Exam 9: Deductions: Employee and Self-Employed-Related Expenses

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

The portion of the office in the home deduction that exceeds the income from the business can be carried over to future years.

(True/False)

4.9/5  (37)

(37)

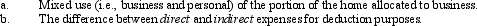

In connection with the office in the home deduction,comment on the following:

(Essay)

4.8/5  (38)

(38)

If a married taxpayer is an active participant in another qualified retirement plan,the traditional IRA deduction phaseout begins at $89,000 of AGI for a joint return in 2010.

(True/False)

4.8/5  (37)

(37)

In which,if any,of the following situations is the automatic mileage available?

(Multiple Choice)

4.9/5  (36)

(36)

Employees who render an adequate accounting to the employer and are fully reimbursed will shift the 50% cutback adjustment to their employer.

(True/False)

4.9/5  (32)

(32)

Joyce,age 39,and Sam,age 40,who have been married for seven years,are both active participants in qualified retirement plans.Their total AGI for 2010 is $120,000.Each is employed and earns a salary of $65,000.What are their combined deductible contributions to traditional IRAs?

(Multiple Choice)

4.9/5  (42)

(42)

A common law employee who chooses the standard deduction will be unable to claim any unreimbursed work-related expenses as a deduction.

(True/False)

4.8/5  (45)

(45)

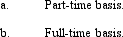

Felicia,a recent college graduate,is employed as an accountant by an oil company.She would like to continue her education and obtain a law degree.Discuss Felicia's tax status if she attends a local law school on a:

(Essay)

4.8/5  (35)

(35)

Ethan,a bachelor with no immediate family,uses the Pine Shadows Country Club exclusively for his business entertaining.None of Ethan's annual dues for his club membership are deductible.

(True/False)

4.9/5  (34)

(34)

How are combined business/pleasure trips treated for travel within the United States as opposed to foreign travel?

(Essay)

4.7/5  (35)

(35)

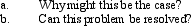

There is reason to believe that many taxpayers who are eligible to claim an office in the home deduction are not doing so.

(Essay)

4.8/5  (41)

(41)

Under the right circumstances,a taxpayer's meals and lodging expense can qualify as a deductible education expense.

(True/False)

4.8/5  (39)

(39)

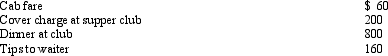

Henry entertains several of his key clients on January 1 of the current year.Expenses paid by Henry are as follows:  Presuming proper substantiation,Henry's deduction is:

Presuming proper substantiation,Henry's deduction is:

(Multiple Choice)

4.9/5  (35)

(35)

In May 2010,after 11 months on a new job,Ken is fired after he assaults a customer.Ken must include in his gross income for 2010 any deduction for moving expenses he may have claimed on his 2009 tax return.

(True/False)

4.7/5  (39)

(39)

Every year,Penguin Corporation gives each employee a fruit basket and a bottle of wine at Christmas.These gifts are not subject to the cutback adjustment.

(True/False)

4.7/5  (38)

(38)

The Federal per diem rates that can be used for "deemed substantiated" purposes are not the same for all locations in the country.

(True/False)

4.8/5  (49)

(49)

A statutory employee is a common law employee and is subject to income tax withholdings.

(True/False)

4.9/5  (41)

(41)

Amanda takes three key clients to a nightclub and incurs the following costs: $220 limousine rental,$360 cover charge,$720 drinks and dinner,and $150 tips.Several days after the function,Amanda mails each client a pen costing $40.The cost includes $4 for engraving of the client's name.Assuming adequate substantiation and a business justification,what is Amanda's deduction?

(Essay)

4.9/5  (37)

(37)

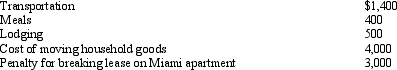

Due to a merger,Allison transfers from Miami to Chicago.Under a new job description,she is reclassified from employee to independent contractor status.Her moving expenses,which are not reimbursed,are as follows:  Allison's deductible moving expense is:

Allison's deductible moving expense is:

(Multiple Choice)

4.8/5  (36)

(36)

Showing 101 - 120 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)