Exam 23: State and Local Taxes

Exam 1: An Introduction to Tax110 Questions

Exam 2: Tax Compliance, the Irs, and Tax Authorities111 Questions

Exam 3: Tax Planning Strategies and Related Limitations115 Questions

Exam 4: Individual Income Tax Overview, Exemptions, and Filing Status126 Questions

Exam 5: Gross Income and Exclusions131 Questions

Exam 6: Individual Deductions114 Questions

Exam 7: Investments76 Questions

Exam 8: Individual Income Tax Computation and Tax Credits157 Questions

Exam 9: Business Income, Deductions, and Accounting Methods99 Questions

Exam 10: Property Acquisition and Cost Recovery107 Questions

Exam 11: Property Dispositions110 Questions

Exam 12: Compensation102 Questions

Exam 13: Retirement Savings and Deferred Compensation115 Questions

Exam 14: Tax Consequences of Home Ownership112 Questions

Exam 15: Entities Overview70 Questions

Exam 16: Corporate Operations138 Questions

Exam 17: Accounting for Income Taxes100 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions100 Questions

Exam 19: Corporate Formation, Reorganization, and Liquidation100 Questions

Exam 20: Forming and Operating Partnerships100 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions100 Questions

Exam 22: S Corporations134 Questions

Exam 23: State and Local Taxes117 Questions

Exam 24: The Us Taxation of Multinational Transactions100 Questions

Exam 25: Transfer Taxes and Wealth Planning123 Questions

Select questions type

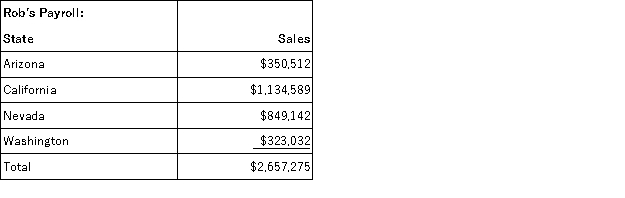

Handsome Rob provides transportation services in several western states. Rob has sales as follows:  Rob is a California Corporation and has the following facts.

Rob has nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $200,000 of payroll for services provided in Nevada by California based drivers. What is Rob's California sale numerator?

Rob is a California Corporation and has the following facts.

Rob has nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $200,000 of payroll for services provided in Nevada by California based drivers. What is Rob's California sale numerator?

(Multiple Choice)

4.7/5  (40)

(40)

Roxy operates a dress shop in Arlington, Virginia. Lisa, a Maryland resident, comes in for a measurement and purchases a $1,500 dress. Lisa returns to Virginia a few weeks later to pick up the dress and drive it back to her Maryland residence where she will use the property. Assuming that Virginia's sales tax rate is 5 percent and that Maryland's sales tax rate is 6 percent, what is Roxy's sales and use tax liability?

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following statements regarding income tax commercial domicile is incorrect?

(Multiple Choice)

4.9/5  (25)

(25)

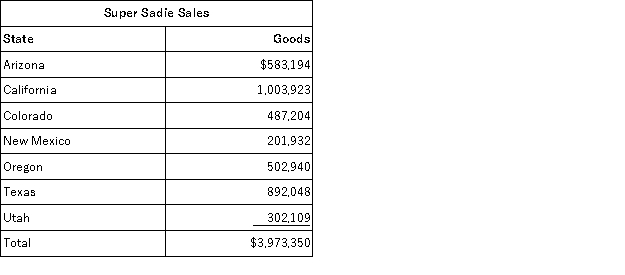

Super Sadie, Incorporated manufactures sandals and distributes them across the southwestern United States. Assume that Super Sadie has sales and use tax nexus in Arizona, California, Colorado, New Mexico, and Texas. Super Sadie has sales as follows:  Assume the following sales tax rates: Arizona (6 percent), California (8 percent), Colorado (7 percent), New Mexico (6.5 percent), Oregon (7.25 percent), Texas (8 percent), and Utah (5 percent). What is Super Sadie's total sales and use tax liability? (Round your interim calculations to the nearest whole number)

