Exam 14: Property Transactions: Capital Gains and Losses, Section 1231, and Recapture Provisions

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law211 Questions

Exam 2: Working with the Tax Law102 Questions

Exam 3: Computing the Tax180 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: In General156 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses94 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion120 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses153 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions104 Questions

Exam 11: Investor Losses130 Questions

Exam 12: Tax Credits and Payments111 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges285 Questions

Exam 14: Property Transactions: Capital Gains and Losses, Section 1231, and Recapture Provisions167 Questions

Exam 15: Taxing Business Income60 Questions

Exam 16: Accounting Periods and Methods88 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure109 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation185 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations71 Questions

Exam 21: Partnerships248 Questions

Exam 22: S Corporations129 Questions

Exam 23: Exempt Entities153 Questions

Exam 24: Multistate Corporate Taxation204 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics184 Questions

Exam 27: The Federal Gift and Estate Taxes141 Questions

Exam 28: Income Taxation of Trusts and Estates161 Questions

Select questions type

"Collectibles" held long-term and sold at a gain are subject to maximum tax rate of 28%. An individual taxpayer recently sold an antique car for $40,000. The car had been held for several years and $30,000 was originally paid for it. Explain why the car is or is not a collectible.

(Essay)

4.9/5  (39)

(39)

Short-term capital losses are netted against long-term capital gains and long-term capital losses are netted against short-term capital gains.

(True/False)

4.8/5  (37)

(37)

In early 2017, Wanda paid $33,000 for an option on a parcel of land she intended to hold as an investment. After a survey of the land (paid for by the grantor) determined that the parcel was much smaller than the grantor said it was, she let the option lapse when it expired in 2018 after 14 months. How should Wanda treat these events in 2017?2018?

(Essay)

4.7/5  (39)

(39)

An individual taxpayer received a valuable painting from his uncle, a famous painter. The painter created the painting. After the taxpayer held the painting for two years, he sold it for a $400,000 gain. The gain is a long-term capital gain.

(True/False)

4.8/5  (29)

(29)

Cason is filing as single and has 2018 taxable income of $36,000 which includes $34,000 of 0%/15%/20% net long- term capital gain. What is his tax on taxable income using the alternative tax method? Note: Use the tax rate schedule rather than the tax table.

(Multiple Choice)

5.0/5  (38)

(38)

Section 1231 gain that is treated as long-term capital gain carries from the 2017 Form 4797 to the 2017 Form 1040, Schedule D, line .

(Multiple Choice)

4.9/5  (42)

(42)

All collectibles short-term gain is subject to a potential alternative tax rate of 28%.

(True/False)

4.8/5  (30)

(30)

Phil's father died on January 10, 2018. The father had owned stock for 20 years with a basis of $45,000 that was transferred to Phil as a gift on August 10, 2017, when the stock was worth $430,000. His father paid no gift taxes. This stock was worth $566,000 at the date of the father's death. Phil sold the stock for $545,000 net of commissions on February 23, 2018. What is the amount and nature of Phil's gain or loss from disposition of this property?

(Essay)

4.8/5  (36)

(36)

Lana purchased for $1,410 a $2,000 bond when it was issued two years ago. Lana amortized $200 of the original issue discount and then sold the bond for $1,800. Which of the following statements is correct?

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following assets held by a cash basis accounting firm is a § 1231 asset?

(Multiple Choice)

4.8/5  (39)

(39)

In 2014, Aaron purchased a classic car that he planned to restore for $12,000. However, Aaron is too busy to work on the car and he gives it to his daughter Ellie in 2018. At this time, the fair market value of the car has declined to $10,000. Aaron paid no gift tax on the transaction. Ellie completes some of the restoration herself with out-of-pocket costs of $5,000. She later sells the car for $30,000. What is Ellie's recognized gain or loss on the sale of the car?

(Essay)

4.8/5  (39)

(39)

Section 1231 applies to the sale or exchange of business properties, but not to personal use activity casualties.

(True/False)

4.9/5  (50)

(50)

Describe the circumstances in which the maximum unrecaptured § 1250 gain (25% gain) does not become part of the Schedule D netting process for an individual taxpayer?

(Essay)

4.9/5  (32)

(32)

Lease cancellation payments received by a lessor are always ordinary income because they are considered to be in lieu of rental payments.

(True/False)

4.9/5  (39)

(39)

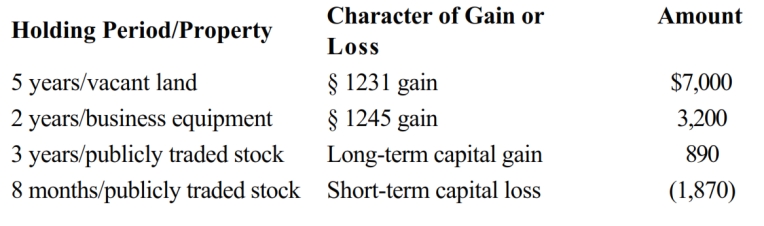

An individual taxpayer has the gains and losses shown below. There are $3,000 of § 1231 lookback losses. What is the net long-term capital gain?

(Essay)

4.8/5  (31)

(31)

Stanley operates a restaurant as a sole proprietorship. Which of the following items are capital assets in the hands of Stanley?

(Multiple Choice)

4.9/5  (36)

(36)

Describe the circumstances in which the potential § 1245 depreciation recapture is extinguished.

(Essay)

4.9/5  (39)

(39)

A personal use property casualty loss that occurs in a non federally declared disaster area is deductible only to the extent it exceeds 10% of AGI.

(True/False)

4.8/5  (39)

(39)

Showing 101 - 120 of 167

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)