Exam 21: Cost Allocation and Performance Measurement

Exam 1: Accounting in Business240 Questions

Exam 2: Analyzing and Recording Transactions197 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements224 Questions

Exam 4: Completing the Accounting Cycle176 Questions

Exam 5: Accounting for Merchandising Operations198 Questions

Exam 6: Inventories and Cost of Sales198 Questions

Exam 7: Accounting Information Systems176 Questions

Exam 8: Cash and Internal Controls196 Questions

Exam 9: Accounting for Receivables191 Questions

Exam 10: Plant Assets, Natural Resources, and Intangibles223 Questions

Exam 11: Current Liabilities and Payroll Accounting193 Questions

Exam 12: Accounting for Partnerships139 Questions

Exam 13: Accounting for Corporations246 Questions

Exam 14: Long-Term Liabilities198 Questions

Exam 15: Investments and International Operations192 Questions

Exam 16: Reporting the Statement of Cash Flows187 Questions

Exam 17: Analysis of Financial Statements187 Questions

Exam 18: Managerial Accounting Concepts and Principles197 Questions

Exam 19: Job Order Cost Accounting164 Questions

Exam 20: Process Cost Accounting174 Questions

Exam 21: Cost Allocation and Performance Measurement170 Questions

Exam 22: Cost-Volume-Profit Analysis186 Questions

Exam 23: Master Budgets and Planning162 Questions

Exam 24: Flexible Budgets and Standard Costs174 Questions

Exam 25: Capital Budgeting and Managerial Decisions150 Questions

Exam 26: Time Value of Money60 Questions

Select questions type

A department that is responsible for maximizing revenues is known as a profit center.

(True/False)

4.8/5  (38)

(38)

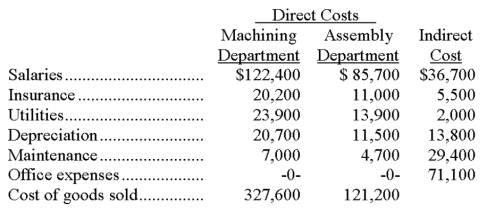

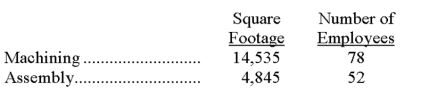

Renton Co. has two operating (production) departments supported by a number of service departments. The following information was collected for a recent period:  Indirect costs are allocated as follows: salaries on the basis of sales, office expenses on the basis of the number of employees, and all other costs on the basis of square footage. Additional information about the production departments follows:

Indirect costs are allocated as follows: salaries on the basis of sales, office expenses on the basis of the number of employees, and all other costs on the basis of square footage. Additional information about the production departments follows:  Sales for the Machining Department are $724,404 and sales for the Assembly Department are $356,796.

Determine the departmental contribution to overhead and the departmental net income for each production department.

Sales for the Machining Department are $724,404 and sales for the Assembly Department are $356,796.

Determine the departmental contribution to overhead and the departmental net income for each production department.

(Not Answered)

This question doesn't have any answer yet

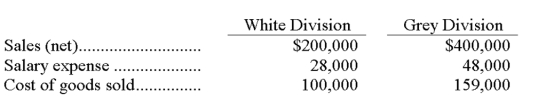

Jamesway Corporation has two separate divisions that operate as profit centers. The following information is available for the most recent year:  The White Division occupies 20,000 square feet in the plant. The Grey Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the White and Grey Divisions, respectively.

The White Division occupies 20,000 square feet in the plant. The Grey Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the White and Grey Divisions, respectively.

(Multiple Choice)

4.8/5  (33)

(33)

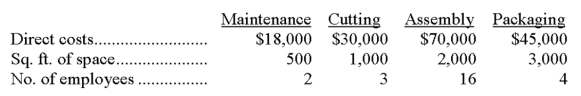

Dresden, Inc. has four departments. Information about these departments follows is listed below. If allocated maintenance cost is based on floor space occupied by each, compute the amount of maintenance cost allocated to the Cutting Department.

(Multiple Choice)

4.8/5  (43)

(43)

Describe the information found on a responsibility accounting performance report.

(Essay)

4.9/5  (43)

(43)

Why would a firm use activity-based costing (ABC) rather than traditional two-stage methods of cost allocation for overhead?

