Exam 4: Activity-Based Costing

Exam 1: Introduction to Cost Management151 Questions

Exam 2: Basic Cost Management Concepts199 Questions

Exam 3: Cost Behavior193 Questions

Exam 4: Activity-Based Costing198 Questions

Exam 5: Product and Service Costing: Job-Order System149 Questions

Exam 6: Process Costing181 Questions

Exam 7: Allocating Costs of Support Departments and Joint Products171 Questions

Exam 8: Budgeting for Planning and Control202 Questions

Exam 9: Standard Costing: a Functional-Based Control Approach125 Questions

Exam 10: Decentralization: Responsibility, Accounting, Performance Evaluation, and Transfer Pricing134 Questions

Exam 11: Strategic Cost Management148 Questions

Exam 12: Activity-Based Management146 Questions

Exam 13: The Balanced Scorecard: Strategic-Based Control124 Questions

Exam 14: Quality and Environmental Cost Management199 Questions

Exam 15: Lean Accounting and Productivity Measurement161 Questions

Exam 16: Cost-Volume-Profit Analysis128 Questions

Exam 17: Activity Resource Usage Model and Tactical Decision Making121 Questions

Exam 18: Pricing and Profitability Analysis159 Questions

Exam 19: Capital Investment125 Questions

Exam 20: Inventory Management: Economic Order Quantity, Jit, and the Theory of Constraints127 Questions

Select questions type

Figure 4-17

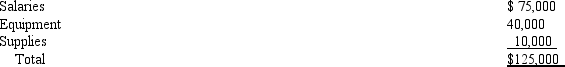

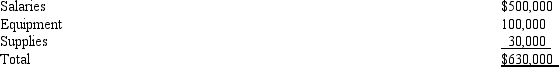

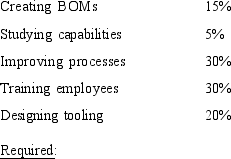

X-TREME Corporation has the following activities: creating bills of materials (BOM), studying manufacturing capabilities, improving manufacturing processes, training employees, and designing tooling. The general ledger accounts reveal the following expenditures for manufacturing engineering:

The equipment is used for two activities: improving processes and designing tooling. Thirty-five percent of the equipment's time is used for improving processes and 65 percent is used for designing tools. The salaries are for two engineers. One is paid $50,000, while the other earns $25,000. The $50,000 engineer spends 40 percent of his time training employees in new processes and 60 percent of his time on improving processes. The remaining engineer spends equal time on all activities. Supplies are consumed in the following proportions:

The equipment is used for two activities: improving processes and designing tooling. Thirty-five percent of the equipment's time is used for improving processes and 65 percent is used for designing tools. The salaries are for two engineers. One is paid $50,000, while the other earns $25,000. The $50,000 engineer spends 40 percent of his time training employees in new processes and 60 percent of his time on improving processes. The remaining engineer spends equal time on all activities. Supplies are consumed in the following proportions:

-Refer to 4-17. What is the cost assigned to the training employees activity?

-Refer to 4-17. What is the cost assigned to the training employees activity?

(Multiple Choice)

4.8/5  (41)

(41)

Which is NOT a characteristic of a unit-based costing system?

(Multiple Choice)

4.9/5  (34)

(34)

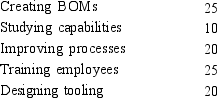

Figure 4-5

The Brookstone Company produces 9 volt batteries and AAA batteries. The Brookstone Company uses a plantwide rate to apply overhead based on direct labor hours. The following data is given:  -Refer to Figure 4-5. How much was overhead over/underapplied?

-Refer to Figure 4-5. How much was overhead over/underapplied?

(Multiple Choice)

4.9/5  (39)

(39)

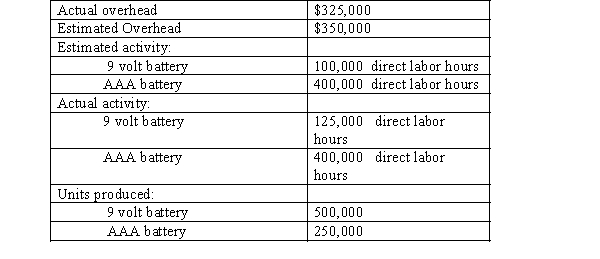

Figure 4-10

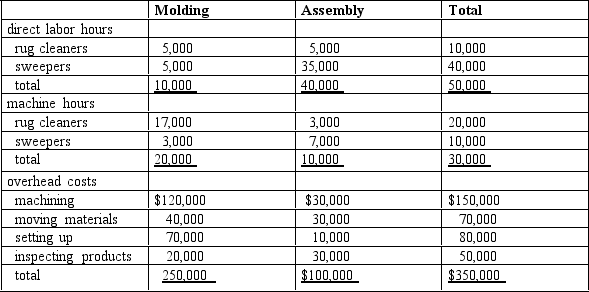

The Manoli Company has collected the following data for use in calculating product costs:

Activity Data: (expected and actual)

Departmental Data: (expected and actual)

Departmental Data: (expected and actual)

-Refer to Figure 4-10. What is the consumption ratio for the plantwide activity rate of direct labor hours?

