Exam 14: Property Transactions: Capital Gains and Losses, Section 1231, and Recapture Provisions

Exam 1: An Introduction to Taxation and Understanding the Federal Tax Law211 Questions

Exam 2: Working with the Tax Law102 Questions

Exam 3: Computing the Tax180 Questions

Exam 4: Gross Income: Concepts and Inclusions125 Questions

Exam 5: Gross Income: Exclusions113 Questions

Exam 6: Deductions and Losses: In General156 Questions

Exam 7: Deductions and Losses: Certain Business Expenses and Losses94 Questions

Exam 8: Depreciation, Cost Recovery, Amortization, and Depletion120 Questions

Exam 9: Deductions: Employee and Self-Employed-Related Expenses153 Questions

Exam 10: Deductions and Losses: Certain Itemized Deductions104 Questions

Exam 11: Investor Losses130 Questions

Exam 12: Tax Credits and Payments111 Questions

Exam 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges285 Questions

Exam 14: Property Transactions: Capital Gains and Losses, Section 1231, and Recapture Provisions167 Questions

Exam 15: Taxing Business Income60 Questions

Exam 16: Accounting Periods and Methods88 Questions

Exam 17: Corporations: Introduction and Operating Rules108 Questions

Exam 18: Corporations: Organization and Capital Structure109 Questions

Exam 19: Corporations: Distributions Not in Complete Liquidation185 Questions

Exam 20: Corporations: Distributions in Complete Liquidation and an Overview of Reorganizations71 Questions

Exam 21: Partnerships248 Questions

Exam 22: S Corporations129 Questions

Exam 23: Exempt Entities153 Questions

Exam 24: Multistate Corporate Taxation204 Questions

Exam 25: Taxation of International Transactions146 Questions

Exam 26: Tax Practice and Ethics184 Questions

Exam 27: The Federal Gift and Estate Taxes141 Questions

Exam 28: Income Taxation of Trusts and Estates161 Questions

Select questions type

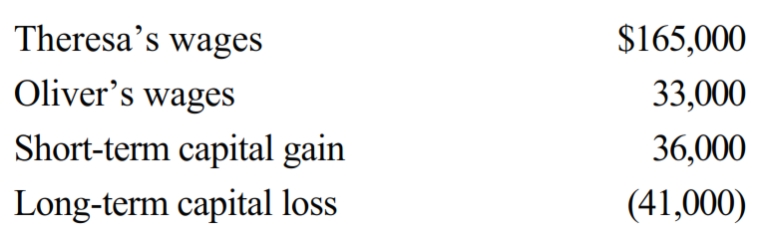

Theresa and Oliver, married filing jointly, and both over 65 years of age, have no dependents. Their 2018 income tax facts are:

What is their taxable income for 2018?

What is their taxable income for 2018?

(Essay)

4.9/5  (41)

(41)

Janet received stock worth $4,000 at the time it was gifted to her by her father. The father had acquired the stock several years earlier for $2,200. The father paid no gift tax on the transfer to Janet. Janet sells the stock for $6,600 two months after receiving it. What is the nature and amount of Janet's gain or loss?

(Essay)

4.8/5  (37)

(37)

When a patent is transferred, the most common forms of payment received by the transferor are a lump sum and/or periodic payment.

(True/False)

4.8/5  (37)

(37)

A corporation has a $50,000 short-term capital loss for the year. The corporation has $1,200,000 of taxable income from other sources. The taxable income for the year is $1,200,000.

(True/False)

4.9/5  (48)

(48)

Ryan has the following capital gains and losses for 2018: $6,000 STCL, $5,000 28% gain, $2,000 25% gain, and $6,000 0%/15%/20% gain. Which of the following is correct:

(Multiple Choice)

4.8/5  (34)

(34)

Violet, Inc., has a 2018 $80,000 long-term capital gain included in its $285,000 taxable income. Which of the following is correct?

