Exam 3: Computing the Tax

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

Kyle,whose wife died in December 2007,filed a joint tax return for 2007.He did not remarry,but has continued to maintain his home in which his two dependent children live.What is Kyle's filing status as to 2010?

(Multiple Choice)

4.9/5  (31)

(31)

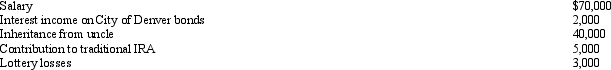

Warren,age 17,is claimed as a dependent by his father.In 2010,Warren has dividend income of $1,500 and earns $400 from a part-time job.

(Essay)

4.9/5  (43)

(43)

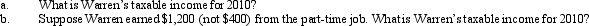

Millie,age 80,is supported during the current year as follows:  During the year,Millie lives in an assisted living facility.Under a multiple support agreement,indicate which parties can qualify to claim Millie as a dependent.

During the year,Millie lives in an assisted living facility.Under a multiple support agreement,indicate which parties can qualify to claim Millie as a dependent.

(Multiple Choice)

4.8/5  (42)

(42)

In terms of the tax formula applicable to individual taxpayers,which,if any,of the following statements is correct?

(Multiple Choice)

4.8/5  (37)

(37)

Wilma is a widow,age 80 and blind,who is claimed as a dependent by her son.During 2010,she received $4,800 in Social Security benefits,$2,200 in bank interest,and $1,800 in cash dividends from stocks.Wilma's taxable income is:

(Multiple Choice)

4.8/5  (35)

(35)

A dependent cannot claim a personal exemption on his or her own return.

(True/False)

4.8/5  (39)

(39)

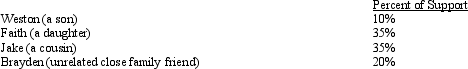

During 2010,Trevor has the following capital transactions:  After the netting process,the following results:

After the netting process,the following results:

(Multiple Choice)

4.9/5  (32)

(32)

Mel is not quite sure whether an expenditure he made is a deduction for AGI or a deduction from AGI.Since he plans to choose the standard deduction option for the year,does the distinction matter? Explain.

(Essay)

4.7/5  (41)

(41)

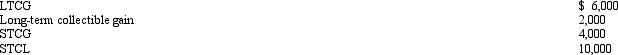

During 2010,Anna had the following transactions:  Anna's AGI is:

Anna's AGI is:

(Multiple Choice)

4.8/5  (34)

(34)

Since an abandoned spouse is considered to be unmarried with dependents,the standard deduction for head of household can be used.

(True/False)

4.8/5  (36)

(36)

Because they appear on page 1 of Form 1040,itemized deductions are also referred to as "page 1 deductions."

(True/False)

4.8/5  (32)

(32)

Heloise,age 74 and a widow,is claimed as a dependent by her daughter.For 2010,she had income as follows: $2,500 interest on municipal bonds;$3,200 Social Security benefits;$3,000 income from a part-time job;and $2,800 dividends on stock investments.What is Heloise's taxable income for 2010?

(Essay)

4.9/5  (45)

(45)

Under the income tax formula,a taxpayer must choose between deductions for AGI and the standard deduction.

(True/False)

4.8/5  (30)

(30)

Once TI (taxable income)is determined,the taxpayer must make a choice between itemizing or claiming the standard deduction.

(True/False)

4.9/5  (38)

(38)

DeWayne is a U.S.citizen and resident.He spends much of each year in the United Kingdom on business.He is married to Petula,a U.K.citizen and resident of London.DeWayne has heard that it is possible that he can file a joint income tax return for U.S.purposes.If this is so,what are the constraints he should consider in making any such decision?

(Essay)

4.7/5  (46)

(46)

Even if the individual does not spend funds that have been received from another source (e.g. ,interest on municipal bonds),the unexpended amounts are considered for purposes of the support test.

(True/False)

4.9/5  (39)

(39)

An individual taxpayer uses a fiscal year February 1-January 31.The due date of this taxpayer's Federal income tax return is June 15 of each tax year.

(True/False)

4.7/5  (35)

(35)

Tony,age 15,is claimed as a dependent by his grandmother.During 2010,Tony had interest income from Boeing Corporation bonds of $1,000 and earnings from a part-time job of $700.Tony's taxable income is:

(Multiple Choice)

4.8/5  (43)

(43)

Debby,age 18,is claimed as a dependent by her mother.During 2010,she earned $1,100 in interest income on a savings account.Debby's standard deduction is $1,400 ($1,100 + $300).

(True/False)

4.7/5  (24)

(24)

Mr.Lee is a citizen and resident of Hong Kong,while Mr.Anderson is a citizen and resident of the U.S.In the taxation of income,Hong Kong uses a territorial approach,while the U.S.follows the global system.In terms of effect,explain what this means to Mr.Lee and Mr.Anderson.

(Essay)

4.9/5  (28)

(28)

Showing 41 - 60 of 130

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)