-Refer to Figure 4-10. What is the consumption ratio for the plantwide activity rate of direct labor hours?

(Multiple Choice)

4.8/5  (39)

(39)

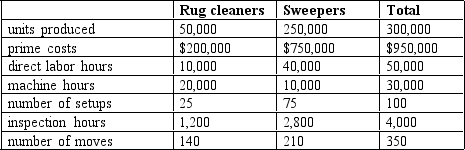

Figure 4-6

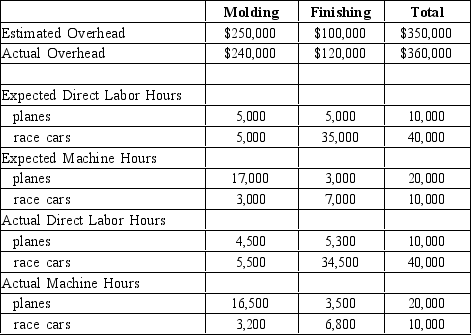

The Fast & Furious Company produces two products: toy planes and toy race cars. They use departmental overhead rates for the two production departments: molding and finishing. Molding uses machine hours to assign overhead and Finishing uses direct labor hours. 50,000 planes and 250,000 race cars are produced. Please find the following data:

-Tarot Company has a predetermined overhead rate of $6 per direct labor hour. Last year the company incurred $156,600 of actual manufacturing overhead cost and the account was $12,600 underapplied. How many direct labor hours were worked during the year?

-Tarot Company has a predetermined overhead rate of $6 per direct labor hour. Last year the company incurred $156,600 of actual manufacturing overhead cost and the account was $12,600 underapplied. How many direct labor hours were worked during the year?

(Multiple Choice)

4.8/5  (40)

(40)

An activity-based costing system uses which of the following procedures?

(Multiple Choice)

4.9/5  (33)

(33)

Figure 4-4

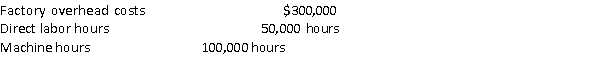

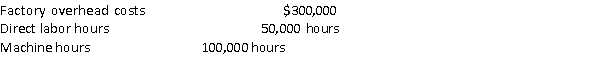

Mannitou Company made the following predictions for 2016:  Job A2 (which was started and completed in June) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.

-Refer to Figure 4-4. If factory overhead is applied based on machine hours, the cost of Job A2 for the Mannitou Company is

Job A2 (which was started and completed in June) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.

-Refer to Figure 4-4. If factory overhead is applied based on machine hours, the cost of Job A2 for the Mannitou Company is

(Multiple Choice)

4.8/5  (45)

(45)

Which of the following is NOT an advantage of a time-driven ABC system?

(Multiple Choice)

4.8/5  (42)

(42)

Inventive Manufacturing Company has the following activities: creating bills of materials (BOM), studying manufacturing capabilities, improving manufacturing processes, training employees, and designing tooling. The general ledger accounts reveal the following expenditures for manufacturing engineering:

The equipment is used for two activities: improving processes and designing tooling. Forty percent of the equipment's time is used for improving processes and 60 percent is used for designing tools. The salaries are for five engineers, one who earns $160,000 and four who earn $85,000 each. The $160,000 engineer spends 30 percent of his time training employees in new processes and 70 percent of his time on improving processes. One engineer spends 100 percent of her time on designing tooling and another engineer spends 100 percent of his time on improving processes. The remaining two engineers spend equal time on all activities. Supplies are consumed in the following proportions:

The equipment is used for two activities: improving processes and designing tooling. Forty percent of the equipment's time is used for improving processes and 60 percent is used for designing tools. The salaries are for five engineers, one who earns $160,000 and four who earn $85,000 each. The $160,000 engineer spends 30 percent of his time training employees in new processes and 70 percent of his time on improving processes. One engineer spends 100 percent of her time on designing tooling and another engineer spends 100 percent of his time on improving processes. The remaining two engineers spend equal time on all activities. Supplies are consumed in the following proportions:

Using the resource drivers and direct tracing, calculate the cost of each manufacturing engineering activity. What are the resource drivers?

