Exam 10: The Money Supply and the Federal Reserve System

Explain what near monies are.

Near monies are close substitutes for transactions money, such as savings accounts and money market accounts.

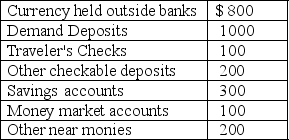

Answer the questions below using the following information:

All figures are in billions of dollars.

a. What is the value of M1?

b. What is the value of M2?

a. What is the value of M1?

b. What is the value of M2?

a. M1 = 800 + 1000 + 100 + 200 = $2100 billion.

b.M2 = 2100 (M1) + 300 + 100 + 200 = $2700 billion.

Assume there is an economy with a single bank, and the central bank sets the reserve requirement ratio at 10%. Assume also that the only bank had no transactions (i.e., no loans, reserves, or deposits) prior to an individual who deposits $1000 of currency with the bank.

(a) As a result of this deposit, calculate the amount of required reserves, actual reserves, and excess reserves.

(b) After the bank has issued the maximum amount of loans, what will be the total amount of loans, deposits, and money in the economy?

(c) What is the size of the money multiplier for this economy?

(d) If the central bank wants to increase the money supply by $500, should it buy or sell bonds? Also, how many bonds should it buy or sell?

(a) Total reserves will be $1,000. Required reserves will be 10% of the $1,000 deposit . Excess reserves will be $900.

(b) The total money supply will be $10,000. The bank will have issued $9,000 of new loans. Total deposits will equal $10,000.

(c) The money multiplier is 1/rr = 1/.1 = 10.

(d) The central bank will have to buy bonds. Given that the money multiplier is 10, it would have to purchase $50 worth of bonds.

Assume the Bank of Smithville opens its doors to depositors and receives $100,000 in cash deposits. Assume furthermore that the bank has to abide by a 20% reserve ratio. Could this bank make a loan in the amount of $90,000?

Explain what bank runs are and why fear serves to reinforce them. Explain where the fear may originate.

Why do you suppose that vault cash would not be considered as part of the money supply as defined by M1?

Why is it not sufficient for money to be considered as money merely by government fiat? Explain.

Explain why the discount rate cannot be used to control the money supply with great precision.

Suppose that a group of farmers form a cooperative in which they deposit all of their grain in a common warehouse elevator and are given a receipt for their deposits. After a period of time the manager of the cooperative notices that very few farmers are returning to the warehouse to redeem their grain. What do you suppose is going on here? Furthermore, suppose that someone who is not a member of the cooperative decided to borrow some grain but was willing to take a receipt instead of the grain. How is this example similar to the story in the text about the goldsmiths? What would happen if everyone returned to the cooperative to demand their grain all at once.

What are liabilities of commercial banks and why are they liabilities.

The required reserve ratio is 10%. Dollar Bank has $50,000 in deposits and $10,000 in reserves. Assume all other commercial banks are loaned up.

(a) What is the value of this bank's excess reserves?

(b) What is the value of the additional loans that can be made by the commercial banking system?

(c) What is the money multiplier?

(d) How much in total deposits will be supported by Dollar Bank's reserves, if this bank lends all its excess reserves and there is no leakage from the banking system?

Explain what happens to the value of M2 if the public withdraws $1 million worth of cash from the banking system.

Prior to the passage of the Depository Institutions Deregulation and Monetary Control Act many banks used to offer toasters or blenders to prospective customers to encourage them to open checking accounts. Can you think of a reason why this practice was so prevalent prior to the passage of this law but has completely faded away since?

Suppose there are $10 million in excess reserves in the banking system and the required reserve ratio is 10%. By how much could the money supply expand?

Comment on the following statement. "The Treasury is able to print money to finance the deficit."

Assume that banks become more conservative and begin to hold excess reserves instead of lending them out. How would the money multiplier in this situation compare to the case where (an amount equivalent to) all excess reserves are lent out? How will this behavior affect the Fed's behavior.

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)