Exam 7: Inventory

Exam 1: An Overview of the Australian External Reporting Environment50 Questions

Exam 2: The Conceptual Framework of Accounting and Its Relevance to Financ62 Questions

Exam 3: Theories of Financial Accounting61 Questions

Exam 4: An Overview of Accounting for Assets62 Questions

Exam 5: Depreciation of Property, Plant and Equipment62 Questions

Exam 6: Revaluation and Impairment Testing of Non-Current Assets59 Questions

Exam 7: Inventory60 Questions

Exam 8: Accounting for Intangibles63 Questions

Exam 9: Accounting for Heritage Assets and Biological Assets61 Questions

Exam 10: An Overview of Accounting for Liabilities58 Questions

Exam 11: Accounting for Lease66 Questions

Exam 12: Set-Off and Extinguishment of Debt47 Questions

Exam 13: Accounting for Employee Benefits67 Questions

Exam 15: Accounting for Financial Instruments72 Questions

Exam 16: Revenue Recognition Issues64 Questions

Exam 17: The Statement of Comprehensive Income and Statement of Changes in E62 Questions

Exam 19: Accounting for Income Taxes65 Questions

Exam 20: Cash-Flow Statements60 Questions

Exam 21: Accounting for the Extractive Industries60 Questions

Exam 22: Accounting for General Insurance Contracts58 Questions

Exam 23: Accounting for Superannuation Plans62 Questions

Exam 24: Events Occurring After Balance Sheet Date62 Questions

Exam 25: Segment Reporting61 Questions

Exam 26: Related-Party Disclosures60 Questions

Exam 28: Accounting for Group Structures69 Questions

Exam 29: Further Consolidation Issues I: Accounting for Intragroup Transact46 Questions

Exam 30: Further Consolidation Issues Ii: Accounting for Minority Interests34 Questions

Exam 31: Further Consolidation Issues Iii: Accounting for Indirect Ownershi38 Questions

Exam 32: Further Consolidation Issues Iv: Accounting for Changes in the Deg39 Questions

Exam 33: Accounting for Equity Investments67 Questions

Exam 33: Accounting for Equity Investments59 Questions

Exam 35: Accounting for Foreign Currency Transactions59 Questions

Exam 36: Translation of the Accounts of Foreign Operations42 Questions

Exam 37: Accounting for Corporate Social Responsibility59 Questions

Select questions type

The definition of inventories includes assets in the form of materials or supplies to be consumed in the production process or in rendering of services:

(True/False)

4.9/5  (40)

(40)

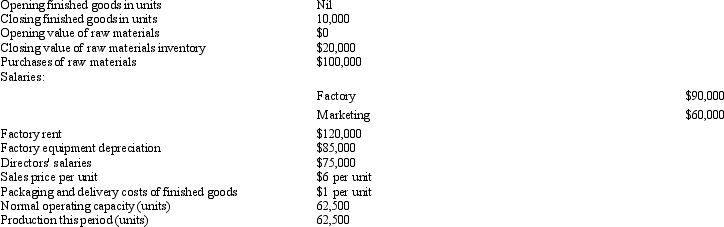

Video Productions Ltd commenced business manufacturing video tapes on 1 July 2002. Summary data for the first full year of production are:

Packaging and delivery are essential to be able to sell the product. What total value should be attributed to finished goods inventory in the financial statements in accordance with AASB 102?

Packaging and delivery are essential to be able to sell the product. What total value should be attributed to finished goods inventory in the financial statements in accordance with AASB 102?

(Multiple Choice)

4.8/5  (38)

(38)

Fixed production costs are those that, within normal operating limits:

(Multiple Choice)

4.9/5  (38)

(38)

In times of rising prices for inventory, which of the following is true?

(Multiple Choice)

4.9/5  (43)

(43)

According to AASB 102 material information relating to which of the following must be disclosed?

(Multiple Choice)

4.9/5  (30)

(30)

The cost of sub-contracted work is not included in costs of conversion for the purposes of calculating the cost of inventory:

(True/False)

4.8/5  (39)

(39)

The value of inventory reported in the financial statements under AASB 102 may be reported at an amount lower than its original cost:

(True/False)

4.8/5  (46)

(46)

The cost-flow assumption selected for inventory costing purposes should always reflect the physical flow of goods out of inventory:

(True/False)

4.9/5  (36)

(36)

According to AASB 102, one or more of which set of methods should be used to apply the costs of inventories to particular items of inventory?

