Exam 17: Markets With Asymmetric Information

Exam 1: Preliminaries78 Questions

Exam 2: The Basics of Supply and Demand139 Questions

Exam 3: Consumer Behavior134 Questions

Exam 4: Individual and Market Demand131 Questions

Exam 5: Uncertainty and Consumer Behavior150 Questions

Exam 6: Production125 Questions

Exam 7: The Cost of Production178 Questions

Exam 8: Profit Maximization and Competitive Supply164 Questions

Exam 9: The Analysis of Competitive Markets183 Questions

Exam 10: Market Power: Monopoly and Monopsony158 Questions

Exam 11: Pricing With Market Power130 Questions

Exam 12: Monopolistic Competition and Oligopoly120 Questions

Exam 13: Game Theory and Competitive Strategy150 Questions

Exam 14: Markets for Factor Inputs134 Questions

Exam 15: Investment, Time, and Capital Markets153 Questions

Exam 16: General Equilibrium and Economic Efficiency126 Questions

Exam 17: Markets With Asymmetric Information133 Questions

Exam 18: Externalities and Public Goods131 Questions

Exam 19: Behavioral Economics101 Questions

Select questions type

The principal-agent problem of ownership vs. control of the corporation arises when owners and managers:

(Multiple Choice)

4.9/5  (36)

(36)

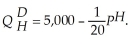

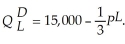

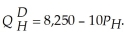

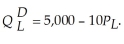

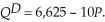

Prestige University grants degrees only to high skill students who perform well for their eventual employers. Mediocre University grants degrees only to low skill students. The market demand for newly graduated high skilled workers is:  The market demand for newly graduated low skilled workers is:

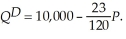

The market demand for newly graduated low skilled workers is:  Currently, Prestige University graduates 1,000 students while Mediocre University graduates 5,000. Determine the equilibrium prices for low and high skilled graduates. Suppose that in an effort to cut costs, the State has merged Prestige University and Mediocre University into State University. This merger has eliminated the signal that employers use to rely on to discern graduate quality. As a result, the demand for State University graduates is:

Currently, Prestige University graduates 1,000 students while Mediocre University graduates 5,000. Determine the equilibrium prices for low and high skilled graduates. Suppose that in an effort to cut costs, the State has merged Prestige University and Mediocre University into State University. This merger has eliminated the signal that employers use to rely on to discern graduate quality. As a result, the demand for State University graduates is:  The number of graduates from State University will be 6,000. Calculate the equilibrium price for State University graduates. Before the merger, would students at both Universities be willing to pay higher tuition in an effort to prevent the Universities from merging? Why or why not?

The number of graduates from State University will be 6,000. Calculate the equilibrium price for State University graduates. Before the merger, would students at both Universities be willing to pay higher tuition in an effort to prevent the Universities from merging? Why or why not?

(Essay)

4.9/5  (34)

(34)

Which of the following statements is NOT a reason that the cost of a college education is greater for the low-productivity group than for the high-productivity group?

(Multiple Choice)

4.8/5  (41)

(41)

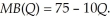

Glen's friend Andre is a big strong guy. Andre will not allow anyone to harm Glen. Glen enjoys teasing people. In fact, Glen's marginal benefit of teasing people is given by:  Generally, people do not enjoy Glen teasing them. Thus, they retaliate to Glen's teasing. Without Andre around to protect Glen from the retaliation, Glen's marginal cost of teasing people is

Generally, people do not enjoy Glen teasing them. Thus, they retaliate to Glen's teasing. Without Andre around to protect Glen from the retaliation, Glen's marginal cost of teasing people is  due to the retaliation. However, with Andre around, Glen perceives his marginal costs of teasing to always be zero as no one will retaliate with Andre around. This is because Andre will step in to protect Glen from retaliation. Without Andre around, what is Glen's choice for teasing? How much does Glen increase teasing when Andre's around? Is Glen's behavior characteristic of a moral hazard or adverse selection?

due to the retaliation. However, with Andre around, Glen perceives his marginal costs of teasing to always be zero as no one will retaliate with Andre around. This is because Andre will step in to protect Glen from retaliation. Without Andre around, what is Glen's choice for teasing? How much does Glen increase teasing when Andre's around? Is Glen's behavior characteristic of a moral hazard or adverse selection?

