Exam 21: Cost Allocation and Performance Measurement

Exam 1: Accounting in Business240 Questions

Exam 2: Analyzing and Recording Transactions197 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements224 Questions

Exam 4: Completing the Accounting Cycle176 Questions

Exam 5: Accounting for Merchandising Operations198 Questions

Exam 6: Inventories and Cost of Sales198 Questions

Exam 7: Accounting Information Systems176 Questions

Exam 8: Cash and Internal Controls196 Questions

Exam 9: Accounting for Receivables191 Questions

Exam 10: Plant Assets, Natural Resources, and Intangibles223 Questions

Exam 11: Current Liabilities and Payroll Accounting193 Questions

Exam 12: Accounting for Partnerships139 Questions

Exam 13: Accounting for Corporations246 Questions

Exam 14: Long-Term Liabilities198 Questions

Exam 15: Investments and International Operations192 Questions

Exam 16: Reporting the Statement of Cash Flows187 Questions

Exam 17: Analysis of Financial Statements187 Questions

Exam 18: Managerial Accounting Concepts and Principles197 Questions

Exam 19: Job Order Cost Accounting164 Questions

Exam 20: Process Cost Accounting174 Questions

Exam 21: Cost Allocation and Performance Measurement170 Questions

Exam 22: Cost-Volume-Profit Analysis186 Questions

Exam 23: Master Budgets and Planning162 Questions

Exam 24: Flexible Budgets and Standard Costs174 Questions

Exam 25: Capital Budgeting and Managerial Decisions150 Questions

Exam 26: Time Value of Money60 Questions

Select questions type

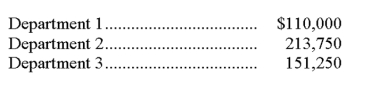

A retail store has three departments, 1, 2, and 3, and does general advertising that benefits all departments. Advertising expense totaled $50,000 for the year, and departmental sales were as follows. Allocate advertising expense to Department 2 based on departmental sales.

(Multiple Choice)

4.7/5  (40)

(40)

The most useful evaluation of a manager's cost performance is based on:

(Multiple Choice)

4.9/5  (31)

(31)

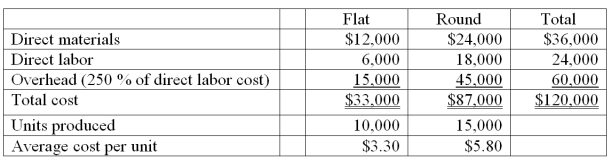

Larabee Company produces two types of product, flat and round, on the same production line. For the current period, the company reports the following data.  Larabee's controller wishes to apply activity-based costing (ABC) to allocate the $60,000 of overhead costs incurred by the two product lines to see whether cost per unit would change markedly from that reported above. She has collected the following information.

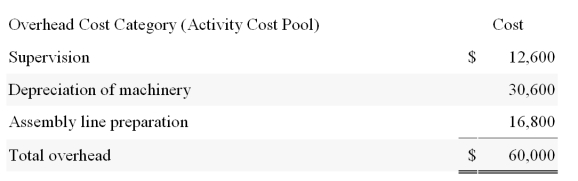

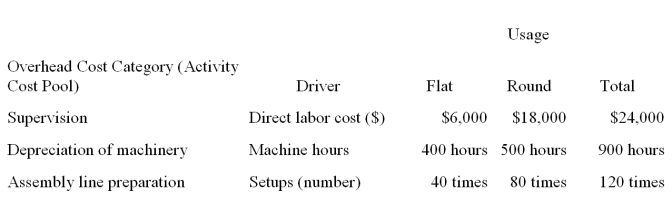

Larabee's controller wishes to apply activity-based costing (ABC) to allocate the $60,000 of overhead costs incurred by the two product lines to see whether cost per unit would change markedly from that reported above. She has collected the following information.  She has also collected the following information about the cost drivers for each category (cost pool) and the amount of each driver used by the two product lines.