(Multiple Choice)

4.8/5  (37)

(37)

Upward revaluation of inventory is permitted for as long as all assets in same inventory class are revalued.

(True/False)

4.9/5  (30)

(30)

Which of the following statements is correct in relation to the costing of inventories?

(Multiple Choice)

4.9/5  (32)

(32)

AASB 102 provides that inventories must be valued at the lower of cost and net realisable value for groups of homogeneous items where it is impracticable to measure them on an item-by-item basis:

(True/False)

4.8/5  (38)

(38)

The measurement of inventories is no different for not-for-profit entities.

(True/False)

4.9/5  (36)

(36)

In addition to the cost-flow assumption, the system used to record movements in inventory also affects the determination of the cost of inventory. What are the systems commonly in use for recording the movement of inventory?

(Multiple Choice)

4.9/5  (35)

(35)

Consistent with positive accounting theory, an entity close to breaching their debt covenant will:

(Multiple Choice)

4.8/5  (26)

(26)

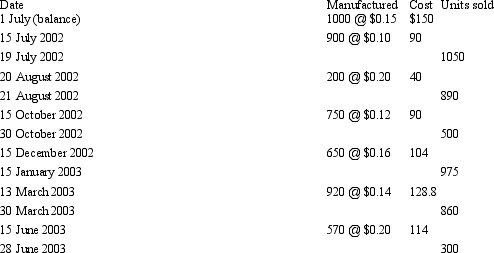

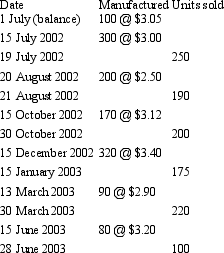

Circle Ltd manufactures polystyrene trays for a variety of purposes. The following information relates to the production of the medium trays used by meat packing companies for the period ended 30 June 2003.

The company uses a perpetual inventory system. The net realisable value per extra large cardboard box is $0.17 at the end of the period. What are the costs of sales and the value of ending inventory for Rectangle Ltd assuming the FIFO cost-flow assumption is used?

The company uses a perpetual inventory system. The net realisable value per extra large cardboard box is $0.17 at the end of the period. What are the costs of sales and the value of ending inventory for Rectangle Ltd assuming the FIFO cost-flow assumption is used?

(Multiple Choice)

4.8/5  (25)

(25)

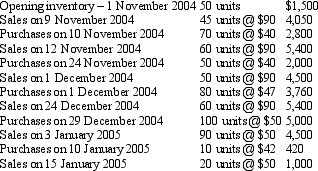

Big Games for Big Kids sell a variety of gaming consoles and games. It has presented you with the following information for the sales of a new product Angel's Hat 2 for the three months from November to January. They began November with 50 units on hand valued at $1,500. In the lead up to Christmas each unit sold for $90 but in the post Christmas sales in January this price was reduced to $50.

Big Games for Big Kids use the periodic system to record inventory. A physical stock take reveals 30 units on hand at the end of January. What is the cost of sales and value of ending inventory using the weighted average cost-flow assumption?

Big Games for Big Kids use the periodic system to record inventory. A physical stock take reveals 30 units on hand at the end of January. What is the cost of sales and value of ending inventory using the weighted average cost-flow assumption?

(Multiple Choice)

4.7/5  (35)

(35)

Oblong Ltd manufactures cardboard boxes for a variety of purposes. The following information relates to the production of the extra large packing boxes used by removalists for the period ended 30 June 2003.

The company uses a perpetual inventory system. The net realisable value per extra large cardboard box is $3.15 at the end of the period. What are the costs of sales and the value of ending inventory for Oblong Ltd assuming the FIFO cost-flow assumption is used?

The company uses a perpetual inventory system. The net realisable value per extra large cardboard box is $3.15 at the end of the period. What are the costs of sales and the value of ending inventory for Oblong Ltd assuming the FIFO cost-flow assumption is used?

(Multiple Choice)

4.8/5  (31)

(31)

FIFO method is an income decreasing inventory cost flow method in periods of rising prices.

(True/False)

4.9/5  (42)

(42)

Showing 21 - 40 of 60

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)