Exam 9: Current Liabilities and Contingencies

Exam 1: The Demand for and Supply of Financial Accounting Information89 Questions

Exam 2: Financial Reporting: Its Conceptual Framework87 Questions

Exam 3: Review of a Companys Accounting System146 Questions

Exam 5: The Income Statement and the Statement of Cash Flows151 Questions

Exam 6: Cash and Receivables149 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions123 Questions

Exam 8: Inventories: Special Valuation Issues148 Questions

Exam 9: Current Liabilities and Contingencies128 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments105 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal143 Questions

Exam 12: Intangibles105 Questions

Exam 13: Investments and Long-Term Receivables140 Questions

Exam 14: Financing Liabilities: Bonds and Notes Payable171 Questions

Exam 15: Contributed Capital154 Questions

Exam 17: Advanced Issues in Revenue Recognition113 Questions

Exam 18: Accounting for Income Taxes108 Questions

Exam 19: Accounting for Postretirement Benefits98 Questions

Exam 20: Accounting for Leases149 Questions

Exam 21: The Statement of Cash Flows107 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Time Value of Money Module121 Questions

Select questions type

King Sales sells a certain product for $20,000. Included in this price is an implied service contract of $600. Fifty machines were sold in 2014. Warranty expense incurred during 2014 amounted to $35,000. The company uses the sales warranty accrual method. Which entry would probably not be made in 2014?

(Multiple Choice)

4.8/5  (39)

(39)

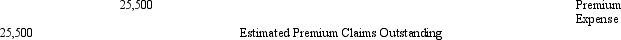

Excellence, Inc., places a coupon in each box of its product. Customers may send in ten coupons and $2.50, and the company will send them a CD. Sufficient CDs were purchased at $6 apiece. A certain number of boxes of product were sold in 2014. It was estimated that a total of 5% of the coupons will be redeemed. In 2014, 18,000 coupons were redeemed. Mailing costs were $0.75 per CD. At December 31, 2014, the following adjusting entry was made to record the estimated liability for premium outstanding:  Required:

Compute the number of boxes of product sold by Excellence in 2014.

Required:

Compute the number of boxes of product sold by Excellence in 2014.

(Essay)

4.8/5  (42)

(42)

On December 1, 2013, Sons, Inc. borrowed money at the bank by signing a 90-day non-interest-bearing note for $40,000 that was discounted at 12%. Which of the following entries is not correct?

(Multiple Choice)

4.8/5  (32)

(32)

The following information is given for Airflight Airlines:

Airflight had $10,000 of notes coming due on January 30, 2014. On January 4, 2014, the company used $3,000 of excess cash to pay off part of the note. On January 29, 2014, a refinancing of the entire $10,000 was completed. The $3,000 was replaced and the rest of the notes were extended for another two years.

Airflight has negotiated a long-term refinancing contract permitting refinancing of up to 60% of accounts receivable balances. Accounts receivable were expected to range between $12,000 and $16,000 the following year.

Airflight also has negotiated a new long-term refinancing contract permitting refinancing up to 35% of inventory, which is expected to range between $75,000 and $85,000 next year.

Required:

a.On the December 31, 2013 balance sheet, how much of the $10,000 note should be shown as short-term?

b.Airflight has a currently maturing note of $20,000 related to the accounts receivable refinancing contract. How much can be classified as long-term debt at the end of 2013?

c.Compute the amount of the company's currently maturing note payable of $50,000 related to refinancing inventory that must be classified as short-term debt on December 31, 2013.

(Essay)

4.9/5  (26)

(26)

Sick pay benefits that are related to an employee's services already rendered, whose payment is probable and the amount reasonably estimated, must be accrued and recognized as a current liability if the obligation relates to rights that

I. No No II. Yes No III No Yes IV Yes Yes

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following loss contingencies is not usually accrued?

(Multiple Choice)

4.8/5  (27)

(27)

The uncertainty associated with a loss contingency can vary widely. GAAP requires companies to categorize the likelihood of occurrences of the loss into three categories. What are these three categories and list three common loss contingencies?

(Essay)

4.9/5  (44)

(44)

Showing 121 - 128 of 128

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)