(Essay)

4.7/5  (32)

(32)

Traditional two-stage cost allocation means that indirect costs are first allocated to both operating and service departments, then operating department costs are allocated to service departments.

(True/False)

4.9/5  (34)

(34)

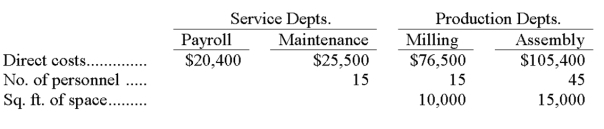

White Company has two service departments and two operating (production) departments. The Payroll Department services all three of the other departments in proportion to the number of employees in each. The Maintenance Department costs are allocated to the two operating departments in proportion to the floor space used by each. Listed below are the operating data for the current period:  The total cost of operating the Milling Department for the current period is:

The total cost of operating the Milling Department for the current period is:

(Multiple Choice)

4.8/5  (36)

(36)

Expenses that are not easily associated with a specific department, and which are incurred for the benefit of more than one department, are:

(Multiple Choice)

4.9/5  (47)

(47)

The process of preparing departmental income statements starts with allocating service departments.

(True/False)

4.9/5  (38)

(38)

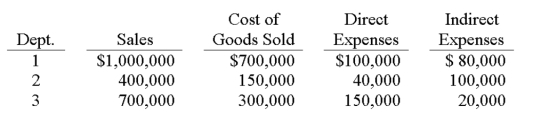

Mach Co. operates three production departments as profit centers. The following information is available for its most recent year. Department 1's contribution to overhead as a percent of sales is:

(Multiple Choice)

4.7/5  (33)

(33)

Abbe Company reported the following financial numbers for one of its divisions for the year; average total assets of $4,100,000; sales of $4,525,000; cost of goods sold of $2,550,000; and operating expenses of $1,372,000. Compute the division's return on assets:

(Multiple Choice)

4.9/5  (31)

(31)

A company pays $15,000 per period to rent a small building that has 10,000 square feet of space. This cost is allocated to the company's three departments on the basis of the amount and value of the space occupied by each. Department One occupies 2,000 square feet of ground-floor space, Department Two occupies 3,000 square feet of ground-floor space, and Department Three occupies 5,000 square feet of second-floor space. If rents for comparable floor space in the neighborhood average $2.20 per square foot for ground-floor space and $1.10 per square foot for second-floor space and the rent is allocated based on the total value of the space, Department One should be charged rent expense for the period of:

(Multiple Choice)

4.8/5  (33)

(33)

An activity-based costing system usually involves a fewer number of allocations compared with a traditional cost allocation system.

(True/False)

4.8/5  (34)

(34)

What is the primary purpose for using a responsibility accounting system?

(Essay)

4.8/5  (30)

(30)

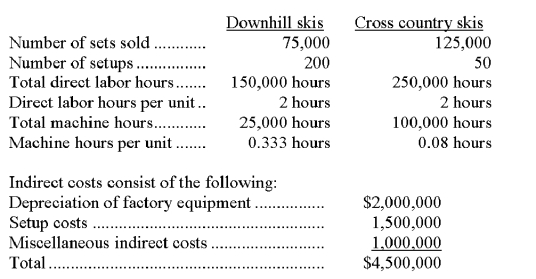

Outdoor Sports, Inc., produces two types of skis, downhill skis and cross country skis. Product and production information about the two items is shown below:  Required:

1. If Outdoor Sports uses the traditional two-stage method of allocating overhead costs based on direct labor hours, what is the amount of indirect costs per set of skis for each of the two types of skis?

2. If Outdoor Sports uses activity based costing, what is the total amount of indirect costs per set of skis for each of the two types of skis? Assume that depreciation is allocated based on machine hours, setup costs based on the number of setups, and miscellaneous costs based on the number of direct labor hours.

Required:

1. If Outdoor Sports uses the traditional two-stage method of allocating overhead costs based on direct labor hours, what is the amount of indirect costs per set of skis for each of the two types of skis?

2. If Outdoor Sports uses activity based costing, what is the total amount of indirect costs per set of skis for each of the two types of skis? Assume that depreciation is allocated based on machine hours, setup costs based on the number of setups, and miscellaneous costs based on the number of direct labor hours.

(Not Answered)

This question doesn't have any answer yet

Showing 81 - 100 of 170

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)