Exam 3: Computing the Tax

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

In early 2010,Ben sold a yacht,held for 9 months and for pleasure,for a $5,000 gain.Concerned about offsetting the gain before year-end,Ben is considering selling one of the following-each of which would yield a $5,000 loss:

· Houseboat used for recreation.

· Truck used in business.

· Stock investment held for 13 months.

Evaluate each choice.

(Essay)

4.8/5  (38)

(38)

Maude's parents live in another state and she cannot claim them as her dependents.If Maude pays their medical expenses,can she derive any tax benefit from doing so? Explain.

(Essay)

4.7/5  (45)

(45)

Arnold is married to Sybil,who abandoned him in 2008.He has not seen or communicated with her since April of that year.He maintains a household in which their son,Evans,lives.Evans is age 25 and earns over $20,000 each year.For tax year 2010,Arnold's filing status is:

(Multiple Choice)

4.9/5  (34)

(34)

For tax purposes,married persons filing separate returns are treated the same as single taxpayers.

(True/False)

4.9/5  (34)

(34)

During the current year,Doris received a large gift from her parents and a sizeable inheritance from an uncle.She also paid premiums on an insurance policy on her life.Doris is confused because she cannot find any place on Form 1040 to report these items.Explain.

(Essay)

4.8/5  (40)

(40)

Katrina,age 16,is claimed as a dependent by her parents.During 2010,she earned $5,500 as a checker at a grocery store.Her standard deduction is $5,800 ($5,500 earned income + $300).

(True/False)

4.9/5  (28)

(28)

Clara,age 68,claims head of household filing status.If she has itemized deductions of $9,500 for 2010,she should claim the standard deduction.

(True/False)

4.8/5  (35)

(35)

Lee,a citizen of Korea,is a resident of the U.S.Any income Lee receives from land he owns in Korea is subject to the U.S.income tax.

(True/False)

4.8/5  (33)

(33)

Benjamin,age 16,is claimed as a dependent by his parents.During 2010,he earned $700 at a car wash.Benjamin's standard deduction is $1,250 ($950 + $300).

(True/False)

4.9/5  (33)

(33)

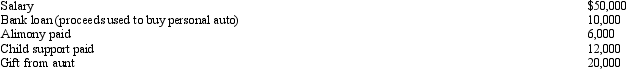

During 2010,Marvin had the following transactions:  Marvin's AGI is:

Marvin's AGI is:

(Multiple Choice)

4.8/5  (39)

(39)

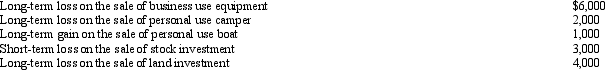

During the year,Marcus had the following transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

(Essay)

4.8/5  (44)

(44)

After paying down the mortgage on their personal residence,the Hills have found that their itemized deductions for each year are always slightly less than the standard deduction option.

(Essay)

4.8/5  (36)

(36)

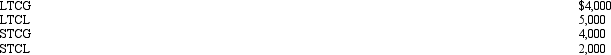

During 2010,Carmen had salary income of $90,000 and the following capital transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

(Essay)

4.9/5  (36)

(36)

The Hutters filed a joint return for 2010.They provide more than 50% of the support of Carla,Melvin,and Aaron.Carla (age 18)is a cousin and earns $5,000 from a part-time job.Melvin (age 25)is their son and is a full-time law student.He received from the university a $3,800 scholarship for tuition.Aaron is a brother who is a citizen of Israel but resides in France.Carla and Melvin live with the Hutters.How many personal and dependency exemptions can the Hutters claim on their Federal income tax return?

(Multiple Choice)

4.8/5  (41)

(41)

Muriel,age 70 and single,is claimed as a dependent on her daughter's tax return.During 2010,she had interest income of $2,400 and $800 of earned income from baby sitting.Muriel's taxable income is:

(Multiple Choice)

4.8/5  (34)

(34)

It is possible for an individual taxpayer to claim more than one type of standard deduction.

(True/False)

4.9/5  (38)

(38)

Logan,an 80-year-old widower,dies on January 2,2010.Even though he lived for only two days,on his final income tax return for 2010,the full basic and additional standard deductions can be claimed.

(True/False)

4.8/5  (35)

(35)

Which,if any,of the statements regarding the standard deduction is correct?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 21 - 40 of 130

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)