of Accounting Information and the Financial Statements178 Questions

Exam 2: Measurement Concepts: Recording Business Transactions139 Questions

Exam 3: Measuring Business Income: Adjusting the Accounts168 Questions

Exam 4: Foundations of Financial Reporting and the Classified Balance Sheet130 Questions

Exam 5: Accounting for Merchandising Operations177 Questions

Exam 6: Inventories162 Questions

Exam 7: Cash and Internal Control141 Questions

Exam 8: Receivables111 Questions

Exam 9: Long-Term Assets227 Questions

Exam 10: Current Liabilities and Fair Value Accounting179 Questions

Exam 11: Long-Term Liabilities200 Questions

Exam 12: Stockholders Equity196 Questions

Exam 13: The Statement of Cash Flows147 Questions

Exam 14: Financial Statement Analysis164 Questions

Exam 15: Managerial Accounting and Cost Concepts199 Questions

Exam 16: Costing Systems: Job Order Costing121 Questions

Exam 17: Costing Systems: Process Costing139 Questions

Exam 18: Value-Based Systems: Activity-Based Costing and Lean Accounting146 Questions

Exam 19: Cost-Volume-Profit Analysis167 Questions

Exam 20: The Budgeting Process113 Questions

Exam 21: Flexible Budgets and Performance Analysis116 Questions

Exam 22: Standard Costing and Variance Analysis118 Questions

Exam 23: Short-Run Decision Analysis128 Questions

Exam 24: Capital Investment Analysis106 Questions

Exam 25: Pricing Decisions, including Target Costing and Transfer Pricing139 Questions

Exam 26: Quality Management and Measurement101 Questions

Exam 27: Accounting for Unincorporated Businesses106 Questions

Exam 28: Accounting for Investments112 Questions

Select questions type

List four advantages and four disadvantages of the partnership form of business.

(Essay)

4.8/5  (42)

(42)

It is possible to allocate income to partners based solely on interest.

(True/False)

4.9/5  (38)

(38)

Income is divided equally among the partners unless the partnership agreement specifies otherwise.

(True/False)

4.8/5  (40)

(40)

Which of the following will not result in dissolution of a partnership?

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following partnership characteristics is an advantage?

(Multiple Choice)

4.7/5  (39)

(39)

Joan contributes cash of $48,000,and Jamie contributes office equipment that cost $40,000 but is valued at $32,000 to the formation of a new partnership.The entry to record the investments in the partnership is:

(Multiple Choice)

4.8/5  (42)

(42)

The admission of a partner does not change the composition of partners' equity if the new partner purchases the old partner's interest by paying the old partner directly.

(True/False)

4.9/5  (37)

(37)

Under the partnership form of business,it may be difficult to raise large amounts of capital.

(True/False)

4.8/5  (40)

(40)

Austin invests $80,000 for a 20 percent interest in a partnership that has capital totaling $300,000 after admitting Austin.Which of the following is true?

(Multiple Choice)

4.8/5  (41)

(41)

Jordan,Kyle,and Noah have equities in a partnership of $100,000,$160,000,and $140,000,respectively,and share income in a ratio of 5:3:2,respectively.The partners have agreed to admit Billy to the partnership.Prepare entries in journal form without explanations to record the admission of Billy to the partnership under each of the following assumptions:

a.Billy invests $80,000 for a 25 percent interest,and a bonus is recorded for Billy.

b.Billy invests $160,000 for a one-fifth interest,and a bonus is recorded for the old partners.

(Essay)

4.8/5  (41)

(41)

Income can be allocated to partners based solely on average capital balances.

(True/False)

4.8/5  (42)

(42)

If the asset accounts did not reflect their current values,the asset accounts would need to be adjusted before admitting the new partner.

(True/False)

4.9/5  (43)

(43)

Partners A and B receive a salary of $16,000 and $14,000,respectively.They agree to share income equally.If the partnership has income of $280,000 in 20x5,the entry to close the income into their capital accounts is:

(Multiple Choice)

4.8/5  (38)

(38)

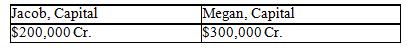

Jacob and Megan are partners who share profits in a ratio of 2:3,respectively,and have the following capital balances on September 30,20x5:

The partners agree to admit Mitchell to the partnership.Calculate the capital balances of each partner after the admission of Mitchell,assuming that bonuses are recorded when appropriate for each of the following assumptions:

a.Mitchell pays Jacob $100,000 for 40 percent of his interest

b.Mitchell invests $100,000 for a one-sixth interest in the partnership

c.Mitchell invests $100,000 for a 25 percent interest in the partnership

d.Mitchell invests $100,000 for a 15 percent interest in the partnership

The partners agree to admit Mitchell to the partnership.Calculate the capital balances of each partner after the admission of Mitchell,assuming that bonuses are recorded when appropriate for each of the following assumptions:

a.Mitchell pays Jacob $100,000 for 40 percent of his interest

b.Mitchell invests $100,000 for a one-sixth interest in the partnership

c.Mitchell invests $100,000 for a 25 percent interest in the partnership

d.Mitchell invests $100,000 for a 15 percent interest in the partnership

(Essay)

4.8/5  (36)

(36)

When individuals invest property in a partnership,the property becomes an asset of the partnership and is owned jointly by the partners.

(True/False)

4.9/5  (40)

(40)

A liquidation differs from a dissolution in that in a liquidation

(Multiple Choice)

4.8/5  (41)

(41)

As long as the action is within the scope of the partnership,any partner can bind the partnership.

(True/False)

4.9/5  (46)

(46)

Erin,Rachel,and Travis are partners in ERT Company,with average capital balances for the year of $60,000,$80,000,and $40,000,respectively.They share remaining income in a 2:5:3 ratio,respectively,after each receives a $30,000 salary and 10 percent interest on his or her average capital balance.In the journal provided,prepare the entries without explanations to close income into their Capital accounts,assuming net income of $148,000.

(Essay)

4.7/5  (33)

(33)

If a partnership agreement does not specify how income is to be distributed,the partners share the income equally.

(True/False)

4.8/5  (36)

(36)

The division of income is one area in which a partnership differs from a corporation.

(True/False)

4.9/5  (34)

(34)

Showing 81 - 100 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)