Using the resource drivers and direct tracing, calculate the cost of each manufacturing engineering activity. What are the resource drivers?

(Essay)

4.9/5  (42)

(42)

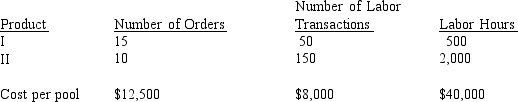

Figure 4-11

Longview Manufacturing Company manufactures two products (I and II). The overhead costs ($58,000) have been divided into three cost pools that use the following activity drivers:

-Refer to Figure 4-11. If the number of labor hours is used to assign labor costs from the cost pool, determine the amount of overhead cost to be assigned to Product I.

-Refer to Figure 4-11. If the number of labor hours is used to assign labor costs from the cost pool, determine the amount of overhead cost to be assigned to Product I.

(Multiple Choice)

4.9/5  (28)

(28)

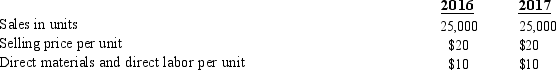

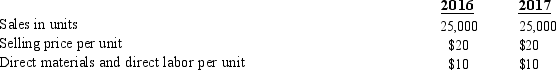

Figure 4-1

The Foremost Company predicted factory overhead for 2016 and 2017 would be $120,000 for each year. The predicted activity for 2016 and 2017 were 30,000 and 20,000 direct labor hours, respectively. Additional data are as follows:

The company assumes that the long-run normal production level is 20,000 direct labor hours per year. The actual factory overhead cost for the end of 2016 and 2017 was $120,000. Assume that it takes one direct labor hour to make one finished unit.

-Refer to Figure 4-2. If normal costing is used, the amount of overhead applied for the year is

The company assumes that the long-run normal production level is 20,000 direct labor hours per year. The actual factory overhead cost for the end of 2016 and 2017 was $120,000. Assume that it takes one direct labor hour to make one finished unit.

-Refer to Figure 4-2. If normal costing is used, the amount of overhead applied for the year is

(Multiple Choice)

4.8/5  (39)

(39)

Figure 4-1

The Foremost Company predicted factory overhead for 2016 and 2017 would be $120,000 for each year. The predicted activity for 2016 and 2017 were 30,000 and 20,000 direct labor hours, respectively. Additional data are as follows:

The company assumes that the long-run normal production level is 20,000 direct labor hours per year. The actual factory overhead cost for the end of 2016 and 2017 was $120,000. Assume that it takes one direct labor hour to make one finished unit.

-Refer to Figure 4-1. When the normal factory overhead rate is used, the gross profits for 2016 and 2017, respectively, are

The company assumes that the long-run normal production level is 20,000 direct labor hours per year. The actual factory overhead cost for the end of 2016 and 2017 was $120,000. Assume that it takes one direct labor hour to make one finished unit.

-Refer to Figure 4-1. When the normal factory overhead rate is used, the gross profits for 2016 and 2017, respectively, are

(Multiple Choice)

4.9/5  (34)

(34)

Figure 4-21

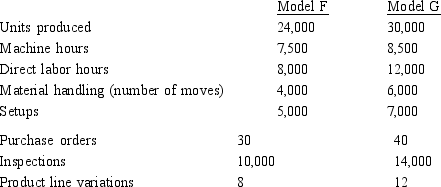

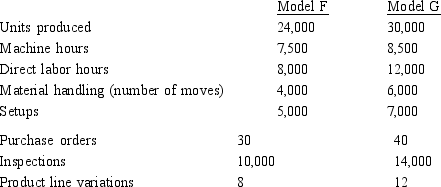

Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:

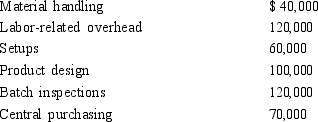

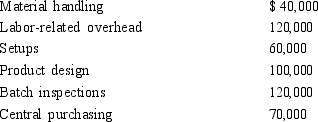

The following overhead costs are reported for the following activities of the production process:

The following overhead costs are reported for the following activities of the production process:

