Exam 14: Financing Liabilities: Bonds and Notes Payable

Exam 1: The Demand for and Supply of Financial Accounting Information89 Questions

Exam 2: Financial Reporting: Its Conceptual Framework87 Questions

Exam 3: Review of a Companys Accounting System146 Questions

Exam 5: The Income Statement and the Statement of Cash Flows151 Questions

Exam 6: Cash and Receivables149 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions123 Questions

Exam 8: Inventories: Special Valuation Issues148 Questions

Exam 9: Current Liabilities and Contingencies128 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments105 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal143 Questions

Exam 12: Intangibles105 Questions

Exam 13: Investments and Long-Term Receivables140 Questions

Exam 14: Financing Liabilities: Bonds and Notes Payable171 Questions

Exam 15: Contributed Capital154 Questions

Exam 17: Advanced Issues in Revenue Recognition113 Questions

Exam 18: Accounting for Income Taxes108 Questions

Exam 19: Accounting for Postretirement Benefits98 Questions

Exam 20: Accounting for Leases149 Questions

Exam 21: The Statement of Cash Flows107 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Time Value of Money Module121 Questions

Select questions type

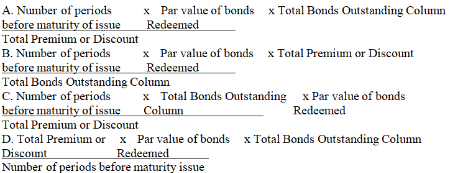

If a company redeems bonds from any individual series prior to their maturity date, it eliminates the amount of un-amortized discount or premium for these bonds. When the Bonds outstanding method is used, this amount can be determined from the amortization table by applying the which formula?

(Essay)

4.7/5  (33)

(33)

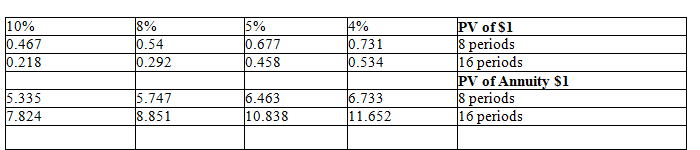

Briggs Industries, Inc. issued $900,000 of 8% debentures on July 1, 2013. The bonds pay interest semiannually on January 1 and July 1. The maturity date on these bonds is July 1, 2021. The bonds were sold to yield an effective-interest rate of 10%. Briggs incurred issuance costs of $15,000.  Requirements

1) Calculate the selling price of the bonds.

2) Prepare the journal entry for the issuance of the bonds and the issuance costs.

Requirements

1) Calculate the selling price of the bonds.

2) Prepare the journal entry for the issuance of the bonds and the issuance costs.

(Essay)

4.9/5  (36)

(36)

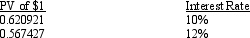

On January 1, 2014, the Porter Corporation issued a five-year, non-interest-bearing, $44,000 note to Longshore Corporation in exchange for used equipment. Neither the fair market value of the equipment nor that of the note is determinable. The incremental borrowing rate of Porter is 12% and the incremental borrowing rate of Longshore is 10%. Present value factors for n = 5 years are  Required:

a.Prepare the journal entry to record the issuance of the note by Porter on January 1, 2014.

b.Prepare the journal entry to record the interest expense on December 31, 2014.

c.Prepare the journal entry to record the interest expense on December 31, 2015.

Required:

a.Prepare the journal entry to record the issuance of the note by Porter on January 1, 2014.

b.Prepare the journal entry to record the interest expense on December 31, 2014.

c.Prepare the journal entry to record the interest expense on December 31, 2015.

(Essay)

4.7/5  (39)

(39)

The bond interest expense reflected on the income statement should reflect an amount based on the

(Multiple Choice)

4.8/5  (37)

(37)

On December 31, 2013, Manny Ltd. owes Stew Corp. $50,000 on a 10% note payable. Two years of interest is also unpaid and due. Manny cannot pay off the debt. Stew agrees to reduce the principal amount to $30,000, forgive the accrued interest owed, extend the due date to December 31, 2016, and reduce the interest rate to 5% per year for the extended period. What amount of gain on restructuring should Manny record?

(Multiple Choice)

4.9/5  (44)

(44)

On April 1, 2013, Bond Corporation issued 8% debentures dated January 1, 2013. The debentures had a face value of $3,000,000 and interest was payable on January 1 and July 1. The debentures were sold at par plus accrued interest. To record this event on April 1, 2013, Everly should debit cash for

(Multiple Choice)

4.9/5  (41)

(41)

Exhibit 14-2 Joseph issued 9%, ten-year bonds dated January 1, 2014, with a face value of $100,000 at 102 plus accrued interest on March 1, 2014. Joseph amortizes premiums and discounts using the straight-line method. Expenses connected with the issue totaled $5,000 and were deducted in arriving at the net proceeds.