(Essay)

4.8/5  (36)

(36)

Scenario 17.1

Consider the information below:

For Group A the cost of attaining an educational level y is

CA(y) = $6,000y

and for Group B the cost of attaining that level is

CB(y) = $10,000y.

Employees will be offered $50,000 if they have  where y* is an education threshold determined by the employer. They will be offered $130,000 if they have

where y* is an education threshold determined by the employer. They will be offered $130,000 if they have  -Refer to Scenario 17.1. If the threshold educational level y* is set at 10,

-Refer to Scenario 17.1. If the threshold educational level y* is set at 10,

(Multiple Choice)

4.8/5  (33)

(33)

The principal-agent problem in corporations exists because the managers of a firm:

(Multiple Choice)

4.9/5  (37)

(37)

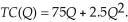

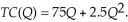

Trisha's Fashion Boutique is considering a profit sharing arrangement with her employees. Currently, the employees receive an annual bonus. Trisha can sell all the output she produces for $150 per unit. Trisha's total cost function (including bonus payments to employees) is:  The marginal cost function is:

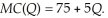

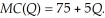

The marginal cost function is:  The profit sharing plan would pay employees 30% of profits. However, due to greater cost saving initiatives from employees, Trisha's total cost function becomes:

The profit sharing plan would pay employees 30% of profits. However, due to greater cost saving initiatives from employees, Trisha's total cost function becomes:  The relevant marginal cost function becomes:

The relevant marginal cost function becomes:  Which plan offers Trisha the greatest profits for herself?

Which plan offers Trisha the greatest profits for herself?

(Essay)

4.7/5  (38)

(38)

In the text, the authors present evidence that the market for free agents in professional baseball is subject to the lemons problem. How could a prospective free agent overcome this problem when seeking a new contract?

(Multiple Choice)

4.9/5  (35)

(35)

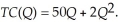

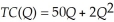

Trisha's Fashion Boutique is considering a profit sharing arrangement with her employees. Currently, the employees receive an annual bonus. In a "Boom" market, Trisha can sell all the output she produces for $225 per unit. In a "Bust" market, Trisha can sell all the output she produces for $125 per unit. The probability of a "Boom" market is 75% and the probability of a bust market is 25%. Trisha's total cost function (including bonus payments to employees) is:  The marginal cost function is:

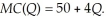

The marginal cost function is:  The profit sharing plan would pay employees 30% of profits. However, due to greater cost saving initiatives from employees, Trisha's total cost function becomes:

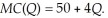

The profit sharing plan would pay employees 30% of profits. However, due to greater cost saving initiatives from employees, Trisha's total cost function becomes:  . The relevant marginal cost function becomes:

. The relevant marginal cost function becomes:  Which plan offers Trisha the greatest expected profits for herself? Suppose the employees will only approve a profit sharing plan if they are guaranteed their portion of profits will be at least $400. Will the employees approve of the profit sharing program?

Which plan offers Trisha the greatest expected profits for herself? Suppose the employees will only approve a profit sharing plan if they are guaranteed their portion of profits will be at least $400. Will the employees approve of the profit sharing program?

(Essay)

4.7/5  (46)

(46)

Assume that a particular state has decided to outlaw the sharing of individuals' credit histories as an illegal invasion of privacy. As a result of this action we would expect the:

(Multiple Choice)

4.9/5  (34)

(34)

If all of the divisions in a vertically integrated firm are owned by the same company, why is it possible that asymmetric information problems can lead to inefficient outcomes in vertically integrated firms?

