Exam 14: Property Transactions: Capital Gains and Losses, Section 1231, and Recapture Provisions

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law211 Questions

Exam 2: Working with the Tax Law102 Questions

Exam 3: Computing the Tax180 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: In General156 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses94 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion120 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses153 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions104 Questions

Exam 11: Investor Losses130 Questions

Exam 12: Tax Credits and Payments111 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges285 Questions

Exam 14: Property Transactions: Capital Gains and Losses, Section 1231, and Recapture Provisions167 Questions

Exam 15: Taxing Business Income60 Questions

Exam 16: Accounting Periods and Methods88 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure109 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation185 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations71 Questions

Exam 21: Partnerships248 Questions

Exam 22: S Corporations129 Questions

Exam 23: Exempt Entities153 Questions

Exam 24: Multistate Corporate Taxation204 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics184 Questions

Exam 27: The Federal Gift and Estate Taxes141 Questions

Exam 28: Income Taxation of Trusts and Estates161 Questions

Select questions type

For § 1245 recapture to apply, accelerated depreciation must have been taken on the property.

(True/False)

4.8/5  (36)

(36)

Jambo invented a new flexible cover for a popular brand of cellphone, but did not have the finances to begin production of the cover. Instead, he sold all his rights to the invention (after patenting it) for $450,000 plus $.10 for each cover sold by the company that purchased the patent. Jambo had a zero tax basis for the invention. What is the character of his gain from disposition of the patent?

(Essay)

4.9/5  (40)

(40)

Mike is a self-employed TV technician. He is usually paid as soon as he completes repairs, but occasionally bills a customer with payment expected within 30 days. At the end of the year he has $2,500 of receivables outstanding. He expects to collect $1,200 of this and write off the remainder. Mike is a cash basis taxpayer and had net earnings from his business (not including the effect of the items above) of $55,000. He also had $3,500 interest income, $200 gambling winnings, and sold corporate stock for $7,000. The stock had been purchased in 2014 for $8,200. Mike is single and claims the standard deduction. What is his 2018 taxable income? (Ignore the self-employment tax deduction.)

(Essay)

4.8/5  (40)

(40)

In order to be long-term, the holding period must include at least parts of two tax years.

(True/False)

4.8/5  (28)

(28)

On June 1, 2018, Brady purchased an option to buy 1,000 shares of General, Inc. at $40 per share. He purchased the option for $3,000. It was to remain in effect for five months. The market experienced a decline during the latter part of the year, so Brady decided to let the option lapse as of December 1, 2018. On his 2018 tax return, what should Brady report?

(Multiple Choice)

4.7/5  (43)

(43)

Emilio owns vacant land he is holding for investment. Two years ago he granted an option to purchase the land. The option grantee paid $25,000 for the option. This year the option expired unexercised. As a result, Emilio has:

(Multiple Choice)

4.8/5  (35)

(35)

Copper Corporation sold machinery for $47,000 on December 31, 2018. The machinery had been purchased on January 2, 2015, for $60,000 and had an adjusted basis of $41,000 at the date of the sale. For 2018, what should Copper Corporation report?

(Multiple Choice)

4.8/5  (43)

(43)

Ranja acquires $200,000 face value corporate bonds for $186,000 when the bonds are issued. He holds the bonds as an investment for two years and then sells them for $198,000. He amortizes $2,000 of the OID. What tax issues does Ranja have with respect to these bonds?

(Essay)

4.8/5  (33)

(33)

Recognized gains and losses from disposition of a capital asset may occur as a result of a:

(Multiple Choice)

4.8/5  (40)

(40)

Section 1231 property includes nonpersonal use property where casualty gains exceed casualty losses for the taxable year.

(True/False)

4.8/5  (39)

(39)

A sheep must be held more than 18 months to qualify as a § 1231 asset.

(True/False)

4.8/5  (42)

(42)

The only things that the grantee of an option may do with the option are exercise it or let it expire.

(True/False)

4.8/5  (36)

(36)

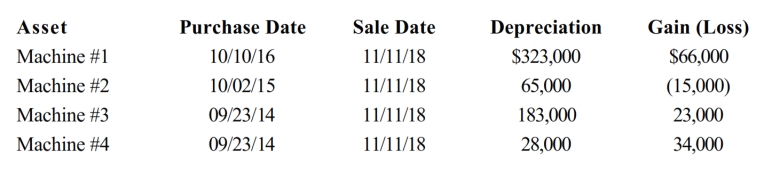

A business taxpayer sold all the depreciable assets of the business, calculated the gains and losses, and would like to know the final character of those gains and losses. The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets. The taxpayer had unrecaptured § 1231 lookback loss of $22,000. What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self- employment tax deduction.)

(Essay)

4.8/5  (27)

(27)

Annabelle is a "trader" in securities. She works for a national securities firm. She occasionally buys and sells securities for her personal account. On May 10, 2017, she purchased 100 shares of Acorn, Inc. common stock for a total of $40,000. She sold all of those shares for a total of $46,000 on July 11, 2018. What was the amount and nature of her gain or loss from this transaction? What could she have done to change this result?

(Essay)

4.8/5  (36)

(36)

Section 1231 property generally includes certain purchased intangible assets (such as patents and goodwill) that are eligible for amortization and held for more than one year.

(True/False)

4.8/5  (40)

(40)

A worthless security had a holding period of 6 months when it became worthless on December 10, 2018. The investor who had owned the security had a basis of $20,000 for it. Which of the following statements is correct?

(Multiple Choice)

4.8/5  (34)

(34)

Williams owned an office building (but not the land) that was destroyed by a fire. The building was insured and Williams has a $156,000 gain because his insurance recovery exceeded his adjusted basis for the building. Williams may replace the building. Williams had taken $145,000 of depreciation on the building, has no § 1231 lookback loss, has no other § 1231 transactions for the year, and has no Schedule D transactions for the year. What is the final nature of Jamison's gain for the year and what tax rate(s) apply to the gain if:

(a) He does reinvest the insurance proceeds?

(b) If he doesn't reinvest the insurance proceeds?

(Essay)

4.9/5  (43)

(43)

The tax law requires that capital gains and losses be separated from other types of gains and losses because there are limitations on the deduction of net capital losses.

(True/False)

4.8/5  (41)

(41)

A security that was purchased by an individual and qualifies as § 1244 stock becomes worthless. The taxpayer is single and the loss is $30,000. The loss is treated as an ordinary loss.

(True/False)

4.9/5  (31)

(31)

Which of the following real property could be subject to § 1250 depreciation recapture?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 81 - 100 of 167

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)