Exam 15: Alternative Minimum Tax

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law139 Questions

Exam 2: Working With the Tax Law78 Questions

Exam 3: Computing the Tax130 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions116 Questions

Exam 6: Deductions and Losses: in General144 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses90 Questions

Exam 8: Depreciation,cost Recovery,amortization,and Depletion108 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses150 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions100 Questions

Exam 11: Investor Losses94 Questions

Exam 12: Tax Credits and Payments104 Questions

Exam 13: Part 1--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges199 Questions

Exam 13: Part 2--Property Transactions: Determination of Gain or Loss,basis Considerations,and Nontaxable Exchanges82 Questions

Exam 14: Property Transactions: Capital Gains and Losses,1231,and Recapure Provisions144 Questions

Exam 15: Alternative Minimum Tax119 Questions

Exam 16: Accounting Periods and Methods86 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure93 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation136 Questions

Exam 20: Distributions in Complete Liquidation and an Overview of Reorganizations66 Questions

Exam 21: Partnerships157 Questions

Exam 22: S Corporations144 Questions

Exam 23: Exempt Entities132 Questions

Exam 24: Multistate Corporate Taxation119 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics135 Questions

Exam 27: The Federal Gift and Estate Taxes144 Questions

Exam 28: Income Taxation of Trusts and Estates132 Questions

Select questions type

Prior to the effect of tax credits,Brent's regular income tax liability is $145,000 and his tentative AMT is $120,000.Brent has nonrefundable business tax credits of $32,000.Brent's tax liability is $113,000.

(True/False)

4.9/5  (32)

(32)

Identify an AMT adjustment that applies for the individual taxpayer that does not apply for the corporate taxpayer and identify an AMT adjustment that applies for the corporate taxpayer that does not apply for the individual taxpayer.

(Essay)

4.8/5  (38)

(38)

In 2010 and under § 1202,Jordan excludes from gross income 75% of the realized gain of $80,000 on the sale of qualifying small business stock.As a result of this exclusion,Jordan will have an AMT preference in calculating AMTI of $40,000.

(True/False)

4.8/5  (31)

(31)

Assuming no phaseout,the AMT exemption amount for married taxpayers filing jointly for 2010 is the same as the AMT exemption amount for C corporations.

(True/False)

4.8/5  (32)

(32)

Danica owned a car that she used exclusively for business.The car was purchased in 2008 and sold in 2010 for a recognized gain of $5,000.However,the sale resulted in no AMT.Why?

(Essay)

4.8/5  (37)

(37)

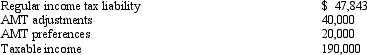

Meg,who is single and age 36,provides you with the following information from her financial records.  Calculate her AMT exemption for 2010.

Calculate her AMT exemption for 2010.

(Multiple Choice)

4.9/5  (42)

(42)

How can the positive AMT adjustment for research and experimental expenditures be avoided?

(Essay)

4.9/5  (39)

(39)

Frances,who had AGI of $100,000,itemized her deductions in the current year.She incurred unreimbursed employee business expenses of $6,200.Frances must make a positive AMT adjustment of $2,000 in computing AMT.

(True/False)

4.7/5  (37)

(37)

Negative AMT adjustments for the current year caused by timing differences are offset by the positive AMT adjustments for prior tax years also caused by timing differences.

(True/False)

4.8/5  (36)

(36)

Kay had percentage depletion of $82,000 for the current year for regular income tax purposes.Cost depletion was $55,000.Her basis in the property was $70,000 at the beginning of the current year.Kay must treat the percentage depletion deducted in excess of cost depletion,or $27,000,as a tax preference in computing AMTI.

(True/False)

4.9/5  (30)

(30)

Mauve,Inc. ,has the following for 2009,2010,and 2011 and no prior ACE adjustments.

(Multiple Choice)

4.9/5  (33)

(33)

Kay,who is single,had taxable income of $0 in 2010.She has positive timing adjustments of $200,000 and exclusion items of $100,000 for the year.What is the amount of her alternative minimum tax credit for carryover to 2011?

(Multiple Choice)

4.7/5  (39)

(39)

If the regular income tax deduction for medical expenses is $0,under certain circumstances the AMT deduction for medical expenses can be greater than $0.

(True/False)

4.8/5  (24)

(24)

Altrice incurs circulation expenditures of $90,000 in 2010.No additional circulation expenditures are incurred in 2011 or 2012.The cumulative adjustment for circulation expenditures for 2010,2011,and 2012 is $0.

(True/False)

4.9/5  (41)

(41)

The deduction for charitable contributions in calculating the regular income tax can differ from that in calculating the AMT because the percentage limitations (20%,30%,and 50%)may be applied to a different base amount.

(True/False)

4.8/5  (35)

(35)

Corporations are subject to a positive AMT adjustment equal to 75% of the excess of ACE over AMTI before the ACE adjustment.

(True/False)

4.8/5  (30)

(30)

Showing 61 - 80 of 119

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)