Exam 9: Deductions: Employee and Self-Employed-Related Expenses

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

Christopher just purchased an automobile for $40,000 which he plans to claim 100% as being for business use.In order to take advantage of MACRS and § 179,he plans to use the actual cost method for determining his deduction in the first year.In subsequent years,he will switch to the automatic mileage method.Comment on Christopher's proposed approach.

(Essay)

4.7/5  (49)

(49)

Dan is employed as an auditor by a CPA firm.On most days,he commutes by auto from his home to the office (28 miles round trip).During one month,however,he has an extensive audit assignment closer to home.For this engagement,Dan drives directly from home to the client's premises and back (26 miles round trip).How much,if any,of this mileage can Dan claim as a deduction?

(Essay)

4.9/5  (32)

(32)

Which,if any,of the following expenses are not subject to the 2%-of-AGI floor?

(Multiple Choice)

4.9/5  (35)

(35)

Which,if any,of the following expenses is subject to the 2%-of-AGI floor?

(Multiple Choice)

4.9/5  (39)

(39)

Lloyd,a practicing CPA,pays tuition to attend law school.Since a law degree involves education leading to a new trade or business,the tuition is not deductible.

(True/False)

4.9/5  (37)

(37)

Although a § 401(k)plan avoids taxation on any employer contributions,any income earned on such contributions is taxed yearly.

(True/False)

4.9/5  (40)

(40)

Under the actual expense method,which,if any,of the following expenses will not be allowed?

(Multiple Choice)

4.8/5  (48)

(48)

During 2010,Tracy used her car as follows: 12,000 miles (business),2,500 miles (commuting),and 4,000 miles (personal).In addition,she spent $440 for tolls (business)and $310 for parking (business).If Tracy uses the automatic mileage method,what is the amount of her deduction?

(Essay)

4.9/5  (37)

(37)

Meg teaches the fifth grade at a local school.During 2010,she spends $1,200 for school supplies for use in her classroom.On her income tax return for 2010,some of this expense is not reported and the balance is deducted in two different places.Explain what has probably happened.

(Essay)

4.9/5  (40)

(40)

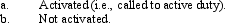

In terms of the deductibility of military uniforms,comment on the difference between a member of the National Guard who is:

(Essay)

4.7/5  (26)

(26)

Marvin lives with his family in Alabama.He has two jobs: one in Alabama and one in North Carolina.Marvin's tax home is where he lives (Alabama).

(True/False)

4.9/5  (40)

(40)

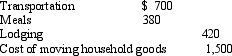

After graduating from college,Dylan obtained employment in Boston.In moving from his parents' home in Wichita to Boston,Dylan incurred the following expenses:

(Essay)

4.7/5  (43)

(43)

In terms of meeting the distance test for purposes of deducting moving expenses,which of the following statements is correct?

(Multiple Choice)

4.8/5  (28)

(28)

Bill is the regional manager for a national chain of auto-parts stores and is based in Salt Lake City.When the company opens new stores in Boise,Bill is given the task of supervising their initial operation.For three months,he works weekdays in Boise and returns home on weekends.He spends $410 returning to Salt Lake City but would have spent $390 had he stayed in Boise for the weekend.As to the weekend trips,how much,if any,qualifies as a deduction?

(Multiple Choice)

5.0/5  (37)

(37)

A participant has a zero basis in the deductible contributions made to a traditional IRA.

(True/False)

4.8/5  (38)

(38)

Crow Corporation pays for a trip to Bermuda for its two top salespersons.This expense is not subject to the cutback adjustment.

(True/False)

4.8/5  (31)

(31)

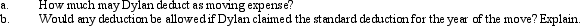

Amy works as an auditor for a large major CPA firm.During the months of September through November of each year,she is permanently assigned to the team auditing Garnet Corporation.As a result,every day she drives from her home to Garnet and returns home after work.Mileage is as follows:  For these three months,Amy's deductible mileage for each workday is:

For these three months,Amy's deductible mileage for each workday is:

(Multiple Choice)

4.9/5  (46)

(46)

The total of traditional deductible,traditional nondeductible,and Roth IRA contributions in 2010 may not exceed $5,000 per year for a taxpayer age 39.

(True/False)

4.8/5  (35)

(35)

Donna,age 27 and unmarried,is an active participant in a qualified retirement plan.Her AGI is $111,000.What amount,if any,may Donna contribute to a Roth IRA in 2010?

(Multiple Choice)

4.8/5  (47)

(47)

A participant who is at least age 59 1/2 can make a tax-free qualified withdrawal from a Roth IRA after a five-year holding period.

(True/False)

4.9/5  (31)

(31)

Showing 121 - 140 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)