She has also collected the following information about the cost drivers for each category (cost pool) and the amount of each driver used by the two product lines.  Assign these three overhead cost pools to each of the two products using ABC. Show each overhead cost allocation by product and the total overhead allocated to each product. Determine average cost per unit for each of the two products using ABC. (Round your answer to 2 decimal places.) Which overhead cost allocation method would you recommend to the controller?

Assign these three overhead cost pools to each of the two products using ABC. Show each overhead cost allocation by product and the total overhead allocated to each product. Determine average cost per unit for each of the two products using ABC. (Round your answer to 2 decimal places.) Which overhead cost allocation method would you recommend to the controller?

(Not Answered)

This question doesn't have any answer yet

In producing oat bran, the joint cost of milling the oats into bran, oatmeal, and animal feed is considered a direct cost to the oat bran, because the oat bran cannot be produced without incurring the joint cost.

(True/False)

4.9/5  (42)

(42)

A company rents a building with a total of 100,000 square feet, which are evenly divided between two floors. The space on the first floor is considered twice as valuable as that on the second floor. The total monthly rent for the building is $30,000. How much of the monthly rental expense should be allocated to a department that occupies 10,000 square feet on the first floor?

(Multiple Choice)

4.9/5  (31)

(31)

Activity-based costing attempts to better allocate costs to the proper users of overhead by focusing on activities.

(True/False)

4.9/5  (37)

(37)

A _________________ is a factor that causes the cost of an activity to go up and down.

(Short Answer)

4.8/5  (36)

(36)

Costs that the manager does not have the power to determine or at least strongly influence are:

(Multiple Choice)

4.7/5  (32)

(32)

A company rents a small building with 10,000 square feet of space for $100,000 per year. The rent is allocated to the company's three departments on the basis of the value of the space occupied by each. Department One occupies 1,500 square feet of ground-floor space, Department Two occupies 3,500 square feet of ground-floor space, and Department Three occupies 5,000 square feet of second-floor space. If rent for comparable floor space in the neighborhood averages $15.00 per sq. ft. for ground-floor space and $10.00 per sq. ft. for second-floor space, what annual rent expense should be charged to each department?

(Not Answered)

This question doesn't have any answer yet

Departmental contribution to overhead is the amount of revenues for that department less its direct expenses.

(True/False)

4.8/5  (38)

(38)

Under traditional cost allocation methods, low-volume complex products are often __________________ and high-volume simpler products are likely to be ______________.

(Short Answer)

4.9/5  (39)

(39)

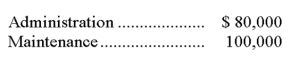

Able Company has two operating (production) departments: Assembly and Fabricating. Assembly has 150 employees and occupies 44,000 square feet; Fabricating has 100 employees and occupies 36,000 square feet. Indirect factory expenses for the current period are as follows:  Administration is allocated based on workers in each department; maintenance is allocated based on square footage. The total amount of indirect factory expenses that should be allocated to the Assembly Department for the current period is:

Administration is allocated based on workers in each department; maintenance is allocated based on square footage. The total amount of indirect factory expenses that should be allocated to the Assembly Department for the current period is:

(Multiple Choice)

4.9/5  (32)

(32)

In the two-stage cost allocation, ______________________ costs are allocated to operating departments, and the operating department costs are allocated to ______________.

(Short Answer)

4.9/5  (38)

(38)

A cost incurred in producing or purchasing two or more products at the same time is a(n):

(Multiple Choice)

4.8/5  (32)

(32)

The salaries of employees who spend all their time working in one department are:

(Multiple Choice)

4.9/5  (33)

(33)

Joint costs are a group of several costs incurred in producing or purchasing a single product.

(True/False)

4.7/5  (35)

(35)

Advertising expense can be reasonably allocated to departments on the basis of sales.

(True/False)

4.9/5  (40)

(40)

Joint costs can be allocated either using a physical basis or a value basis.

(True/False)

4.8/5  (31)

(31)

Showing 101 - 120 of 170

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)