Exam 35: Accounting for Foreign Currency Transactions

Exam 1: An Overview of the Australian External Reporting Environment50 Questions

Exam 2: The Conceptual Framework of Accounting and Its Relevance to Financ62 Questions

Exam 3: Theories of Financial Accounting61 Questions

Exam 4: An Overview of Accounting for Assets62 Questions

Exam 5: Depreciation of Property, Plant and Equipment62 Questions

Exam 6: Revaluation and Impairment Testing of Non-Current Assets59 Questions

Exam 7: Inventory60 Questions

Exam 8: Accounting for Intangibles63 Questions

Exam 9: Accounting for Heritage Assets and Biological Assets61 Questions

Exam 10: An Overview of Accounting for Liabilities58 Questions

Exam 11: Accounting for Lease66 Questions

Exam 12: Set-Off and Extinguishment of Debt47 Questions

Exam 13: Accounting for Employee Benefits67 Questions

Exam 15: Accounting for Financial Instruments72 Questions

Exam 16: Revenue Recognition Issues64 Questions

Exam 17: The Statement of Comprehensive Income and Statement of Changes in E62 Questions

Exam 19: Accounting for Income Taxes65 Questions

Exam 20: Cash-Flow Statements60 Questions

Exam 21: Accounting for the Extractive Industries60 Questions

Exam 22: Accounting for General Insurance Contracts58 Questions

Exam 23: Accounting for Superannuation Plans62 Questions

Exam 24: Events Occurring After Balance Sheet Date62 Questions

Exam 25: Segment Reporting61 Questions

Exam 26: Related-Party Disclosures60 Questions

Exam 28: Accounting for Group Structures69 Questions

Exam 29: Further Consolidation Issues I: Accounting for Intragroup Transact46 Questions

Exam 30: Further Consolidation Issues Ii: Accounting for Minority Interests34 Questions

Exam 31: Further Consolidation Issues Iii: Accounting for Indirect Ownershi38 Questions

Exam 32: Further Consolidation Issues Iv: Accounting for Changes in the Deg39 Questions

Exam 33: Accounting for Equity Investments67 Questions

Exam 33: Accounting for Equity Investments59 Questions

Exam 35: Accounting for Foreign Currency Transactions59 Questions

Exam 36: Translation of the Accounts of Foreign Operations42 Questions

Exam 37: Accounting for Corporate Social Responsibility59 Questions

Select questions type

A hedge is defined by AASB 139 as an action taken, whether by entering into a foreign currency contract or otherwise, with the objective of maximising the possible positive effects of movements in exchange rates:

(True/False)

4.8/5  (41)

(41)

The essential feature of a non-monetary item is the absence of a right to receive (or an obligation to deliver) a fixed or determinable number of units of currency.

(True/False)

4.9/5  (33)

(33)

To classify an arrangement as a hedge, and therefore to apply 'hedge accounting', AASB 132 requires a set of strict conditions be met.

(True/False)

4.8/5  (30)

(30)

AASB 121 requires foreign currency transactions to be recorded, on initial recognition in the presentation currency, by applying to the foreign currency amount the spot exchange rate between the presentation currency and the foreign currency at the date of the transaction.

(True/False)

4.9/5  (35)

(35)

According to AASB 123 a qualifying asset is one that necessarily takes a substantial period of time to get ready for its intended use or sale:

(True/False)

4.8/5  (44)

(44)

Which of the following statements is correct with respect to AASB 112 "The effects of changes in foreign exchange rates"?

(Multiple Choice)

4.8/5  (38)

(38)

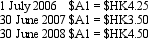

On 1 July 2006 McGrath Ltd enters into an arrangement with a Hong Kong bank to borrow $HK1,500,000. The term of the loan is 3 years with interest payable annually in arrears on 30 June at the rate of 7 per cent. The exchange rate information is:

What journal entries are required in McGrath Ltd's books for 1 July 2006 and 30 June 2007 and 30 June 2008 in accordance with AASB 121 (rounded to the nearest whole $A)?

What journal entries are required in McGrath Ltd's books for 1 July 2006 and 30 June 2007 and 30 June 2008 in accordance with AASB 121 (rounded to the nearest whole $A)?

(Multiple Choice)

4.7/5  (38)

(38)

The exchange rate for a currency depends on many factors including:

(Multiple Choice)

4.9/5  (27)

(27)

An entity's may change its functional currency when there is a change in the underlying transactions, events and conditions.

(True/False)

5.0/5  (41)

(41)

Common examples of qualifying assets are assets that result from development and construction activities in:

(Multiple Choice)

4.9/5  (43)

(43)

The hedge effectiveness criteria prescribed in AASB 139 have made which type of financial instrument much less effective as a potential hedging instrument?

(Multiple Choice)

4.9/5  (42)

(42)

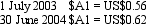

On 1 July 2003 Kanga Consultants Ltd completes a contract to provide advice on the installation of a networked computer system to a company in the US. The client pays the fee of US$500,000 into Kanga Consultants' US bank account on that date. The bank pays interest of 8 per cent annually on 30 June. The exchange rate information is:

What journal entries are required in Kanga Consultants Ltd's books for 1 July 2003 and 30 June 2004 in accordance with AASB 1012 (rounded to the nearest whole $A)?

What journal entries are required in Kanga Consultants Ltd's books for 1 July 2003 and 30 June 2004 in accordance with AASB 1012 (rounded to the nearest whole $A)?

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following is not a condition that must be met, according to AASB 139, before a relationship qualifies for hedge accounting?

(Multiple Choice)

5.0/5  (36)

(36)

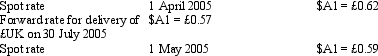

Sure Ltd purchased goods for £210,000 from a British supplier on 1 April 2005. The amount owing on the purchase is payable on 30 July 2005. On 1 May 2005 a forward-exchange contract for the delivery of £210,000 on 30 July 2005 is taken out with Aus Bank. Exchange rates are as follows:

What entries are required to record the initial transaction and the forward-exchange contract in accordance with AASB 121 and AASB 139 (rounded to the nearest whole $A)?

What entries are required to record the initial transaction and the forward-exchange contract in accordance with AASB 121 and AASB 139 (rounded to the nearest whole $A)?

(Multiple Choice)

4.9/5  (33)

(33)

AASB 121 requires that foreign currency monetary items outstanding at reporting date must be:

(Multiple Choice)

4.8/5  (43)

(43)

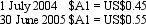

On 1 July 2004 Waugh Ltd enters into an arrangement with a US bank - Big Bank - to borrow US$900,000. The term of the loan is 3 years with interest payable annually in arrears on 30 June at the rate of 10 per cent. The exchange rate information is:

What journal entries are required in Waugh Ltd's books for 1 July 2004 and 30 June 2005 in accordance with AASB 121 (rounded to the nearest whole $A)?

What journal entries are required in Waugh Ltd's books for 1 July 2004 and 30 June 2005 in accordance with AASB 121 (rounded to the nearest whole $A)?

(Multiple Choice)

4.9/5  (47)

(47)

Exchange differences recognised as borrowing costs and included in the cost of an asset, are recogniseD.

(Multiple Choice)

4.8/5  (40)

(40)

An exception to the requirement that foreign currency monetary items should be re-translated at the reporting date is:

(Multiple Choice)

4.8/5  (29)

(29)

Exchange gains or losses on a qualifying asset that arise before it ceases to be a qualifying asset are to be deferred and amortised over the life of the asset according to AASB 123:

(True/False)

4.8/5  (42)

(42)

Showing 21 - 40 of 59

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)