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following represent examples of adverse selection?

(Multiple Choice)

4.9/5  (37)

(37)

Suppose Bob owns two factories that are located several hundred miles apart. Bob decides to manage one of the plants himself, and he hires another person to manage the second plant. For purposes of operating the second plant, who is the agent and who is principal?

(Multiple Choice)

4.8/5  (32)

(32)

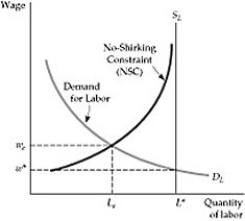

Figure 17.6.1

-Refer to Figure 17.6.1 above. When the no-shirking constraint (NSC) is applied, there is:

Figure 17.6.1

-Refer to Figure 17.6.1 above. When the no-shirking constraint (NSC) is applied, there is:

(Multiple Choice)

4.9/5  (36)

(36)

In the insurance market, "moral hazard" refers to the problem that:

(Multiple Choice)

4.8/5  (48)

(48)

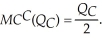

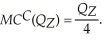

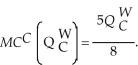

Cecil's Home Appliances sells high quality washing machines. Cecil's marginal cost function is:  Zach's Appliances sells low quality washing machines. Zach's marginal cost function is:

Zach's Appliances sells low quality washing machines. Zach's marginal cost function is:  The market demand for high quality washing machines is:

The market demand for high quality washing machines is:  The market demand for low quality washing machines is:

The market demand for low quality washing machines is:  If Consumer's can distinguish between the quality of Cecil's and Zach's machines (and Cecil and Zach behave as price takers), determine the equilibrium price of washing machines. Calculate Cecil's producer surplus. Now, suppose that consumers cannot distinguish between the quality of Cecil's and Zach's washing machines. In this case, the demand for washing machines is:

If Consumer's can distinguish between the quality of Cecil's and Zach's machines (and Cecil and Zach behave as price takers), determine the equilibrium price of washing machines. Calculate Cecil's producer surplus. Now, suppose that consumers cannot distinguish between the quality of Cecil's and Zach's washing machines. In this case, the demand for washing machines is:  Determine the joint market supply curve. Calculate the equilibrium price of washing machines and the quantity brought to market by Cecil and Zach. What is Cecil's producer surplus? If Cecil offers a warranty on his washing machines, his marginal cost function becomes:

Determine the joint market supply curve. Calculate the equilibrium price of washing machines and the quantity brought to market by Cecil and Zach. What is Cecil's producer surplus? If Cecil offers a warranty on his washing machines, his marginal cost function becomes:  However, consumers will then perceive his machines to be high quality. Should Cecil offer the warranty?

However, consumers will then perceive his machines to be high quality. Should Cecil offer the warranty?

(Essay)

4.8/5  (30)

(30)

Over the past several decades, low-productivity and high-productivity workers in the US and other countries have tended to invest in their own human capital by completing more years of college than earlier generations. Which of the following reasons does NOT help to explain this trend?

(Multiple Choice)

4.8/5  (39)

(39)

In the economic literature on principal-agent problems, the ________ is the person who takes some action, and the ________ is the person whom the action affects.

(Multiple Choice)

4.9/5  (38)

(38)

Scenario 17.1

Consider the information below:

For Group A the cost of attaining an educational level y is

CA(y) = $6,000y

and for Group B the cost of attaining that level is

CB(y) = $10,000y.

Employees will be offered $50,000 if they have  where y* is an education threshold determined by the employer. They will be offered $130,000 if they have

where y* is an education threshold determined by the employer. They will be offered $130,000 if they have  -Refer to Scenario 17.1. If the threshold educational level y* is set at 14,

-Refer to Scenario 17.1. If the threshold educational level y* is set at 14,

(Multiple Choice)

4.8/5  (30)

(30)

Showing 21 - 40 of 133

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)