Exam 3: Predetermined Overhead Rates, Flexible Budgets, and Absorptionvariable Costing

Exam 1: Introduction to Cost Accounting98 Questions

Exam 2: Cost Terminology and Cost Behaviors127 Questions

Exam 3: Predetermined Overhead Rates, Flexible Budgets, and Absorptionvariable Costing200 Questions

Exam 4: Activity-Based Management and Activity-Based Costing176 Questions

Exam 5: Job Order Costing179 Questions

Exam 6: Process Costing211 Questions

Exam 7: Standard Costing and Variance Analysis221 Questions

Exam 8: The Master Budget150 Questions

Exam 9: Break-Even Point and Cost-Volume-Profit Analysis120 Questions

Exam 10: Relevant Information for Decision Making143 Questions

Exam 11: Allocation of Joint Costs and Accounting for By-Products133 Questions

Exam 12: Introduction to Cost Management Systems100 Questions

Exam 13: Responsibility Accounting, Support Department Allocations, and Transfer Pricing175 Questions

Exam 14: Performance Measurement, Balanced Scorecards, and Performance Rewards191 Questions

Exam 15: Capital Budgeting183 Questions

Exam 16: Managing Costs and Uncertainty103 Questions

Exam 17: Implementing Quality Concepts108 Questions

Exam 18: Inventory and Production Management167 Questions

Exam 19: Emerging Management Practices69 Questions

Select questions type

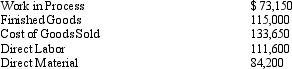

Denver Corporation The records of Denver Corporation revealed the following data for the current year.

Refer to Denver Corporation. Assume that Denver has overapplied overhead of $25,000 and that this amount is material. What is the balance in Cost of Goods Sold after the overapplied overhead is closed?

Refer to Denver Corporation. Assume that Denver has overapplied overhead of $25,000 and that this amount is material. What is the balance in Cost of Goods Sold after the overapplied overhead is closed?

(Multiple Choice)

4.8/5  (36)

(36)

Phantom profits result when absorption costing is used and production exceeds sales.

(True/False)

4.8/5  (35)

(35)

Normal capacity considers present and future production levels and cyclical fluctuations.

(True/False)

4.9/5  (40)

(40)

If sales exceed production, absorption costing net income exceeds variable costing net income.

(True/False)

5.0/5  (41)

(41)

In an actual cost system, factory overhead is assigned to an overhead control account and then allocated to products and services.

(True/False)

4.9/5  (44)

(44)

Why do managers frequently prefer variable costing to absorption costing for internal use?

(Essay)

4.9/5  (42)

(42)

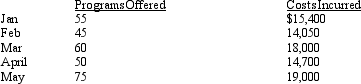

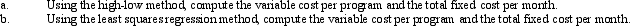

Dynamic Trainers provides a personalized training program that is popular with many companies. The number of programs offered over the last five months, and the costs of offering these programs are as follows:

(Essay)

4.9/5  (27)

(27)

A functional classification of costs would classify "depreciation on office equipment" as a

(Multiple Choice)

4.9/5  (34)

(34)

Practical capacity does not adjust for routine downtime in a production process.

(True/False)

4.8/5  (30)

(30)

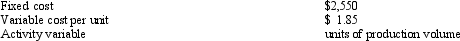

The facility manager of Price Corporation asked the systems analyst for information to help in forecasting handling costs. The following printout was generated using the least squares regression method.

(Essay)

4.8/5  (36)

(36)

Unabsorbed fixed overhead costs in an absorption costing system are

(Multiple Choice)

4.8/5  (46)

(46)

When a relationship between several independent variables and one dependent variable is analyzed, the regression is referred to as ____________________.

(Short Answer)

4.8/5  (43)

(43)

Consider the following three product costing alternatives: process costing, job order costing, and standard costing. Which of these can be used in conjunction with variable costing?

(Multiple Choice)

4.8/5  (45)

(45)

The slope of a regression line is determined by dividing the change in activity level by the change in total cost.

(True/False)

4.7/5  (43)

(43)

When using the high-low method, fixed costs are computed before the variable component is computed.

(True/False)

4.8/5  (33)

(33)

The measure of activity that allows for routine variations in manufacturing activity is:

(Multiple Choice)

4.7/5  (41)

(41)

Cost allocation is the assignment of ____ costs to one or more products using a reasonable basis.

(Multiple Choice)

4.8/5  (47)

(47)

Showing 41 - 60 of 200

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)