Exam 21: Cost Allocation and Performance Measurement

Exam 1: Accounting in Business240 Questions

Exam 2: Analyzing and Recording Transactions197 Questions

Exam 3: Adjusting Accounts and Preparing Financial Statements224 Questions

Exam 4: Completing the Accounting Cycle176 Questions

Exam 5: Accounting for Merchandising Operations198 Questions

Exam 6: Inventories and Cost of Sales198 Questions

Exam 7: Accounting Information Systems176 Questions

Exam 8: Cash and Internal Controls196 Questions

Exam 9: Accounting for Receivables191 Questions

Exam 10: Plant Assets, Natural Resources, and Intangibles223 Questions

Exam 11: Current Liabilities and Payroll Accounting193 Questions

Exam 12: Accounting for Partnerships139 Questions

Exam 13: Accounting for Corporations246 Questions

Exam 14: Long-Term Liabilities198 Questions

Exam 15: Investments and International Operations192 Questions

Exam 16: Reporting the Statement of Cash Flows187 Questions

Exam 17: Analysis of Financial Statements187 Questions

Exam 18: Managerial Accounting Concepts and Principles197 Questions

Exam 19: Job Order Cost Accounting164 Questions

Exam 20: Process Cost Accounting174 Questions

Exam 21: Cost Allocation and Performance Measurement170 Questions

Exam 22: Cost-Volume-Profit Analysis186 Questions

Exam 23: Master Budgets and Planning162 Questions

Exam 24: Flexible Budgets and Standard Costs174 Questions

Exam 25: Capital Budgeting and Managerial Decisions150 Questions

Exam 26: Time Value of Money60 Questions

Select questions type

Community Technical College allocates administrative costs to its teaching departments based on the number of students enrolled, while maintenance and utilities are allocated based on square feet of classrooms. Based on the information below, what is the total amount of expenses allocated to each department (rounded to the nearest dollar) if administrative costs for the college were $150,000, maintenance expenses were $70,000, and utilities were $85,000?

(Not Answered)

This question doesn't have any answer yet

Allocations of joint product costs can be based on the relative sales values of the products:

(Multiple Choice)

4.9/5  (39)

(39)

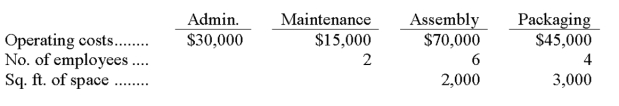

Farber, Inc., has four departments. The Administrative Department costs are allocated to the other three departments based on the number of employees in each and the Maintenance Department costs are allocated to the Assembly and Packaging Departments based on their occupied space. Data for these departments follows:  The total amount of the Administrative Department's cost that would eventually be allocated to the Packaging Department is:

The total amount of the Administrative Department's cost that would eventually be allocated to the Packaging Department is:

(Multiple Choice)

4.7/5  (33)

(33)

Samm's Department Store operates three departments (A, B and C). If total costs of $4,500 are to be allocated on the basis of square feet of space (Dept. A = 1,500 Sq. Ft.; Dept. B = 900 Sq. Ft.; Dept. C = 600 Sq. Ft.) then Dept A's share (in percent) of the $4,500 cost would be __________%; Dept. B would be ________%, and Dept C would be ____________%. The amount of cost allocated to Dept. C would be $__________.

(Essay)

4.8/5  (27)

(27)

The ________________________________ is a report of the amount of sales less direct expenses for a department.

(Short Answer)

4.7/5  (28)

(28)

A ______________________________ accumulates and reports costs and expenses that a manager is responsible for, including budgeted amounts.

(Essay)

5.0/5  (33)

(33)

A __________________________ helps control costs and expenses and evaluates managers' performance by assigning costs and expenses to the managers responsible for controlling them.

(Short Answer)

4.7/5  (43)

(43)

The China Department of the Coulsen Department Store had sales of $282,000, cost of goods sold of $198,750, indirect expenses of $19,875, and direct expenses of $41,250 for the current period. What is the China Department's contribution to overhead as a percent of sales?

(Not Answered)

This question doesn't have any answer yet

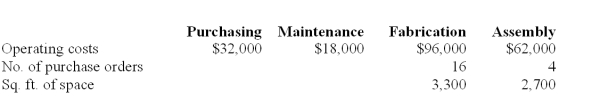

The following is a partially completed lower section of a departmental expense allocation spreadsheet for Stoneham. It reports the total amounts of direct and indirect expenses for the four departments. Purchasing department expenses are allocated to the operating departments on the basis of purchase orders. Maintenance department expenses are allocated based on square footage. Compute the amount of Purchasing department expense to be allocated to Fabrication.

(Multiple Choice)

4.7/5  (38)

(38)

Belgrade Lakes Properties is developing a golf course subdivision that includes 225 home lots; 100 lots are golf course lots and will sell for $95,000 each; 125 are street frontage lots and will sell for $65,000. The developer acquired the land for $1,800,000 and spent another $1,400,000 on street and utilities improvement. Compute the amount of joint cost to be allocated to the golf course lots using value basis.

(Multiple Choice)

4.8/5  (31)

(31)

Showing 161 - 170 of 170

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)