Exam 3: Predetermined Overhead Rates, flexible Budgets, and Absorptionvariable Costing

Exam 1: Introduction to Cost Accounting98 Questions

Exam 2: Cost Terminology and Cost Behaviors127 Questions

Exam 3: Predetermined Overhead Rates, flexible Budgets, and Absorptionvariable Costing199 Questions

Exam 4: Activity-Based Management and Activity-Based Costing176 Questions

Exam 5: Job Order Costing178 Questions

Exam 6: Process Costing213 Questions

Exam 7: Standard Costing and Variance Analysis220 Questions

Exam 8: The Master Budget150 Questions

Exam 9: Break-Even Point and Cost-Volume-Profit Analysis119 Questions

Exam 10: Relevant Information for Decision Making144 Questions

Exam 11: Allocation of Joint Costs and Accounting for By-Products131 Questions

Exam 12: Introduction to Cost Management Systems100 Questions

Exam 13: Responsibility Accounting, support Department Allocations, and Transfer Pricing175 Questions

Exam 14: Performance Measurement, balanced Scorecards, and Performance Rewards192 Questions

Exam 15: Capital Budgeting183 Questions

Exam 16: Managing Costs and Uncertainty101 Questions

Exam 17: Implementing Quality Concepts108 Questions

Exam 18: Inventory and Production Management165 Questions

Exam 19: Emerging Management Practices69 Questions

Select questions type

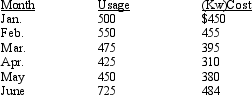

Davis Corporation has the following data relating to its power usage for the first six months of the current year.

Assume usage is within the relevant range of activity.

Required:

Assume usage is within the relevant range of activity.

Required:

(Essay)

4.9/5  (44)

(44)

Which of the following statements is true for a firm that uses variable costing?

(Multiple Choice)

4.9/5  (43)

(43)

When a manufacturing company has a highly automated manufacturing plant producing many different products,which of the following is the more appropriate basis of applying manufacturing overhead costs to work in process?

(Multiple Choice)

5.0/5  (35)

(35)

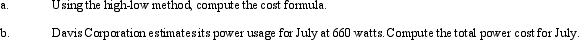

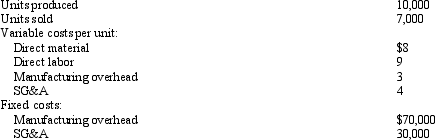

Kellman Corporation Kellman Corporation produces a single product that sells for $7.00 per unit.Standard capacity is 100,000 units per year; 100,000 units were produced and 80,000 units were sold during the year.Manufacturing costs and selling and administrative expenses are presented below.

There were no variances from the standard variable costs.Any under- or overapplied overhead is written off directly at year-end as an adjustment to cost of goods sold.

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation.What is the net income under absorption costing?

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation.What is the net income under absorption costing?

(Multiple Choice)

4.7/5  (38)

(38)

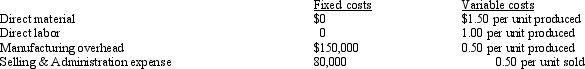

Denver Corporation The records of Denver Corporation revealed the following data for the current year.

Refer to Denver Corporation.Assume,for this question only,actual overhead is $98,700 and applied overhead is $93,250.Manufacturing overhead is:

Refer to Denver Corporation.Assume,for this question only,actual overhead is $98,700 and applied overhead is $93,250.Manufacturing overhead is:

(Multiple Choice)

4.8/5  (35)

(35)

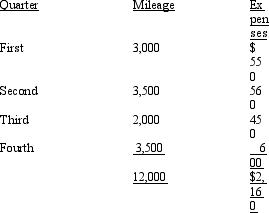

Wyman Company owns two luxury automobiles that are used by employees on company business.Mileage and expenses,excluding depreciation,by quarters for the most recent year are presented below:

Required: Determine the variable cost per mile (nearest tenth of a cent)and the fixed costs per quarter,using the method of least squares.

Required: Determine the variable cost per mile (nearest tenth of a cent)and the fixed costs per quarter,using the method of least squares.

(Essay)

4.8/5  (32)

(32)

If sales exceed production,absorption costing net income is less than variable costing net income.

(True/False)

4.8/5  (53)

(53)

Which of the following is a term more descriptive of the term "direct costing"?

(Multiple Choice)

4.9/5  (49)

(49)

Which of the following must be known about a production process in order to institute a variable costing system?

(Multiple Choice)

4.9/5  (40)

(40)

In an income statement prepared as an internal report using the variable costing method,fixed manufacturing overhead would

(Multiple Choice)

4.8/5  (29)

(29)

A master budget is a planning document that presents expected variable and fixed overhead costs at different activity levels.

(True/False)

4.8/5  (30)

(30)

What factor,related to manufacturing costs,causes the difference in net earnings computed using absorption costing and net earnings computed using variable costing?

(Multiple Choice)

4.8/5  (40)

(40)

When a relationship between several independent variables and one dependent variable is analyzed,the regression is referred to as ____________________.

(Short Answer)

4.8/5  (41)

(41)

If overapplied factory overhead is material,the account is closed by a credit to Cost of Goods Sold.

(True/False)

4.9/5  (37)

(37)

In a actual cost system,factory overhead is assigned directly to products and services.

(True/False)

4.8/5  (35)

(35)

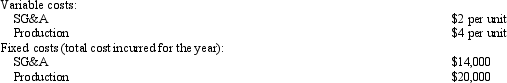

Bush Corporation The following information has been extracted from the financial records of Bush Corporation for its first year of operations:

Refer to Bush Corporation.Based on absorption costing,what amount of period costs will Bush Corporation deduct?

Refer to Bush Corporation.Based on absorption costing,what amount of period costs will Bush Corporation deduct?

(Multiple Choice)

4.9/5  (30)

(30)

Oakwood Corporation Oakwood Corporation produces a single product.The following cost structure applied to its first year of operations:

Refer to Oakwood Corporation.Assume for this question only that during the current year Oakwood Corporation manufactured 5,000 units and sold 3,800.There was no beginning or ending work-in-process inventory.How much larger or smaller would Oakwood Corporation's income be if it uses absorption rather than variable costing?

Refer to Oakwood Corporation.Assume for this question only that during the current year Oakwood Corporation manufactured 5,000 units and sold 3,800.There was no beginning or ending work-in-process inventory.How much larger or smaller would Oakwood Corporation's income be if it uses absorption rather than variable costing?

(Multiple Choice)

4.8/5  (36)

(36)

If actual overhead is less than applied overhead,which of the following will be true? Upon closing,

(Multiple Choice)

4.9/5  (37)

(37)

Showing 141 - 160 of 199

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)