-Refer to Exhibit 14-2. The entry to record the issue would include a debit to Cash for

(Multiple Choice)

4.8/5  (34)

(34)

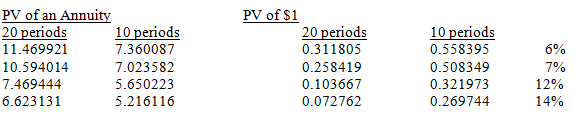

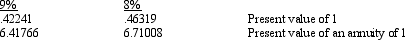

On May 1, 2014, a $300,000, ten-year, 14% bond was sold to yield 12% plus accrued interest. The bond was dated January 1, 2014, and interest is paid each January 1 and July 1. Present value data follow:  Required:

a.Compute the amount of cash received from the sale of the bond.

b.Prepare the journal entry to record the sale.

c.When preparing the journal entry, you recorded a premium or discount. Discuss why.

Required:

a.Compute the amount of cash received from the sale of the bond.

b.Prepare the journal entry to record the sale.

c.When preparing the journal entry, you recorded a premium or discount. Discuss why.

(Essay)

4.8/5  (40)

(40)

In a troubled debt restructuring that involves only a modification of terms, if the amount to be repaid is greater than the current carrying value of the liability

(Multiple Choice)

4.7/5  (40)

(40)

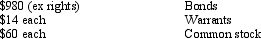

Exhibit 14-8 Yoho Corp. issued $500,000 of its ten-year 6% bonds at 104. Each $1,000 bond carries ten warrants. Each warrant allows the holder to purchase one share of $10 par common stock for $50. Following the sale, relevant market values were:  -Refer to Exhibit 14-8. The entry to record the sale of the bonds would include a

-Refer to Exhibit 14-8. The entry to record the sale of the bonds would include a

(Multiple Choice)

4.9/5  (31)

(31)

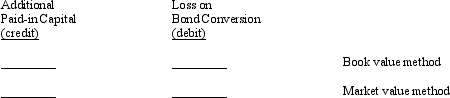

On January 1, 2014, Darth Corp. issued 50,000 of five-year, $1,000 bonds payable at 104. These bonds were each convertible into 100 shares of $10 par common stock. On January 1, 2017, Darth converted all of these bonds when the stock was selling at $11.50 a share.

Required:

Complete the matrix below to indicate the amounts that would be recorded for the indicated accounts in the journal entry to record the bond conversion. Then record the journal entry for the bond conversion.

(Essay)

4.9/5  (33)

(33)

Exhibit 14-9 Marley, Inc. sold $500,000 of its ten-year 8% bonds at 96 on January 1, 2014. Interest is paid each January 1 and July 1 and straight-line amortization is used. Each $1,000 bond is convertible into 100 shares of $10 par common stock. One-half of the bonds were converted on January 1, 2019, when the market value of the stock was $14 per share.

-Refer to Exhibit 14-9. The entry to record the conversion using the market value method would include a

(Multiple Choice)

4.8/5  (38)

(38)

Exhibit 14-1 A $300,000, ten-year, 8% bond issue was sold to yield 9% interest payable annually. Actuarial information for 10 periods is as follows:  -Refer to Exhibit 14-1. These bonds sold at

-Refer to Exhibit 14-1. These bonds sold at

(Multiple Choice)

4.7/5  (35)

(35)

Exhibit 14-11 Harry's Inc. issued a four-year, $75,000, non-interest-bearing note to a customer on January 1, 2013. Harry also agrees to sell inventory to the customer at reduced rates over a five-year period. Sales are to be evenly spread over the five-year period. Harry's incremental interest rate is 8%, and the present value of the note is $55,125.

-Refer to Exhibit 14-11. Harry's sales revenue connected with the note in 2013 is

(Multiple Choice)

4.8/5  (34)

(34)

GAAP considers debt extinguished if one of the following occurs:

* the creditor has been paid in full and has released the company from any further obligations.

* the debtor is legally released from being the primary responsible party to the debt.

(True/False)

4.9/5  (34)

(34)

Two methods of amortization of a discount or premium are used by businesses. These two methods are the effective interest method and the straight-line method.

Required:

a.Explain how premiums and discounts are amortized using the straight-line and effective interest methods.

b.State which of the two methods is preferred and explain why.

c.Explain why many companies are able to use the method that is not considered GAAP.

(Essay)

4.8/5  (35)

(35)

In 2013, Game Co. took advantage of market conditions to refund its outstanding debt. Game should report the excess of the carrying amount of the old debt over the amount paid to extinguish it as a(n)

(Multiple Choice)

4.8/5  (33)

(33)

Exhibit 14-11 Harry's Inc. issued a four-year, $75,000, non-interest-bearing note to a customer on January 1, 2013. Harry also agrees to sell inventory to the customer at reduced rates over a five-year period. Sales are to be evenly spread over the five-year period. Harry's incremental interest rate is 8%, and the present value of the note is $55,125.

-Refer to Exhibit 14-11. Harry's interest expense for 2015 is

(Multiple Choice)

4.8/5  (32)

(32)

Showing 21 - 40 of 171

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)