Exam 5: Consolidated Financial Statementsintra-Entity Asset Transactions

Exam 1: The Equity Method of Accounting for Investments119 Questions

Exam 2: Consolidation of Financial Information118 Questions

Exam 3: Consolidationssubsequent to the Date of Acquisition122 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership115 Questions

Exam 5: Consolidated Financial Statementsintra-Entity Asset Transactions127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues115 Questions

Exam 7: Foreign Currency Transactions and Hedging Foreign Exchange Risk93 Questions

Exam 8: Translation of Foreign Currency Financial Statements97 Questions

Exam 9: Partnerships: Formation and Operation88 Questions

Exam 10: Partnerships: Termination and Liquidation69 Questions

Exam 11: Accounting for State and Local Governments Part 178 Questions

Exam 12: Accounting for State and Local Governments Part 251 Questions

Select questions type

Wilson owned equipment with an estimated life of 10 years when it was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2010. On January 1, 2010, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.

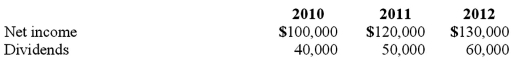

On April 1, 2010 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends:

Compute Wilson's share of income from Simon for consolidation for 2010.

(Multiple Choice)

4.7/5  (38)

(38)

Several years ago Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transaction.

The following selected account balances were from the individual financial records of these two companies as of December 31, 2011:

Assume that Icecap sold inventory to Polar at a markup equal to 25% of cost. Intra-entity transfers were $70,000 in 2010 and $112,000 in 2011. Of this inventory, $29,000 of the 2010 transfers were retained and then sold by Polar in 2011, whereas $49,000 of the 2011 transfers were held until 2012.

Required:

For the consolidated financial statements for 2011, determine the balances that would appear for the following accounts: (1) Cost of Goods Sold, (2) Inventory, and (3) Non-controlling Interest in Subsidiary's Net Income.

(Essay)

4.8/5  (35)

(35)

Pot Co. holds 90% of the common stock of Skillet Co. During 2011, Pot reported sales of $1,120,000 and cost of goods sold of $840,000. For this same period, Skillet had sales of $420,000 and cost of goods sold of $252,000.

Include in the amounts for Pot's sales were Pot's sales of merchandise to Skillet for $140,000. There were no sales from Skillet to Pot. Intra-entity sales had the same markup as sales to outsiders. Skillet had resold all of the intra-entity purchase from Pot to outside parties during 2011. What are consolidated sales and cost of goods sold for 2011?

(Multiple Choice)

4.8/5  (38)

(38)

Bauerly Co. owned 70% of the voting common stock of Devin Co. During 2010, Devin made frequent sales of inventory to Bauerly. There were unrealized gains of $40,000 in the beginning inventory and $25,000 of unrealized gains at the end of the year. Devin reported net income of $137,000 for 2010. Bauerly decided to use the equity method to account for the investment. What is the non-controlling interest's share of Devin's net income for 2010?

(Multiple Choice)

4.8/5  (44)

(44)

Walsh Company sells inventory to its subsidiary, Fisher Company, at a profit during 2010. One-third of the inventory is sold by Walsh uses the equity method to account for its investment in Fisher.

In the consolidation worksheet for 2010, which of the following choices would be a debit entry to eliminate unrealized intra-entity gross profit with regard to the 2010 intra-entity sales?

(Multiple Choice)

4.8/5  (41)

(41)

Walsh Company sells inventory to its subsidiary, Fisher Company, at a profit during 2010. One-third of the inventory is sold by Walsh uses the equity method to account for its investment in Fisher.

In the consolidation worksheet for 2011, which of the following choices would be a debit entry to eliminate unrealized intra-entity gross profit with regard to the 2010 intra-entity sales?

(Multiple Choice)

4.9/5  (43)

(43)

Pepe, Incorporated acquired 60% of Devin Company on January 1, 2010. On that date Devin sold equipment to Pepe for $45,000. The equipment had a cost of $120,000 and accumulated depreciation of $66,000 with a remaining life of 9 years. Devin reported net income of $300,000 and $325,000 for 2010 and 2011, respectively. Pepe uses the equity method to account for its investment in Devin.

Compute the non-controlling interest in the net income of Devin for 2011.

(Multiple Choice)

4.8/5  (38)

(38)

Showing 121 - 127 of 127

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)