Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business190 Questions

Exam 2: Analyzing Transactions224 Questions

Exam 3: The Adjusting Process179 Questions

Exam 4: Completing the Accounting Cycle194 Questions

Exam 5: Accounting Systems160 Questions

Exam 6: Accounting for Merchandising Businesses215 Questions

Exam 7: Inventories165 Questions

Exam 8: Sarbanes-Oxley, Internal Control, and Cash176 Questions

Exam 9: Receivables140 Questions

Exam 10: Fixed Assets and Intangible Assets170 Questions

Exam 11: Current Liabilities and Payroll169 Questions

Exam 12: Accounting for Partnerships and Limited Liability Companies190 Questions

Exam 13: Corporations: Organization, Stock Transactions, and Dividends165 Questions

Exam 14: Long-Term Liabilities: Bonds and Notes185 Questions

Exam 15: Investments and Fair Value Accounting133 Questions

Exam 16: Statement of Cash Flows160 Questions

Exam 17: Financial Statement Analysis185 Questions

Exam 18: Managerial Accounting Concepts and Principles173 Questions

Exam 19: Job Order Costing173 Questions

Exam 20: Process Cost Systems177 Questions

Exam 21: Cost Behavior and Cost-Volume-Profit Analysis215 Questions

Exam 22: Budgeting188 Questions

Exam 23: Performance Evaluation Using Variances From Standard Costs161 Questions

Exam 24: Performance Evaluation for Decentralized Operations200 Questions

Exam 25: Differential Analysis and Product Pricing162 Questions

Exam 26: Capital Investment Analysis179 Questions

Select questions type

Indicate whether the following error would cause the adjusted trial balance totals to be unequal. If the error would cause the adjusted trial balance totals to be unequal, indicate whether the debit or credit total is higher and by how much.

(Essay)

4.8/5  (35)

(35)

The adjustment for accrued fees was debited to Accounts Payable instead of Accounts Receivable. This error will be detected when the Adjusted Trial Balance is prepared.

(True/False)

4.7/5  (38)

(38)

List the four basic types of accounts that require adjusting entries and give an example of each.

(Essay)

4.8/5  (31)

(31)

An adjusting entry would adjust revenue so it is reported when earned and not when cash is received.

(True/False)

4.9/5  (47)

(47)

A one-year insurance policy was purchased on June 1, 2011 for $1,500. The adjusting entry on December 31, 2011 would be:

(Essay)

4.9/5  (41)

(41)

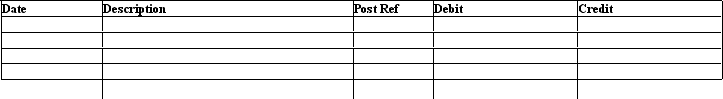

Prepare the December 31 adjusting entries for the following transactions. Omit explanations.

1. Fees accrued but unbilled total $6,300.

2. The supplies account balance on December 31 is $4,750. Supplies on hand are $960.

3. Wages accrued but not paid are $2,700.

4. Depreciation of office equipment is $1,650.

5. Rent expired during year, $10,800.

(Essay)

4.8/5  (29)

(29)

When preparing an income statement vertical analysis, each revenue and expense is expressed as a percent of net income.

(True/False)

4.8/5  (40)

(40)

Which of the following is an example of an accrued expense?

(Multiple Choice)

4.8/5  (40)

(40)

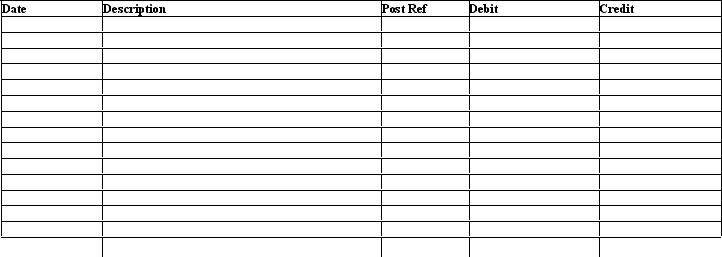

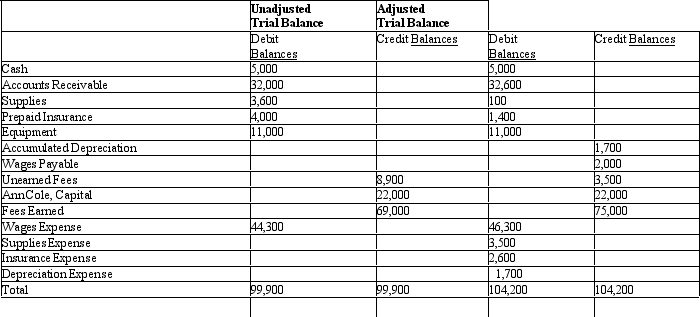

Journalize the six entries to adjust the accounts at December 31. (Hint: One of the accounts was affected by two different adjusting entries).

(Essay)

4.7/5  (38)

(38)

All of the following statements regarding vertical analysis are true except:

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following is not a characteristic of accrual basis of accounting?

(Multiple Choice)

4.7/5  (30)

(30)

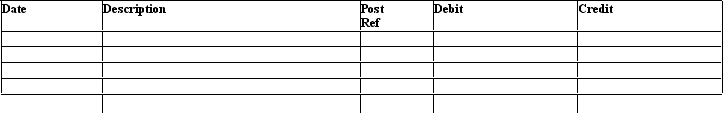

A business pays bi-weekly salaries of $20,000 every other Friday for a ten-day period ending on that day. The last pay day of December is Friday, December 27. Assuming the next pay period begins on Monday, December 30 and the proper adjusting entry is journalized at the end of the fiscal period (December 31). Journalize the entry for the payment of the payroll on Friday, January 10.

(Essay)

4.9/5  (32)

(32)

Prepaid advertising, representing payment for the next quarter, would be reported on the balance sheet as a(n)

(Multiple Choice)

4.8/5  (40)

(40)

Explain the difference between accrual basis accounting and cash basis accounting.

(Essay)

4.8/5  (36)

(36)

The type of account and normal balance of Unearned Rent is

(Multiple Choice)

4.7/5  (35)

(35)

The account type and normal balance of Unearned Revenue is

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following is the proper adjusting entry, based on a prepaid insurance account balance before adjustment of $14,000 and unexpired insurance of $3,000, for the fiscal year ending on April 30?

(Multiple Choice)

4.7/5  (31)

(31)

An adjusting entry would adjust an expense account so the expense is reported when incurred.

(True/False)

4.8/5  (37)

(37)

If the adjustment for accrued salaries at the end of the period is inadvertently omitted, both liabilities and owner's equity will be understated for the period.

(True/False)

4.9/5  (39)

(39)

Showing 141 - 160 of 179

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)