Assume the following sales tax rates: Arizona (6 percent), California (8 percent), Colorado (7 percent), New Mexico (6.5 percent), Oregon (7.25 percent), Texas (8 percent), and Utah (5 percent). What is Super Sadie's total sales and use tax liability? (Round your interim calculations to the nearest whole number)

(Short Answer)

4.9/5  (47)

(47)

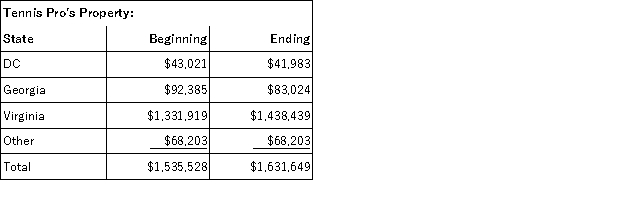

Gordon operates the Tennis Pro Shop in Blacksburg, Virginia. Tennis Pro has property as follows:  Tennis Pro also rents Virginia property at an annual rent of $24,000. What is Tennis Pro's Virginia property numerator and property factor?

Tennis Pro also rents Virginia property at an annual rent of $24,000. What is Tennis Pro's Virginia property numerator and property factor?

(Short Answer)

4.8/5  (36)

(36)

Gordon operates the Tennis Pro Shop in Blacksburg, Virginia. The Shop sells, manufacturers, and customizes tennis racquets for serious amateurs. Virginia has a 5 percent sales tax. Determine the sales and use tax liability that the Shop must collect and remit if it sells a $500 racquet to a Tennessee customer that purchases the merchandise in the retail store?

(Short Answer)

4.8/5  (39)

(39)

Which of the following is not a general rule for calculating the sales factor?

(Multiple Choice)

5.0/5  (42)

(42)

What was the Supreme Court's holding in Complete Auto Transit?

(Multiple Choice)

4.7/5  (37)

(37)

Which of the following activities will create sales tax nexus?

(Multiple Choice)

4.7/5  (32)

(32)

Business income includes all income earned in the ordinary course of business.

(True/False)

4.8/5  (38)

(38)

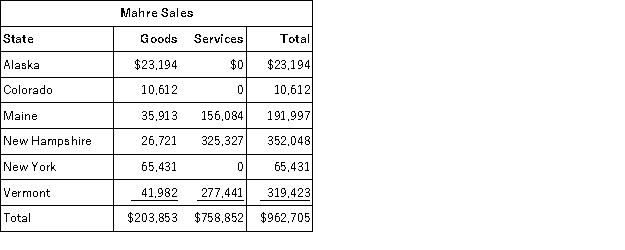

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store which ships to out of state customers. The ski tours operate in Maine, New Hampshire, and Vermont where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (6.6 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (6.6 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit?

(Multiple Choice)

4.9/5  (37)

(37)

Giving samples and promotional materials without charge is a protected solicitation activity.

(True/False)

4.8/5  (38)

(38)

Commercial domicile is the location where a business is headquartered and from whence it directs its operations.

(True/False)

4.8/5  (38)

(38)

Which of the following states is not asserting economic nexus?

(Multiple Choice)

4.9/5  (38)

(38)

Gordon operates the Tennis Pro Shop in Blacksburg, Virginia. Tennis Pro sells, manufacturers, and customizes tennis racquets for serious amateurs. Tennis Pro's business has expanded significantly over the last few years. Currently, it has sales personnel in 10 states (Virginia, North Carolina, South Carolina, Georgia, Tennessee, Kentucky, Ohio, Maryland, District of Columbia, New Jersey). All in state activity is limited to solicitation. Orders are taken by the sales team and forwarded to Blacksburg for approval. All orders are sent by common carrier to customers. Tennis Pro owns retail and warehouse space in Virginia and has another warehouse in Kentucky. Is Tennis Pro subject to Ohio's Commercial Activity Tax?

(Short Answer)

4.8/5  (39)

(39)

Many states are expanding the types of services subject to sales tax.

(True/False)

4.8/5  (36)

(36)

Showing 101 - 117 of 117

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)