(Multiple Choice)

4.9/5  (29)

(29)

To compute the holding period, start counting on the day after the property was acquired and include the day of disposition.

(True/False)

5.0/5  (30)

(30)

Which of the following would be included in the netting of § 1231 gains and losses?

(Multiple Choice)

4.8/5  (36)

(36)

On January 18, 2017, Martha purchased 200 shares of Blue Corporation stock for $2,000. On November 11, 2018, she sold short 200 shares of Blue Corporation stock which she borrowed from her broker for $2,300. On February 10, 2019, Martha closed the short sale by delivering the 200 shares of Blue Corporation stock which she had acquired in 2017. On that date, Blue Corporation stock had a market price of $4 per share. What is Martha's recognized gain or loss and its character in 2018? In 2019?

(Essay)

4.9/5  (45)

(45)

The § 1245 depreciation recapture potential does not reduce the amount of the charitable contribution deduction under § 170.

(True/False)

4.9/5  (33)

(33)

Nonrecaptured § 1231 losses from the six prior tax years may cause current year net § 1231 gain to be treated as ordinary income.

(True/False)

4.9/5  (24)

(24)

Individuals who are not professional real estate developers may get capital gain treatment for sale of their real property if they engage only in limited development activities.

(True/False)

4.7/5  (31)

(31)

Section 1231 property generally does not include accounts receivables arising in the ordinary course of business.

(True/False)

4.9/5  (29)

(29)

In 2018, Satesh has $5,000 short-term capital loss, $13,000 0%/15%/20% long-term capital gain, and $7,000 qualified dividend income. Satesh is single and has other taxable income of $15,000. Which of the following statements is correct?

(Multiple Choice)

4.8/5  (45)

(45)

Robin Corporation has ordinary income from operations of $30,000, net long-term capital gain of $10,000, and net short-term capital loss of $15,000. What is the taxable income for 2018?

(Multiple Choice)

4.8/5  (30)

(30)

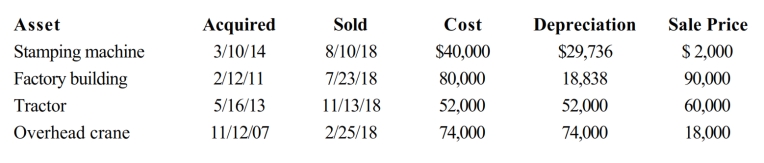

The chart below describes the § 1231 assets sold by the Tan Company (a sole proprietorship) this year. Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year. Assume there is a § 1231 lookback loss of $14,000.

(Essay)

4.8/5  (30)

(30)

Willie is the owner of vacant land that he purchased in 2014 for $1,400,000 and held for investment. On January 22, 2017, he was paid $145,000 for a thirteen-month option on the land by Susan. Susan could buy the land for an additional $1,200,000 by exercising the option. Susan had hoped to build a luxury home on the land, but was unable to get approval to build a big enough home to satisfy her needs. Consequently, Susan did not exercise her option and the option expired on February 22, 2018. (1) What is Willie's basis, gain or loss, and type of gain or loss from these events? (2) What is Susan's basis, gain or loss, and type of gain or loss from these events?

(Essay)

4.8/5  (41)

(41)

In 2017, Jenny had a $12,000 net short-term capital loss and deducted $3,000 as a capital loss deduction. In 2018, Jenny has a $18,000 0%/15%/20% long-term capital gain and no other capital gain or loss transactions. Which of the statements below is correct for 2018?

(Multiple Choice)

4.7/5  (41)

(41)

An individual taxpayer has a $2,500 short-term capital loss for the year. The taxpayer could sell stock and generate a $2,500 long-term capital gain. The taxpayer has significant taxable income from other sources. Explain the impact on the taxpayer's taxable income if he did or did not sell the stock.

(Essay)

4.8/5  (35)

(35)

Section 1239 (relating to the sale of certain property between related taxpayers) does not apply unless the property:

(Multiple Choice)

4.8/5  (32)

(32)

Showing 141 - 160 of 167

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)