Exam 3: Computing the Tax

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

Tad claims his 70-year-old mother as a dependent.The mother may not claim an additional standard deduction for her age.

(True/False)

4.8/5  (31)

(31)

Merle,age 17,is claimed by her parents as a dependent.During 2010,she had interest income from a bank savings account of $2,000 and income from a part-time job of $4,200.Merle's taxable income is:

(Multiple Choice)

4.9/5  (41)

(41)

Ed is divorced and maintains a home in which he and a dependent friend live.Ed qualifies for head of household filing status.

(True/False)

5.0/5  (39)

(39)

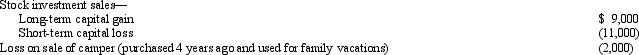

Perry is in the 33% tax bracket.During 2010,he had the following capital asset transactions:  Perry's tax consequences from these gains are as follows:

Perry's tax consequences from these gains are as follows:

(Multiple Choice)

4.7/5  (40)

(40)

The IRS facilitates the filing of income tax returns by persons in the U.S.illegally through the issuance of ITINs.

(True/False)

4.8/5  (41)

(41)

For the current year,David has salary income of $80,000 and the following property transactions:  What is David's AGI for the current year?

What is David's AGI for the current year?

(Multiple Choice)

4.8/5  (42)

(42)

Using borrowed funds from a mortgage on her home,Leah provides 52% of her own support,while her sons furnished the rest.Leah can be claimed as a dependent under a multiple support agreement.

(True/False)

4.9/5  (42)

(42)

After her divorce,Hope continues to support her ex-husband's sister,Cindy,who does not live with her.Hope cannot claim Cindy as a dependent.

(True/False)

5.0/5  (52)

(52)

Gene is single and for 2010 has AGI of $40,000.He is age 65 and has no dependents.For 2010,he has itemized deductions from AGI of $7,000.Determine Gene's taxable income for 2010.

(Essay)

4.8/5  (39)

(39)

Derek,age 46,is a surviving spouse.If he has itemized deductions of $11,600 for 2010,Derek should not claim the standard deduction.

(True/False)

4.9/5  (33)

(33)

Pablo is married to Elena,who lives with him.Both are U.S.citizens and residents of Kansas.Pablo furnishes all of the support of his parents,who are citizens of Nicaragua and residents of Mexico.He also furnishes all of the support of Elena's parents,who are citizens and residents of Nicaragua.Elena has no gross income for the year.If Pablo files as a married person filing separately,how many personal and dependency exemptions can he claim on his return?

(Essay)

4.8/5  (35)

(35)

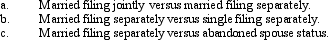

Contrast the tax consequences resulting from the following filing status situations:

(Essay)

4.8/5  (37)

(37)

In order to claim a dependency exemption for other than a qualifying child,a taxpayer must meet the support test.Generally,this is done by furnishing more than 50% of a dependent's support.What exceptions exist,if any,where the support furnished need not be more than 50%?

(Essay)

4.8/5  (36)

(36)

For the year a spouse dies,the surviving spouse is considered married for the entire year for income tax purposes.

(True/False)

4.9/5  (39)

(39)

Nelda is married to Chad,who abandoned her in early June of 2010.She has not seen or communicated with him since then.She maintains a household in which she and her two dependent children live.Which of the following statements about Nelda's filing status in 2010 is correct?

(Multiple Choice)

4.8/5  (35)

(35)

A taxpayer who itemizes his deductions from AGI can claim the property taxes on his personal residence as a deduction.

(True/False)

5.0/5  (35)

(35)

The Martins have a teenage son who has become an accomplished bagpiper.With proper promotion and scheduling,the son has good income potential by charging for his services at special events (particularly funerals).However,the Martins are fearful that the income could generate a kiddie tax and cause them the loss of a dependency exemption deduction.Are the Martins' concerns justified? Explain.

(Essay)

4.8/5  (27)

(27)

Showing 61 - 80 of 130

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)