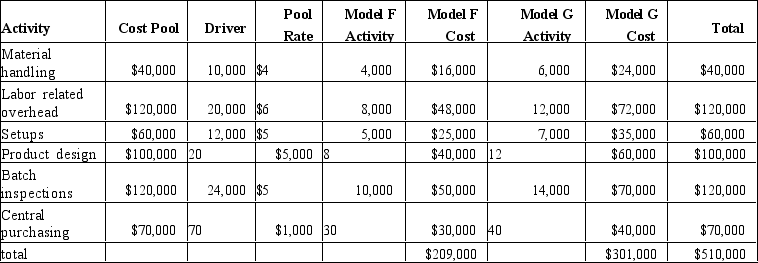

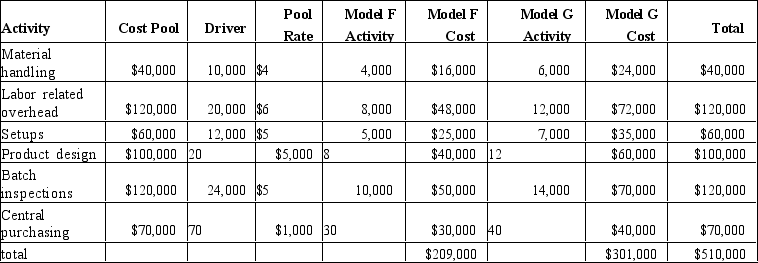

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-Refer to Figure 4-21. Under the equally accurate reduced ABC system, using consumption ratios for labor related and batch inspections, the overhead assigned to labor related activities would be? (round to 5 decimal places)

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-Refer to Figure 4-21. Under the equally accurate reduced ABC system, using consumption ratios for labor related and batch inspections, the overhead assigned to labor related activities would be? (round to 5 decimal places)

(Multiple Choice)

4.9/5  (43)

(43)

Figure 4-21

Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:

The following overhead costs are reported for the following activities of the production process:

The following overhead costs are reported for the following activities of the production process:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-Refer to Figure 4-21. Using ABC as the benchmark, what is the percentage error in the cost assigned to Model G using the approximately relevant ABC approach? (round to 4 decimal places)

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-Refer to Figure 4-21. Using ABC as the benchmark, what is the percentage error in the cost assigned to Model G using the approximately relevant ABC approach? (round to 4 decimal places)

(Multiple Choice)

4.9/5  (37)

(37)

Figure 4-10

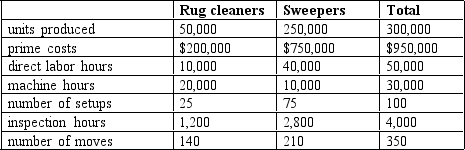

The Manoli Company has collected the following data for use in calculating product costs:

Activity Data: (expected and actual)

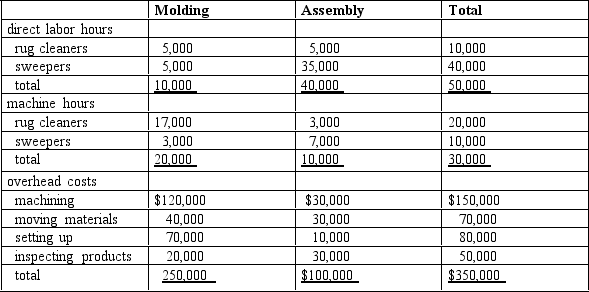

Departmental Data: (expected and actual)

Departmental Data: (expected and actual)

-Refer to Figure 4-10. What are the consumption ratios for rug cleaners and sweepers respectively for the inspection of products activity?

-Refer to Figure 4-10. What are the consumption ratios for rug cleaners and sweepers respectively for the inspection of products activity?

(Multiple Choice)

4.9/5  (26)

(26)

Figure 4-4

Mannitou Company made the following predictions for 2016:  Job A2 (which was started and completed in June) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.

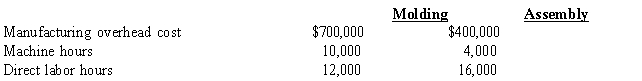

-Bear Claw Industries uses a job-order costing system. The Molding Department applies overhead based on machine hours, while the Assembly Department applies overhead based on direct labor hours. The company made the following estimates at the beginning of the current year:

Job A2 (which was started and completed in June) used 3,000 direct labor hours, 2,000 machine hours, and $57,000 of prime costs.

-Bear Claw Industries uses a job-order costing system. The Molding Department applies overhead based on machine hours, while the Assembly Department applies overhead based on direct labor hours. The company made the following estimates at the beginning of the current year:  The following information was available for Job No. 7-29, which was started and completed during August:

The following information was available for Job No. 7-29, which was started and completed during August:  The predetermined overhead rate for the molding department is

The predetermined overhead rate for the molding department is

(Multiple Choice)

4.9/5  (42)

(42)

Materials handling would be classified as a activity when using activity-level costing.

(Short Answer)

4.8/5  (28)

(28)

A list of the activities identified in the design of an activity-based system is called an activity inventory.

(True/False)

4.9/5  (51)

(51)

Showing 21 - 40 of 198

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)