Exam 9: Standard Costing: a Functional-Based Control Approach

Exam 1: Introduction to Cost Management151 Questions

Exam 2: Basic Cost Management Concepts199 Questions

Exam 3: Cost Behavior193 Questions

Exam 4: Activity-Based Costing198 Questions

Exam 5: Product and Service Costing: Job-Order System149 Questions

Exam 6: Process Costing181 Questions

Exam 7: Allocating Costs of Support Departments and Joint Products171 Questions

Exam 8: Budgeting for Planning and Control202 Questions

Exam 9: Standard Costing: a Functional-Based Control Approach125 Questions

Exam 10: Decentralization: Responsibility, Accounting, Performance Evaluation, and Transfer Pricing134 Questions

Exam 11: Strategic Cost Management148 Questions

Exam 12: Activity-Based Management146 Questions

Exam 13: The Balanced Scorecard: Strategic-Based Control124 Questions

Exam 14: Quality and Environmental Cost Management199 Questions

Exam 15: Lean Accounting and Productivity Measurement161 Questions

Exam 16: Cost-Volume-Profit Analysis128 Questions

Exam 17: Activity Resource Usage Model and Tactical Decision Making121 Questions

Exam 18: Pricing and Profitability Analysis159 Questions

Exam 19: Capital Investment125 Questions

Exam 20: Inventory Management: Economic Order Quantity, Jit, and the Theory of Constraints127 Questions

Select questions type

Price standards specify amounts and quantity standards specify prices.

(True/False)

4.8/5  (26)

(26)

Biscuit Company has developed the following standards for one of its products. Direct labor hours is the driver used to assign overhead costs to products. Direct materials: 10 pounds × $3 per pound

Direct labor: 2.5 hours × $8 per hour

Variable manufacturing overhead: 2.5 hours × $2 per hour

The following activity occurred during the month of June:

Materials purchased: 125,000 pounds at $2.60 per pound

Materials used: 110,000 pounds

Units produced: 10,000 units

Direct labor: 24,000 hours at $7.50 per hour

Actual variable manufacturing overhead: $51,000

The company records materials price variances at the time of purchase.

The direct labor rate variance is

(Multiple Choice)

4.9/5  (30)

(30)

The factors where actual performance differs from planned are called: .

(Short Answer)

4.8/5  (30)

(30)

Somalian Corporation uses a standard costing system. Information for the month of May is as follows: Actual manufacturing overhead costs ($26,000 is fixed) $80,000 Direct labor:

Actual hours worked 12,000 hrs.

Standard hours allowed for actual production 10,000 hrs.

Average actual labor cost per hour $18

The factory overhead rate is based on a normal volume of 12,000 direct labor hours. Standard cost data at 12,000 direct labor hours were as follows:

Variable factory overhead $48,000

Fixed factory overhead 24,000

Total factory overhead $72,000

What is the fixed overhead spending variance for Somalian?

(Multiple Choice)

4.8/5  (37)

(37)

The variance shows the difference between actual output and expected output for a given amount of input.

(Short Answer)

4.9/5  (35)

(35)

Figure 9-1

Bender Corporation produced 100 units of Product AA. The total standard and actual costs for materials and direct labor for the 100 units of Product AA are as follows:

Materials: Standard Actual

Standard: 210 pounds at $3.00 per pound $630

Actual: 240 pounds at $2.85 per pound $684

Direct labor:

Standard: 400 hours at $15.00 per hour 6,000

Actual: 368 hours at $16.50 per hour 6,072

-Refer to Figure 9-1. What is the material usage variance for Bender Corporation?

(Multiple Choice)

4.8/5  (23)

(23)

Malkovich Company uses a standard costing system. The following information pertains to direct materials for the month of July: Standard price per lb. $18.00

Actual purchase price per lb. $16.50

Quantity purchased 3,100 lbs.

Quantity used 2,950 lbs.

Standard quantity allowed for actual output 3,000 lbs.

Actual output 1,000 units

Malkovich Company reports its material price variances at the time of purchase. What is the journal entry to record material purchases?

(Multiple Choice)

4.9/5  (29)

(29)

The direct materials usage variance is the sum of the actual quantities and the standard quantities of units.

(True/False)

4.9/5  (42)

(42)

Standard costing is used in process industries because it's more difficult to utilize.

(True/False)

4.8/5  (34)

(34)

An unfavorable variable overhead spending variance may be caused by

(Multiple Choice)

4.9/5  (29)

(29)

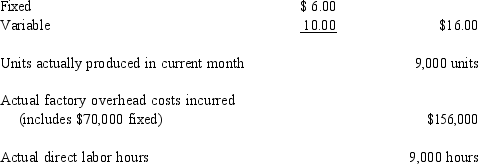

Figure 9-3

Alumni Manufacturing Company has the following information pertaining to a normal monthly activity of 10,000 units:

Standard factory overhead rates are based on a normal monthly volume of one standard direct hour per unit. Standard factory overhead rates per direct labor hour are:

-Refer to Figure 9-3. What is the fixed overhead volume variance for Alumni?

-Refer to Figure 9-3. What is the fixed overhead volume variance for Alumni?

(Multiple Choice)

4.8/5  (38)

(38)

The following information is provided about three materials utilized in the production of a product: Material Standard Mix Standard Unit Price Standard Cost

X 1,250 units $3.00 per unit $3,750

Y 750 units 5.00 per unit $3,750

Z 500 units 4.00 per unit $2,000

Yield 2,250 units

During May, the following actual production information was provided:

Material Actual Mix

X 10,000 units

Y 5,000 units

Z 2,500 units

Yield 15,000 units

Calculate the Material mix variance.

(Multiple Choice)

4.9/5  (37)

(37)

Croissant Company's standard fixed overhead cost is $6 per direct labor hour based on budgeted fixed costs of $600,000. The standard allows 1 direct labor hour per unit. During 2016, Croissant produced 110,000 units of product, incurred $630,000 of fixed overhead costs, and recorded 212,000 actual hours of direct labor.

What is the standard activity level on which Croissant based its fixed overhead rate?

(Multiple Choice)

4.7/5  (33)

(33)

the direct materials mix variance is the difference in the standard cost of actual inputs and the standard costs of inputs that should have been used.

(True/False)

4.9/5  (26)

(26)

The standard cost sheet shows costs needed to make many units of output.

(True/False)

4.8/5  (42)

(42)

Unfavorable variances occur whenever actual prices or usage are less than standard prices or usage, and the opposite for a favorable variance.

(True/False)

4.8/5  (40)

(40)

The direct materials price variance is the difference between actual and standard pricing.

(True/False)

4.8/5  (40)

(40)

Which of the following factors would cause an unfavorable material quantity variance?

(Multiple Choice)

4.9/5  (36)

(36)

The three-variance method requires dividing costs into fixed and variable amounts.

(True/False)

4.8/5  (33)

(33)

Showing 81 - 100 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)