Exam 9: The Government and Fiscal Policy

Exam 1: The Scope and Method of Economics65 Questions

Exam 2: The Economic Problem: Scarcity and Choice107 Questions

Exam 3: Demand, Supply, and Market Equilibrium86 Questions

Exam 4: Demand and Supply Applications37 Questions

Exam 5: Introduction to Macroeconomics64 Questions

Exam 6: Measuring National Output and National Income84 Questions

Exam 7: Unemployment, Inflation, and Long-Run Growth81 Questions

Exam 8: Aggregate Expenditure and Equilibrium Output58 Questions

Exam 9: The Government and Fiscal Policy71 Questions

Exam 10: The Money Supply and the Federal Reserve System96 Questions

Exam 11: Money Demand and the Equilibrium Interest Rate96 Questions

Exam 12: The Determination of Aggregate Output, the Price Level, and the Interest Rate100 Questions

Exam 13: Policy Effects and Costs Shocks in the Asad Model89 Questions

Exam 14: The Labor Market in the Macroeconomy111 Questions

Exam 15: Financial Crises, Stabilization, and Deficits102 Questions

Exam 16: Household and Firm Behavior in the Macroeconomy: a Further Look92 Questions

Exam 17: Long-Run Growth59 Questions

Exam 18: Alternative Views in Macroeconomics88 Questions

Exam 19: International Trade, Comparative Advantage, and Protectionism63 Questions

Exam 20: Open-Economy Macroeconomics: the Balance of Payments and Exchange Rates105 Questions

Exam 21: Economic Growth in Developing and Transitional Economies48 Questions

Select questions type

Suppose that the MPS = .2 and the government is interested in raising the level of output in the economy by $100 billion. Calculate how much the government would have to spend to achieve this objective.

Free

(Essay)

4.7/5  (35)

(35)

Correct Answer:

Y = m x G . Since Y = $100 billion and the m = 1/ mps or 1/.2 or 5, then the change in government spending that would be necessary to achieve this objective would be $20 billion.

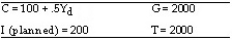

Assume an economy is represented by the following:

(a) Suppose actual output is 3000. What is the level of planned expenditures at this level of output? What is the level of unplanned changes in inventories?

(b) Calculate the equilibrium level of output.

(c) Based on your analysis in Part (b), calculate the levels of consumption and saving that occur when the economy is in equilibrium.

(d) Now suppose that G decreases by 100 and T simultaneously decreases by 100. Calculate the new equilibrium level of income. Given your answer, what is the size of the balanced budget multiplier?

(a) Suppose actual output is 3000. What is the level of planned expenditures at this level of output? What is the level of unplanned changes in inventories?

(b) Calculate the equilibrium level of output.

(c) Based on your analysis in Part (b), calculate the levels of consumption and saving that occur when the economy is in equilibrium.

(d) Now suppose that G decreases by 100 and T simultaneously decreases by 100. Calculate the new equilibrium level of income. Given your answer, what is the size of the balanced budget multiplier?

Free

(Essay)

5.0/5  (23)

(23)

Correct Answer:

(a) AE = 2800. With Y = 3000 and AE = 2800, unplanned changes in inventories equal + 200.

(b) Y = 2600

(c) C = 400 and S = 200

(d) Y = 2500. Y decreases by 100 so the balanced budget multiplier is 1.

Assume the economy was originally at an output level of $800 billion. The government then cut taxes by $20 billion. If the economy expands by $60 billion, what is the value of the tax multiplier?

Free

(Essay)

4.7/5  (39)

(39)

Correct Answer:

The tax multiplier is the ratio of change in the equilibrium level of output to a change in taxes. Therefore the tax multiplier must be -3. ($60 billion -$20 billion)

The MPC in Montavada is .75.

(a) If taxes were reduced by $1,000 in Montavada, by how much would equilibrium output change?

(b) If government spending were increased by $1,000 in Montavada, by how much would equilibrium output change?

(c) Explain why a tax cut of $1,000 would have less effect on the economy of Montavada than an increase in government spending of $1,000.

(Essay)

4.8/5  (43)

(43)

What do economists mean by the concept of a full-employment budget? Explain your answer in relation to the structural and cyclical deficit.

(Essay)

4.8/5  (23)

(23)

The intuition behind the balanced budget multiplier is fairly straightforward. When the government taxes the public and spends the money, it is taking funds from people who would not have spent it all, and giving it to people (government agencies) who will spend it all. Can you think of any flaw in this logic?

(Essay)

4.8/5  (28)

(28)

Assume that you know that the tax multiplier for the economy is -4. From this information calculate the value of the MPC and MPS.

(Essay)

4.8/5  (37)

(37)

Determine the impact of an increase in government spending of $10 billion when the MPC is .8. Determine the impact of a decrease in government spending of $5 billion when the MPS is .25.

(Essay)

4.8/5  (27)

(27)

Suppose policymakers decide to increase government spending by 100 and simultaneously increase taxes by 100. Explain what effect this simultaneous increase in G and increase in T will have on the economy and on the budget deficit.

(Essay)

4.9/5  (28)

(28)

Assume government reforms the unemployment compensation program such that the amount of benefits that are distributed in any given fiscal year are fixed. In periods where there are more claims the amount of the benefits per person would simply decline and vice versa. Would this tend to soften or to weaken macroeconomic stability?

(Essay)

4.8/5  (38)

(38)

For the economy to be in equilibrium what must be the relationship between government spending, investment, savings, and tax revenue. (Hint: write out an equation)

(Essay)

4.9/5  (34)

(34)

Determine the net impact upon the nation's economy that results from equal increases in spending and taxes of $10 billion when the MPC is .8.

(Essay)

4.9/5  (42)

(42)

Suppose that the government's budget deficit is $200 billion and the equilibrium level of output is at $8 trillion. If the output level necessary for full employment is $8.1 trillion, by how much must the government increase spending and taxes to stimulate the economy?

(Essay)

4.8/5  (30)

(30)

Assume the following behavioral equations for a macroeconomy:

C = 100 + .9Yd , I = 50, T = 100 and G = 40

Calculate the equilibrium level of output.

(Essay)

4.8/5  (37)

(37)

How is is possible for the budget deficit to change even when Congress doesn't change spending or taxes?

(Essay)

4.9/5  (35)

(35)

Suppose planned investment drops by 200.

(a) First, graphically illustrate the effects of this reduction in planned investment using the AE - Y graph. Explain what effect it will have on the economy.

(b) Now suppose policymakers wish to prevent this drop in I from having any effect on output. How much would government spending have to increase in order to prevent any change in Y? Explain.

(c) Rather than use a change in spending, suppose policymakers wish to use a change in taxes to prevent Y from changing. Explain what must happen to taxes to achieve this.

(d) Briefly compare and explain any differences in the size of the change in G and change in T in parts (b) and (c).

(Essay)

4.8/5  (35)

(35)

Showing 1 - 20 of 71

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)